Identity verification. Simplified.

Unlock new digital opportunities.

Your customers expect seamless and secure digital transactions, whenever and wherever they want. Meeting that challenge starts with confidently knowing they are who they say they are.

User-friendly. Business-friendly.

The Interac Verified product suite enables businesses to digitally verify customers’ data with secure, future-ready solutions, while giving them the choice to verify using one or all three available options.

Interac®

verification service

With Interac verification service, your customers use their online banking login with a participating financial institution1 for quick, secure identity verification.

See how

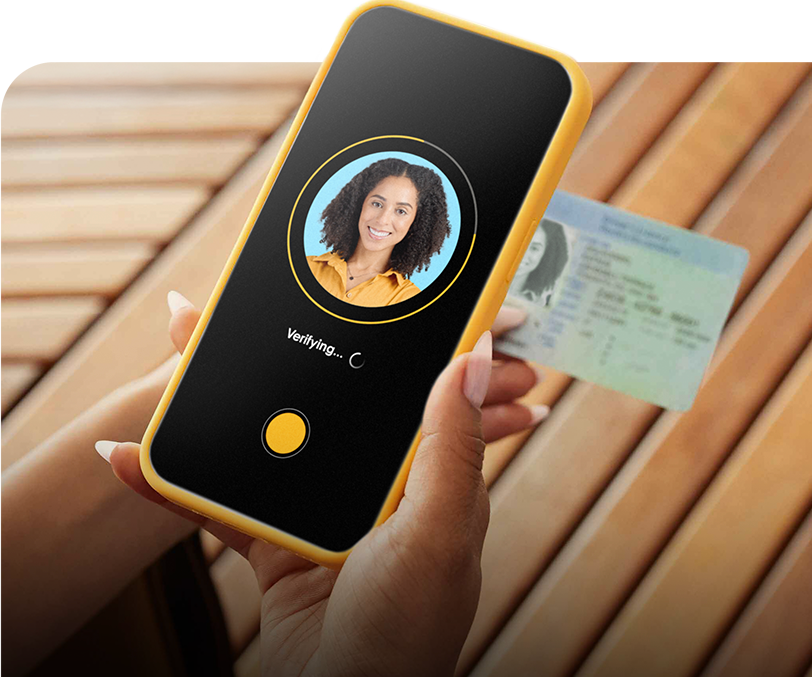

Interac® document verification service

With Interac document verification service, your customers can use their accepted form of government-issued documents2 and a biometric liveness check with their mobile devices to verify their identity.

Learn more

Interac Verified™ credential service

The Interac Verified™ credential service is shaping the future of digital identity. It delivers secure, reusable verification that can help businesses reduce fraud, protect privacy, and streamline interactions.

Explore nowExplore verification opportunities in a variety of Canadian industries.

- Insurance

- Gaming

- Retail/E-Commerce

- Banking

- Real estate

- Government services

Integrating Interac verification hub.

Deploy verification solutions quickly with a single API and a developer portal designed to streamline setup.

Tune in to our Everyday Trust series.

In each episode, Debbie Gamble, Group Head of Strategy & Marketing at Interac, is joined by an expert to discuss the importance of trust within their industry and how credible, secure solutions can help fuel prosperity in Canada.

Watch nowPartner with a brand Canadians count on.

Leveraging decades of experience in delivering secure payments, Interac Verified is making access to online transactions fast, easy, and secure for Canadians.

*Based on Interac data for 2024

**2023 Gustavson Brand Trust Index: Fear of inflation impacts Canada’s Brand Trust – 13,188 Canadian consumers

1For a list of participating financial institutions or credit unions that can be used to log in or access the Interac verification service or generate an Interac Verified credential, click here.

2For full list of government-issued documents eligible for verification by the Interac document verification service, click here.

3For full list of government-issued documents eligible for verification to generate an Interac Verified credential, click here.

4Currently available with BMO, CIBC, Desjardins, RBC, Scotiabank and TD Canada Trust