Offering customers the ability to make secure contactless payments in store can help create a seamless customer experience and minimize checkout time, in turn helping you serve more customers. And with EMV secure chip processing to store and process data securely, both consumers and businesses are kept safe with best-in-class security technology.

You’ll need to speak to a participating acquirer to set up a payment terminal solution that is right for you (click here for a list of participating ones). Once you do, a transaction can be completed in seconds.

*Note that images and user screens displayed are for illustrative purposes only, appearance will differ based on the terminal and acquirer.

Before you begin, you’ll need:

- A Canadian bank account with a participating financial institution

- A point-of-sale (POS) terminal associated with your bank account

- A contactless payment set up with an acquirer

Here’s what to do:

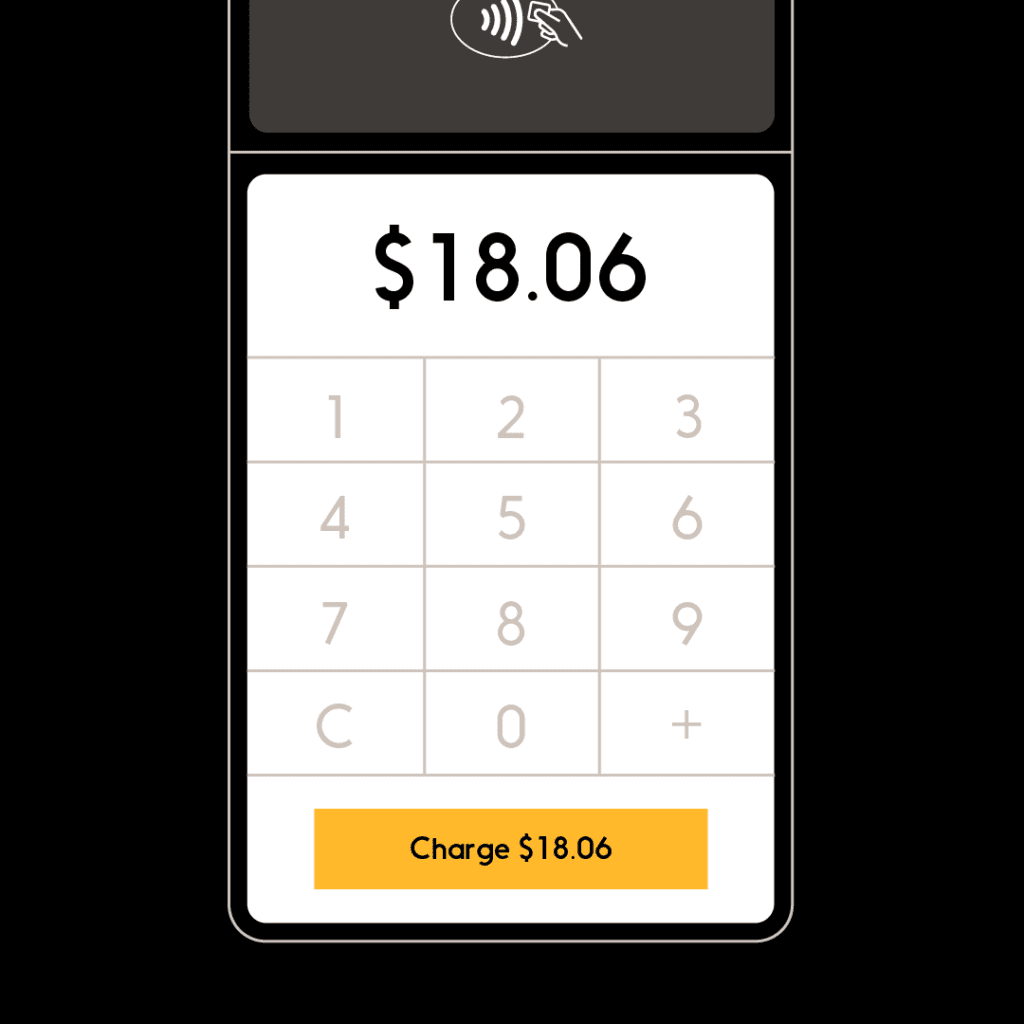

-

Scan the item(s) being purchased or manually input the purchase amount into a point-of-sale (POS) terminal and hand it to the customer.

