Moving to a new country can be an exciting life experience. But it can also feel a little unfamiliar. You may be starting a new job or at a new school and trying to find a place to live, all while adjusting to new customs, a new culture, maybe even a new language.

If you’ve just moved to Canada, you might also just be getting to know how the country’s financial system works – everyday banking, how people pay for things, or how people interact digitally. What forms of payments are most common? Do landlords only take cheques or can rent payments be transferred digitally? When taking public transit, do fare cards need to be purchased in advance or are there other ways to pay for a ride? How do you sign-in to access tax information?

We’ll uncover these answers and more in this article.

As you get settled into Canada, we want to introduce you to Interac and its suite of digital payments and verification solutions. We’ll be covering what products Interac offers, when and how to use them and how they help make your day-to-day digital experiences more simple, secure and convenient.

What you can learn from this page:

- What is Interac?

- How do I pay for goods or services in store and online? (Getting started with Interac Debit)

- How do I send and receive money to and from people and businesses? (What is Interac e-Transfer and how do you use it?)

- What do I need to know about digital verification? (What is Interac Verified?)

- More free resources to bring you up to speed on finance in Canada

What is Interac?

Are you wondering what that Interac logo means on your debit card, in shop windows and online? Interac helps you transact digitally using your own money from your bank account, as well as helping to provide convenient access to government and business services that require you to prove you are who you say you are.

Interac is probably best known for Interac Debit and Interac e-Transfer, which both have a long history of enabling Canadians to withdraw, pay with and move their own money anytime. These products are accessed through your Canadian financial institution (we’re connected to more than 300 of them. If you don’t have a Canadian bank account yet, you can learn about opening one here.)

Most recently, we launched Interac Verified to provide Canadians with easy-to-use and convenient ways to authenticate and verify their personal information to access participating business or government services. For example, when you’re logging in to access your tax information, look for an option to use Interac sign-in service (part of Interac Verified) to use your existing banking credentials (in other words, the login information you use when signing in to your online banking) to gain access. It’s a convenient way to avoid having to create new usernames and passwords.

And when you use our products and services, you can do it with confidence. Interac is one of Canada’s leading and most trusted financial services brands, thanks in large part to the security features built into its products and services. We arm Canadians with helpful information to spot, avoid, and report fraud — and it’s a good idea to get familiar with this if you’re a new Canadian.

Learn how to avoid scams that target newcomers to Canada.

Keep reading to learn more about how each of these services can make your day-to-day life more convenient.

How do I pay for goods or services in store and online? (Getting started with Interac Debit)

Interac Debit is a fast and convenient way to pay for purchases in Canada. When you pay with Interac Debit, you’re using money that’s already in your bank account — so it’s a great way to help stay within your budget and keep track of your spending.

To get started, you’ll need an account at a participating Canadian bank or credit union (also known as your financial institution). They’ll provide you with your debit card after setting up an account. Once you have it, you can use Interac Debit to make purchases in store, add it to your digital wallet on your mobile phone or device, or take out cash at the closest Automated Banking Machine (ABM).

There are a few ways you can pay for something using Interac Debit:

- Paying for an item in store, at a restaurant, or at another physical location: One way to use your Interac Debit is what’s called a “Chip and PIN” transaction. You do this by inserting the card into the payment terminal and entering a PIN (personal identification number) code to securely make a purchase. (For security, you’ll be assigned or choose a unique, secret PIN when you get your debit card with your participating financial institution. Protect your PIN — don’t share the number with anyone else.)

Learn how to pay using Chip and PIN with Interac Debit.

- Paying in store just by tapping: Similar to “Chip and PIN” transactions, another way you can pay at a physical location using your Interac Debit is through contactless payments. You can make an Interac Debit contactless payment using your debit card by tapping your card on a payment terminal to complete a transaction.

Learn how to make a contactless payment with Interac Debit.

This could be at a store, restaurant or even paying for an adult fare on select public transit systems across Canada.

Learn how to use Interac Debit to pay for transit.

- Adding your debit card so you can pay using your mobile phone or wearable device at participating merchants: If you are looking to pay using Interac Debit but without the use of your physical card you have the option to add it to your digital wallet. You can set up Interac Debit as a payment method in your digital wallet and then make a contactless transaction where available by tapping your mobile phone or wearable device on the terminal.

Learn how to add your Interac Debit card to your digital wallet.

- Ordering food, shopping or completing a payment on an app or website: Once you add your debit card to your digital wallet you can also use it to shop and order online at participating merchants through Interac e-Commerce Payments. You can pay using Interac Debit when you select it as your payment method when shopping online on select Canadian merchants’ websites or apps. That way, you can make online purchases with your own money.

Learn more about shopping in apps and online with Interac Debit.

- Using Interac Debit to access ABMs (Automated Banking Machines): When you need cash, you can make a secure and fast withdrawal at any machine that’s part of the Inter-Member Network. (Banks and ABM operators may add a surcharge or “convenience fee” on top for their services.) Find the closest ABM near you.

