Data-driven trends for your small business

Canadian consumer behavior and payment insights for small businesses. Discover how these emerging trends can inform your strategies and help supercharge growth.

Trend 01

Mobile, tap, go: Why Gen Z is ditching the wallet

Learn more

Trend 02

Security concerns: Rise of the data-wary consumer

Learn more

Trend 03

Out with the old: How digitization fuels business growth

Learn more

Trend 01

Mobile, tap, go: Why Gen Z is ditching the wallet

Gen Z is rewriting the rules of spending, and understanding this cashless generation is key to future success for small business owners. Facing a unique set of economic challenges, Gen Z is prioritizing financial literacy and mindful spending, seeking control and flexibility with their money. They embrace a digital-first approach to spending, favouring options like debit cards, tap-and-go, and mobile wallets — ditching cash at a rate that outpaces any previous generation.

To capture this emerging generation of consumers, small businesses need to adapt and offer seamless digital payment options. This includes prioritizing debit card acceptance and ensuring a smooth and user-friendly mobile wallet experience.

Gen Z is leading the mobile wallet revolution, with 7 in 10 of Canadian Gen Z surveyed already onboard1

Gen Z

0%

Millennials

0%

Gen X

0%

Boomers

0%

6 in 10

Gen Z Canadians surveyed are comfortable leaving their physical wallet at home for quick errands2

63%

of all Canadians surveyed expect that it will soon be normal to leave home without a physical wallet3

Trend 02

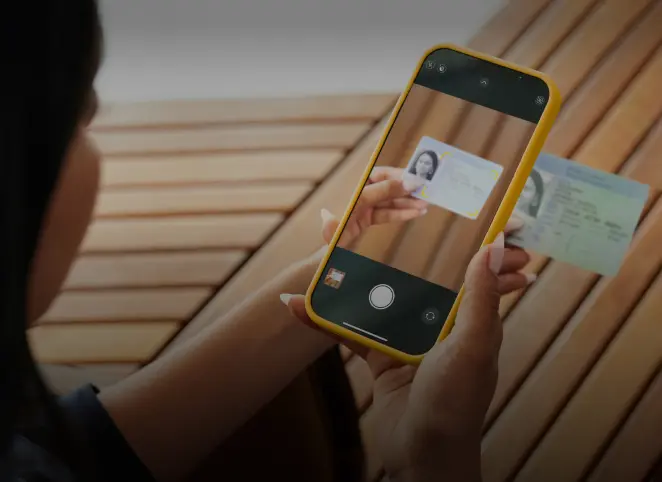

Security concerns: Rise of the data-wary consumer

Canadians are increasingly uneasy about their data privacy, with many feeling vulnerable and feeling they have less control in a digital world that’s becoming increasingly complex. While they expect businesses to protect their information, many doubt the effectiveness of current measures.

The demand for enhanced security is fueling the rise of digital verification tools such as those offered by Interac Verified. Business leaders recognize that such solutions are crucial, not only for protecting customer data but also for making organizations safer for employees.

0%

of Canadians surveyed feel their personal data is more exposed than ever7

0%

of Canadians surveyed believe current data protection measures aren't enough8

0%

of business leaders surveyed see digital verification as a way of protecting customer data9

3 in 4

Canadians surveyed expect businesses to have consumer protection measures in place10

4 in 5

business leaders surveyed agree that digital verification solutions make their organization safer for employees11

Trend 03

Out with the old: How digitization fuels business growth

Time and money are a small business owner's most precious resources, yet many lack confidence in managing them effectively. And as inflation squeezes margins, ditching outdated, time-consuming processes for more innovative solutions is critical for your bottom line.

Digital transformation, like adopting Interac Debit and Interac e-Transfer for payments, can empower businesses to streamline operations, freeing up time and resources for higher-value tasks. By embracing digital tools, small business owners can gain better control of their finances, boost confidence, and unlock their growth potential.

Only 15%

of Canadian entrepreneurs surveyed feel confident managing their business finances from day one12

53

of financial decision-makers surveyed are bogged down with transactional processes — time that could be spent on growth13

3 out of 4

Canadian businesses surveyed plan to ditch cheques within the next 5 years14

Ready to level up? Learn how Interac can help you grow your business.

We can help unlock your business potential

Interac provides solutions to help simplify and speed up your payments — so you can spend more time on building your business.

Get the free report

Let’s geek out and power your growth

Learn how meeting your customers’ evolving needs can help power your business’ growth. Take a deep dive on Interac solutions.

I’m ready to learn