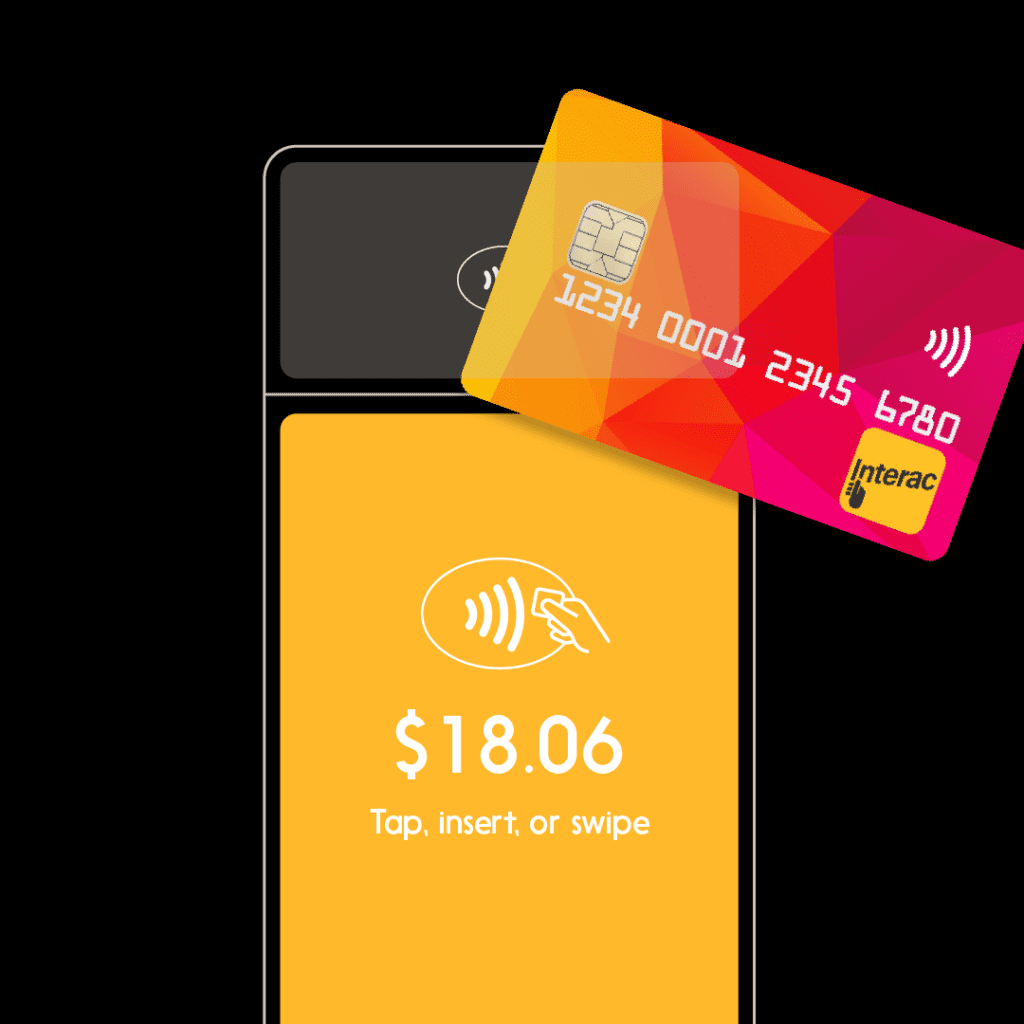

-

The customer will confirm the transaction amount on the terminal and hold their debit card, mobile phone or wearable device on the contactless symbol for a moment.