Find out more about accessing cash using Interac Debit and ABMs.

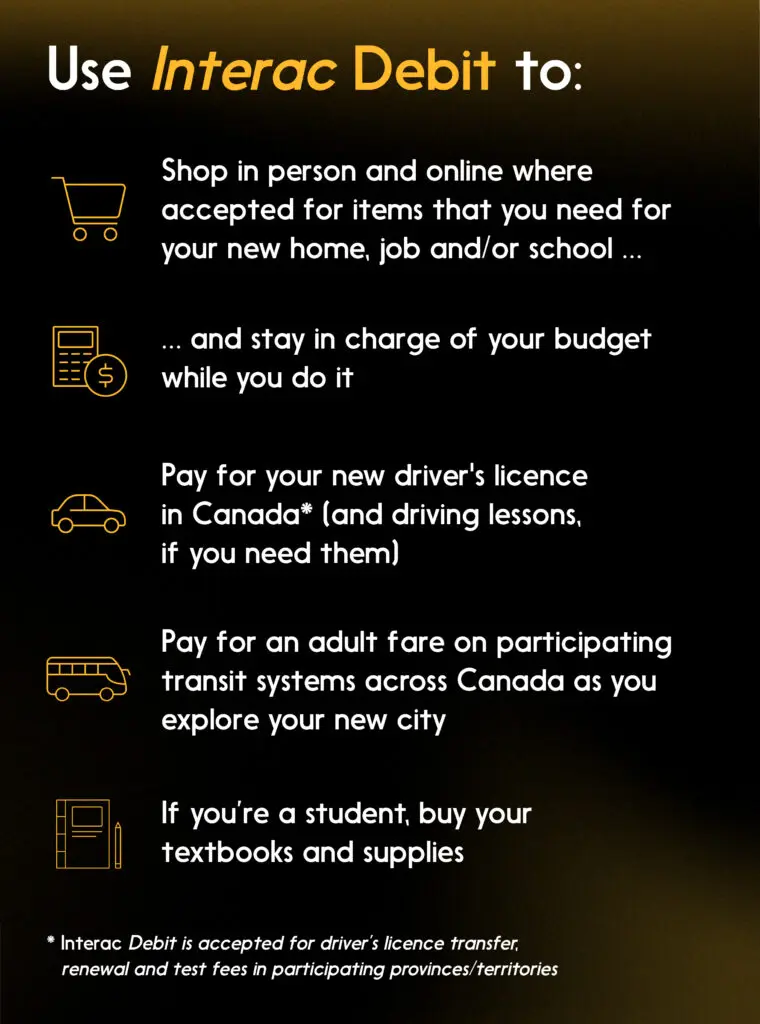

When to use Interac Debit in your daily life

You’ll have plenty of opportunities to use Interac Debit as a payment option to help you keep better track of your spending and use your own money so there are no surprise bills at the end of the month. Here are a few practical examples:

- Household purchases: When you’re making your weekly grocery trip or looking for household supplies, you can use Interac Debit for a simple and secure way to pay.

- Paying for transit: You’ll likely have lots of places you’ll need to get around to. Select transit systems across Canada allow you to tap to pay using Interac Debit for an adult fare with no need to set up or load a separate fare card.

- Paying via an app (maybe your morning coffee or ordering lunch?): Did you know you can use Interac Debit in the app for some coffee shops in Canada? Many merchants in Canada accept Interac Debit as a payment method if you’ve added it to your digital wallet, so take advantage and stay on track of your budget.

And for more ideas, this article shows you how to use Interac Debit to make your busy days more convenient, so you can make the most out of your life in Canada.

To learn more about Interac Debit and how it works, visit this page.

How do I send and receive money to and from people and businesses? (What is Interac e-Transfer and how do you use it?)

Interac e-Transfer is a money movement solution available through your participating Canadian financial institution that allows you to send and receive funds using an email address or mobile phone. It’s easy to access within your online banking platform.

Learn how to send money with Interac e-Transfer.

- Accept money automatically without a security question: If you set up the Interac e-Transfer Autodeposit feature, any funds you receive via Interac e-Transfer will go directly into your bank account without the need for a security question and answer, after routine fraud checks by your financial institution.

Learn how to set up Interac e-Transfer Autodeposit.

- Requesting money: When you want someone to send you money, you can use the Interac e-Transfer Request Money feature to give them an easy way to do it. (Some people use Request Money as a convenient way to ask for payment for informal work, like babysitting or tutoring.)

Learn how to use Interac e-Transfer Request Money.

Many Canadian banks and credit unions offer these transactions as part of your monthly banking package, which helps keep your fees lower.

