Settling in a new country can sometimes feel like rebuilding the basic architecture of daily life from scratch. How do I find affordable housing? How will I travel around? What about utilities, and groceries, and school, and childcare for working parents? And how much will all this cost?

Luckily, there are plenty of resources available to help people new to Canada acclimate to daily life, including money saving tips to balance your budget.

As is often the case, understanding and managing your daily expenses can be less overwhelming if you divide the big tasks (everything!) into a series of smaller, achievable ones. Here are some tips to get you started (after you take a deep breath):

Home is where the heart is…and most of your budget

First things first; you need a place to live. Many people choose to rent rather than buy a home when they’re getting settled in a new place.

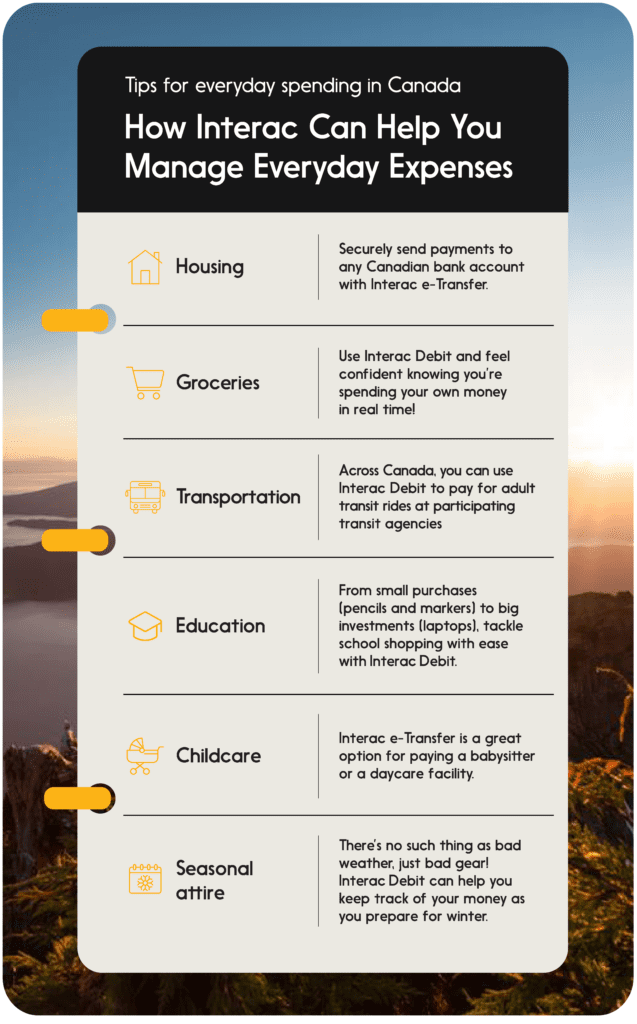

You can securely send payments—from application fees, to a security deposit, to monthly rent—with Interac e-Transfer as long as the person or organization is set up to accept it. (Make sure to be alert to potential rental scams and fraud).

It’s worth noting that affordable housing continues to be a top political topic. Canada’s government has renewed efforts around affordable housing programs, and provides resources on finding housing to suit your budget and needs, including:

In addition, the national housing agency, Canada Mortgage and Housing Corporation (CMHC), has a dedicated section on housing for newcomers. Because different provinces and territories have their own regulations, do consult the Provincial and Territorial Fact Sheets for more information and contact details for provincial and territorial rental authorities. You can always seek individualized assistance from immigrant and newcomer services.

Remember, when going through the housing process, you may need to verify documents or sign into government services. These Interac Verified products can help:

- Interac sign-in service: A secure, private and convenient way to sign in to participating online government services without having to create and manage a new user ID and password by using your login credentials with your participating financial institution—after all, you have enough to keep track of already.

- Interac verification service: Interac verification service provides Canadians with the option to use existing login credentials with a participating financial institution for secure digital verification of their data to get faster and more convenient access to participating services that require personal data confirmation.

