More people than ever are coming to Canada to pursue education opportunities. If you’re an international student, you may be one of the 900,000 that Canada is expected to accept in 2023.

Unfortunately, students aren’t the only people pursuing opportunities — so are fraudsters, who are preying on international students, taking advantage of their needs and their relative unfamiliarity with how things work in Canada. According to a recent survey of newcomers by Interac, almost three-quarters (73 per cent) of newcomers surveyed would like to know more about how to protect themselves.

While there are organizations that can help you in the fight against fraud (your postsecondary institution, the federal government’s Canadian Anti-Fraud Centre, police forces, and financial entities like Interac), you are your own first line of defence — against digital fraud, hacking, attempts to steal personal and financial credentials, and other forms of fraud.

That means it’s important to empower yourself by being alert to potential scams and aware of how to safeguard against them. At Interac we’re here to help. Not only do we build security features into our products and services to help people stay secure when transacting in-store and online, we also work to educate Canadians on how to spot, avoid, and report fraud so they can make digital transactions with confidence.

Fraud prevention resources to get you started

- This article tells you about scams that impact Canadians without specifically targeting any one group — read it to get familiar with the risks, like email fraud and phishing.

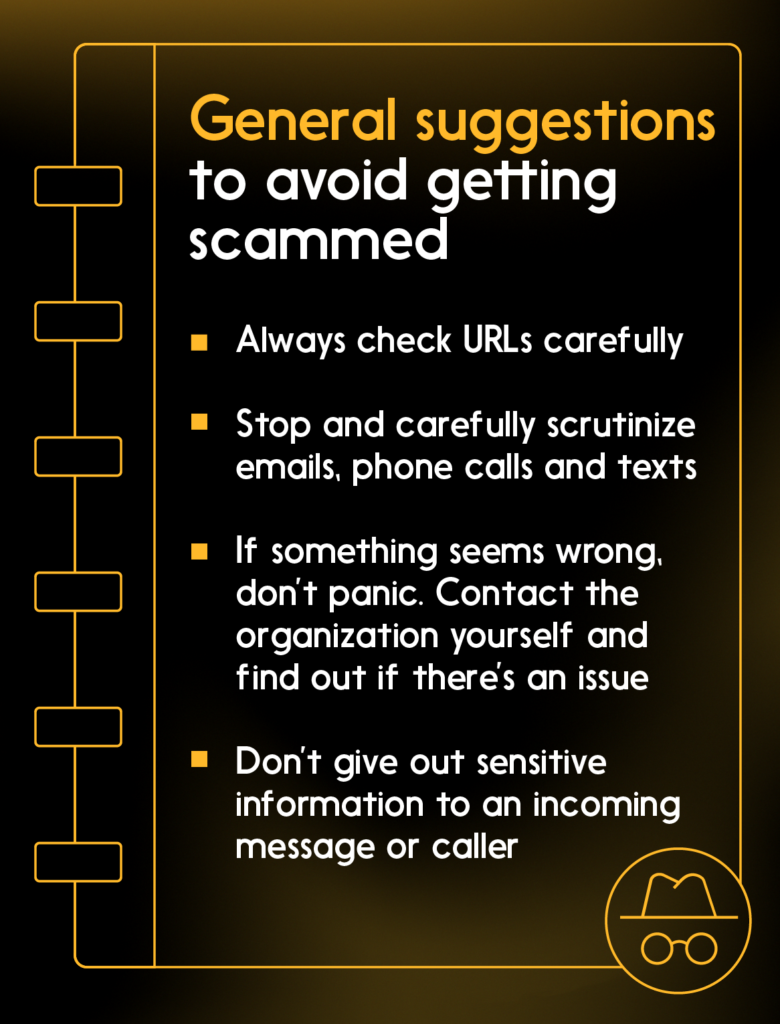

- This one explains how to spot scams that tend to target newcomers to Canada in general, not just students. It also offers general suggestions on avoiding the pitfalls — for example, it’s important to remember that Canadian immigration officials don’t contact people and threaten to deport them unless they pay a fee, or to confirm personal or financial details.

And finally, there are also scams that specifically target international students. Keep reading to see some common and recent scams so you can be prepared and empowered to avoid the risks.

Scams that target international students

Here are some scams that you’ll want to watch out for as an international student in Canada, according to law-enforcement agencies, colleges and universities, and news reports:

Fake university acceptance letters

Students from various countries have been targeted by immigration consultants who scammed them by accepting fees in exchange for forged postsecondary acceptance letters. In at least some cases, the students don’t know they’re forged.

What can you do? Contact your prospective college or university to verify that your letter is real. Check your letter carefully — fraudulent ones may contain errors, like incorrect program start dates or program information and/or they may lack essential information like date of acceptance or the applicant’s identifying details.