If your customer has reached their cumulative spend limit, they will need to insert their card and enter their PIN.

-

Once the transaction is authorized by the customer’s financial institution, the funds will be transferred within seconds.

-

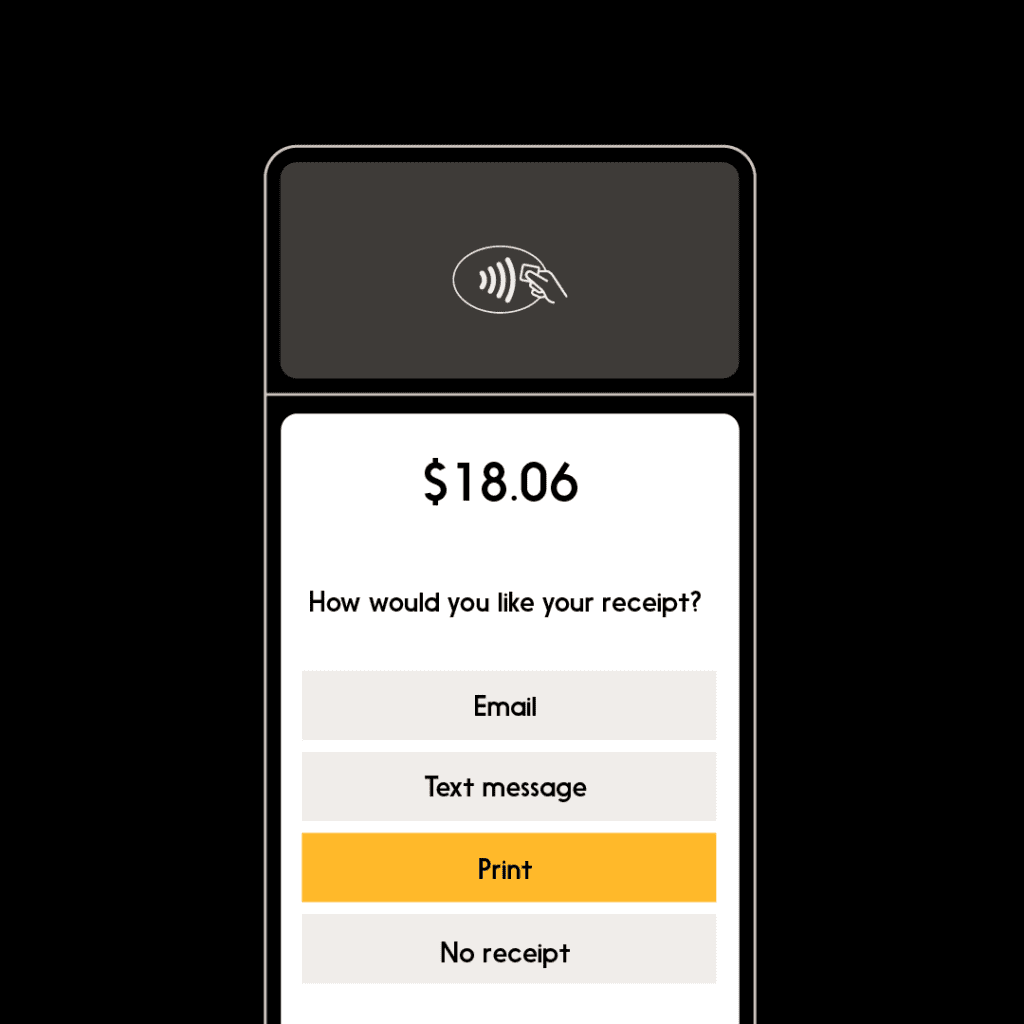

A choice of receipt option may be needed from the customer to complete the transaction.

Learn more about how Interac Debit can help your business grow here.