- Interac document verification service: Interac document verification service offers Canadians the option to digitally confirm their identity using a liveness check and accepted forms of government documents3 using their mobile phones. Get fast and convenient access to participating digital government and business services that require identity verification.

Visit our step-by-step how-to guides for Interac sign-in service, Interac verification service, and Interac document verification service for more information.

Grocery shopping in Canada

Grocery shopping is one of those tasks that seems as if it should be simple, until you’re standing in an unfamiliar aisle, surrounded by new brands and different prices.

In Canada, as in other countries, grocery prices have continued to outpace inflation, prompting government measures. Depending on your financial situation, you might be eligible for a goods and services tax credit.

Regardless of your individual circumstances, there are grocery budgeting tips that will likely be familiar to newcomers, including exploring loyalty programs that offer discounts and rewards, memberships at bulk stores, and of course, the age-old method of clipping coupons—physically or digitally.

You can shop for groceries in many different ways: in store, by ordering through a grocery store’s app for pick-up or delivery, or through various other delivery services and meal programs. Depending on how you shop, you may be able to pay with Interac Debit and feel confident knowing you’re spending your own money and in control of your finances.

Another great resource when it comes to budgeting basics is Credit Canada’s Butterfly app, sponsored by Interac, which offers tailored digital solutions and practice tools for newcomers. It’s a multilingual resource that empowers newcomers to take control of their finances.

Plus: Be aware that many stores will charge you for disposable bags, so make sure to bring your reusable ones along on every shopping trip.

Get around town with ease (even if you get lost)

Traveling in a new country—from navigating public transportation, to budgeting for transit costs—is easier said than done. You’ll probably get on the wrong train or take a wrong turn a time or two.

But whether you’re learning a daily commute to work or school, or traveling to visit family or run errands, you can use Interac Debit to pay for your adult transit ride on select transit systems in Canada.

Plus, contactless payment means you can simply tap your debit card or Interac debit card provisioned in your phone to tap onto the bus, subway or streetcar (or to check out quickly at gas stations if your commute involves a drive).

Learn more about using Interac Debit on Transit Systems in Canada.

Calculate childcare costs

We all know childcare is expensive—prohibitively so, in some cases. In Canada, a majority of the country’s provinces and territories have pledged to implement $10-a-day (on average) regulated childcare. Those that haven’t adopted this policy yet have also lowered parent fees by 50% or more, reflecting Canada’s commitment to providing affordable, regulated childcare options.

Tip: Whether you choose a regulated childcare option or decide on an in-home daycare centre or nanny, check if they accept Interac e- Transfer as a form of payment. Sending money by Interac e-Transfer can be a helpful budgeting tool, because the money leaves your account immediately (instead of you having to hold the funds to pay a bill later) – that way, you always know how much you have left for the month.

Paying for school for your children, or yourself

Canada’s education system is managed by provincial and territorial governments, and more than 95% of Canadians choose public school education for their children. You’ll still be responsible for some of the costs associated with education. From washable markers and folders for your young child, to textbooks, calculators and even laptops for older children, you can tackle school shopping with ease by paying with Interac Debit. And you can use Interac e-Transfer to purchase refurbished electronics and specialty supplies through online marketplaces.

If you’ve come to Canada to pursue higher education yourself, you will have additional costs as part of your adjustment to student life.

There’s no such thing as bad weather…

Only bad gear. Don’t let the Canadian cold winters get the best of you: make sure to factor in seasonal costs such as a very warm coat, thermal wear, snow boots, and snow tires for your car. And winter can be wonderful, so you might want to set aside some discretionary spending money for ice skates or ski rentals.

Canada is beautiful in the warmer months too, so depending on your wardrobe, you might need some sun hats or flip-flops. And remember, rain or shine (or snow), every shopping list should include sunscreen.

Whether you’re buying sweaters or swimsuits, Interac Debit helps you stay in charge all year-round by using your own money, straight from your account and authorized by your financial institution in real-time.

Use Interac e-Transfer to take some of the financial stress out of moving