Housing/rental scams

International students have been lured into sending deposits to secure housing (sometimes even before they arrive in Canada), but the supposed property owner vanishes — because they’re not the owner at all.

What can you do? Avoid renting a unit without seeing it first or having someone you trust see it, if possible. And try to meet the landlord face-to-face. Be wary of high-pressure sales tactics, rents that sound too good to be true, or landlords who don’t ask you very many questions about yourself and your income. Also: If you use Interac e-Transfer to send money, you have an opportunity to check the recipient’s registered name before you confirm the transaction. This gives you a chance to make sure it’s the name you’re expecting.

Deportation threats

Students have been contacted by scammers who claim to be immigration officers, demanding a payment to avoid being deported.

What can you do? Don’t respond to the message (or hang up if it’s a phone call), and contact Immigration, Refugees and Citizenship Canada (IRCC) yourself to see if there’s any issue with your file.

Ghostwriting scams

International students are susceptible to scams in which a person offers to write class assignments (e.g., essays) in exchange for a fee. After receiving the money, the fraudster either doesn’t produce the work, or sends a plagiarized piece.

What can you do? Follow standard Canadian guidelines for students: All coursework must be your own — you may not hire someone else to produce it (this is considered cheating), nor should you produce work for anyone else.

Money mule recruiting

A money mule is someone who moves money from one bank account to another on behalf of someone else — usually for criminal purposes. Criminals enlist the target to accept a large amount of money and then transfer it somewhere else, in exchange for a fee. International students have been scammed into acting as money mules, which leaves them open to criminal charges.

What can you do? As always, be skeptical when an offer seems too good to be true. Don’t move packages or transfer funds on behalf of someone else if a legitimate courier or money transfer service could do it — if someone is asking you to do it instead, their purposes may be criminal.

How to be ready for fraud prevention when studying abroad

Part of fraud prevention is being prepared to stop and scrutinize a situation when it doesn’t feel right. Be ready to withhold your trust until and unless you can verify for yourself what’s actually happening.

Scammers will often try to pose as legitimate organizations — your college or university, bank, or IRCC. For example, in a phishing attack, a fraudster might pose as one of these.

When someone tries to commit fraud against you, they sometimes use harsh or threatening language. Financial therapist Aseel El-Baba, with the Canadian not-for-profit economic education organization Conscious Economics, says that can be a big hint that the caller is not legitimate. “Thinking about how an encounter makes you feel is a good guide. Genuine Canadian companies and organizations don’t try to make you feel fearful. They don’t pressure you to act quickly, nor do they threaten people,” she says.

And if you have questions, many postsecondary institutions provide free advice to international students.

How building financial literacy boosts your confidence — and security

Aseel says confidence starts with financial literacy, which can give newcomers the knowledge they need to navigate daily life and money management in Canada.

She notes that Interac products and services can help newcomers stay on track with their budgets and payments. “Building healthy money habits like creating a monthly budget and paying for purchases with your own money with Interac Debit can help you take charge and build financial confidence,” she says.

As for critical payments like rent, learn how to use Interac e-Transfer to pay your landlord in near real time (and on time) if that is an accepted payment method. “That way you know when the money is sent, so you don’t have to worry about it later,” she says.

It’s OK if it takes a while to figure out the cultural differences around money, Aseel says, as attitudes can vary quite a bit around the world. “For example, Canadians are encouraged to start saving for their retirements as soon as they start working, whereas in other places, home and family needs take precedence. Not only that, but Canadians trust their employers, governments, financial institutions and pension plans with their retirement savings and contributions. That can be something to get used to if you’re from a part of the world where people don’t have that trust in institutions.”

However — and this is where knowledge of fraud comes in — there are also situations where Canadians have learned not to be trusting. For example, “Offers that seem too good to be true often aren’t,” Aseel says.

Finally, if you do encounter fraud, or lose money because of a scam, Aseel says it’s essential not to beat yourself up over it. You’re not alone, for one thing: The Interac survey found that 53 per cent of newcomers to Canada surveyed had encountered fraud, or an immediate family member had.

If you didn’t spot a scam the first time around, be proactive and contact the authorities — and then go easy on yourself for what happened. “Self-forgiveness and ‘letting go’ exercises can help you find compassion towards yourself,” Aseel says. “A lot of self-criticism is unhelpful, and moving forward means accepting that you’re vulnerable — just like everyone else.”

More resources for financial literacy in Canada

Interac and Conscious Economics have partnered to offer a free digital learning program tailored to newcomers to help them develop financial literacy in Canada, including how to spot scams and avoid the pitfalls of fraud. The three-part course is available free and online to all newcomers who wish to participate, and it has subtitles available in French, Mandarin, Farsi, Arabic and Punjabi as well as English.

The program will be a part of the international student’s orientation package at Toronto Metropolitan University (TMU).

Boost your Canadian financial literacy — and your confidence.