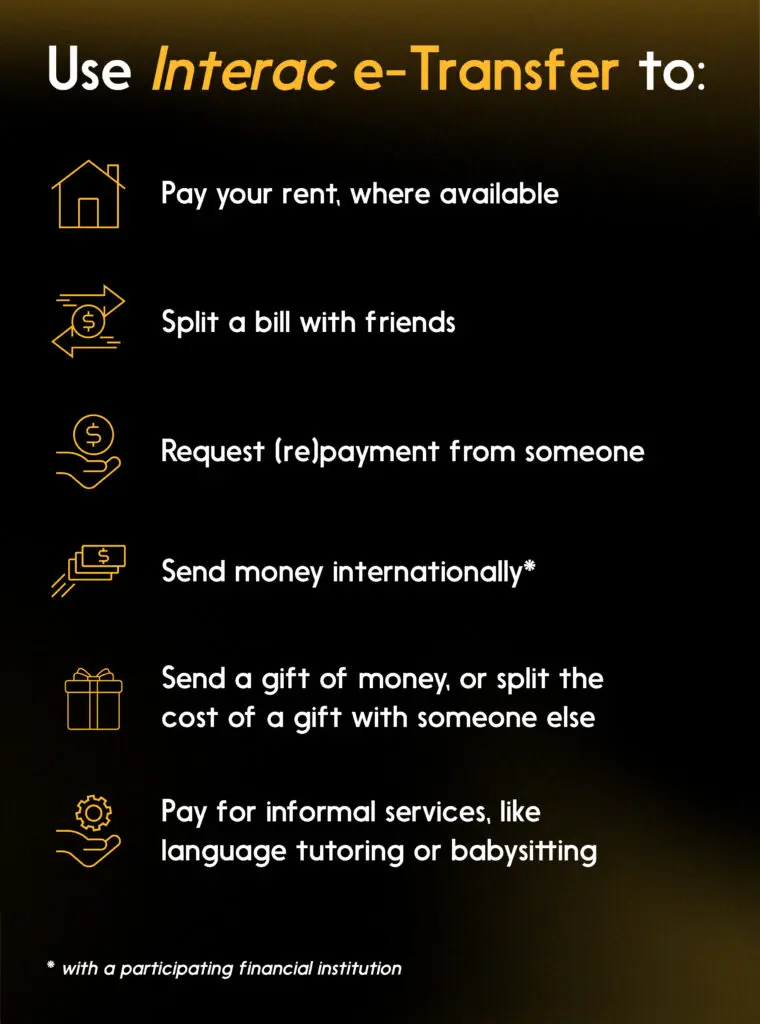

When to use Interac e-Transfer

- To pay your rent: Check with your landlord to see if they accept Interac e-Transfer as a method of paying rent. This way, you can feel confident knowing that your payment is coming out of your account when you send it, with virtually no delay.

- Paying for services: Many Canadian service providers have begun accepting Interac e-Transfer as a payment method – from movers, contractors, babysitters, tutors, house cleaners and more. Plus, by adding details into the Interac e-Transfer memo field, you can easily keep track of the services you paid for.

- Do you have your own business and are looking to start accepting Interac e-Transfer as a payment method? Click here to learn more.

- Splitting costs: If you’re splitting the cost of an item, service, or even a gift among several people, and need to gather money from each of them, you can use Interac e-Transfer to receive each of their shares directly into your account without the need to exchange any cash.

Learn how to receive (accept) money with Interac e-Transfer.

- Sending money overseas: Looking for a convenient way to send money back home? Using International Transfer by Mastercard and Interac, you can send money internationally if you bank with a participating financial institution.

This explainer page can help you understand more ways you can use Interac e-Transfer.

What do I need to know about digital verification? (What is Interac Verified?)

Interac Verified enables you to verify yourself in order to have convenient digital access to participating government and business services that require personal data. (It’s actually a suite of three services: Interac sign-in service, Interac document verification service and Interac verification service.)

Using Interac sign-in service, you can access select government services using your existing banking credentials (login and password) — for example, you can use Interac sign-in service to access your IRCC (Immigration, Refugees and Citizenship Canada) account to manage your application, check your status on a work visa, and more. All you need to do is select “Sign in with a Sign-In Partner” from the government service page.

You may also be able to use Interac Verified to open accounts with participating service providers. Look for opportunities to use it when you’re signing up for financial services in Canada, or shopping with a membership-based retailer to buy what you need to set up your new home.

Learn how to access government services using Interac sign-in service.

Your journey with Interac Verified is just getting started. Learn more about Interac verification solutions.

More free resources to bring you up to speed on some interesting finance topics in Canada

To help people who are navigating a new country and a new financial system, Interac has partnered with Conscious Economics, a Canadian non-profit, to offer a free course designed to help newcomers to Canada. The three-part course is available free and online to all newcomers who wish to participate, and it has subtitles available in French, Mandarin, Farsi, Arabic and Punjabi as well as English.

We hope to help you:

- Feel more secure in your budgeting and other money management

- Understand the ins and outs of daily financial life in Canada, including taxes

- Get acclimated to how housing works in Canada, including rent, home ownership and other options

Get started with the free Conscious Economics course for Canadian newcomers.