“Once-in-a-lifetime opportunity!“

“Urgent: Your account faces debt collection“

“Are you looking for love?“

“Don’t miss out again!“

Do messages like this look familiar? Probably, because these days digital fraud and scam attempts seem to be ubiquitous. In 2024, Canadians lost $638 million to fraud, according to the Canadian Anti-Fraud Centre (CAFC). So it’s no surprise that a new survey from Interac, conducted in February 2025, found that nearly nine in 10 Canadian fraud victims (87 per cent) agree that fraud scams are everywhere, and more than seven in 10 (71 per cent) agree that they constantly see new types of scams.

Other research has shown that fraud attempts are largely disseminated at random and at a high volume. Addressing the problem requires recognition.

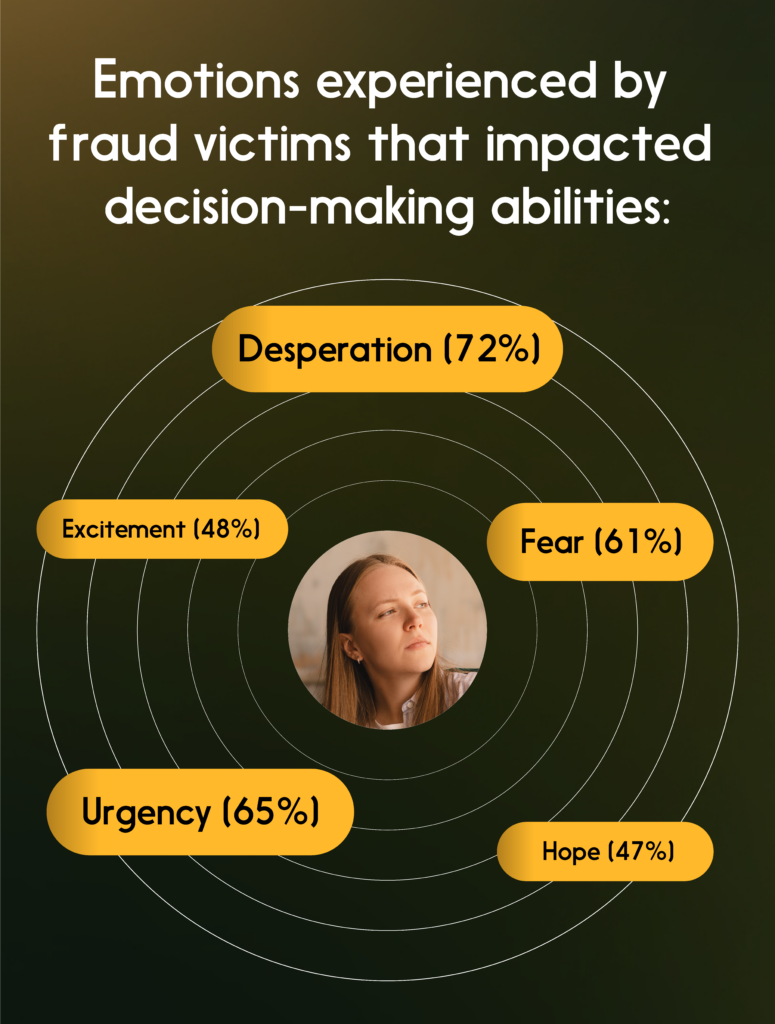

No one is immune to potentially becoming a victim of fraud, and falling prey isn’t a reflection of intelligence. On the contrary, scammers typically don’t try to outsmart us. Instead, they seek to exploit universal human emotions: our fear, our excitement, our hope, our anxiety, our loneliness. That’s been the experience of most Canadian fraud victims polled: 75 per cent said it is important to manage your emotions during a fraud attempt.

Fraudsters exploit our emotions

Before falling victim to fraud, some survey respondents reported experiencing negative emotions, such as feeling anxious, concerned, or stressed. And the majority of those who reported feeling anxious (61 per cent) or stressed (55 percent) said those emotions had a direct impact on their decision-making ability. At the same time, nearly half of the respondents said they experienced positive emotions, like excitement and hope, in connection to the fraud attempt. The fact is that emotions — positive and negative — have the potential to impair rational thinking, clouding judgment and leading to impulsive actions.

Some of the most common types of scams are specifically designed to target us by leveraging these emotions — but there are ways to take charge.

How fraudsters evoke emotional responses

Multiple scams seek to manipulate victims into sending money or providing sensitive financial information. It could be a warning that a loved one is in danger and a plea for help. It could be the threat of account closure or debt collection. It could masquerade as an official communication from a government agency. Or it could be the promise of a big, once-in-a-lifetime prize or a dream job offer.

One thing all these schemes have in common? They try to evoke emotional responses, leading people to make rash decisions.

When people make quick decisions based on limited information, they often don’t deploy critical thinking and analysis, making them vulnerable to manipulation.

Romance scams: Money can’t buy me love

Among survey respondents, 60 per cent reported that feeling lonely made them highly vulnerable to fraud — and loneliness is the emotion at the heart of romance scam attempts. The CAFC saw a recent uptick in these scams, in which an individual is contacted on a dating app or social media platform by a fraudster who tries to form a relationship and establish trust. This frequently leads to an attempt to get the victim to invest in cryptocurrency in a “get rich quick” scheme.

It’s impossible to completely untangle the connections between cognitive processes and emotional responses when it comes to how humans make decisions. Many people are unaware of how these elements influence their actions, according to the Canadian Financial Crimes Academy: By heightening emotions, scammers create a state where logical thought processes become secondary to immediate feelings. That’s why it’s important to only share personal information with people you know, and to reach out for help if you need it.

Reward scams: Hope springs eternal

Most people have probably imagined what they would do if they won the lottery, or received a huge prize. These scams are designed around time-sensitive offers, because feeling rushed can prevent us from taking the time to process the situation or seek help.

These “jackpot scams” seek to inspire risky behaviour by preying on excitement or hope, and a sense of scarcity. (The same is true of job scams, where fraudsters attempt to gain personal or financial information, or charge a fee, for access to a “dream job opportunity”).

Don’t be intimidated by high-pressure sales tactics and be wary of upfront fees. And remember that in Canada, there are no fees or taxes on lottery winnings.

Recovery scams: Adding insult to injury

Direct financial losses are just part of the equation when it comes to fraud — victims also experience significant emotional costs after the fraud takes place.

Among survey respondents, the most common emotion experienced was anger, as identified by 71 per cent of fraud victims. In addition, a significant proportion of victims felt distrustful (63 per cent) and stressed (57 per cent), reflecting the potential impacts of fraud on victims’ perceptions of their own safety and trust.

The CAFC and the Canadian Investment Regulatory Organization (CIRO) are warning consumers about “recovery scams,” in which fraudsters reach out to previous investment fraud victims and offer to help them recover lost funds — for a fee. These fraudsters sometimes claim to be employees of investment regulators, and CAFC stresses that people should not send funds. Only sending money and personal information to people you know and trust is one of the most important tips for securing your data online.

Three steps to take charge in the face of fraud

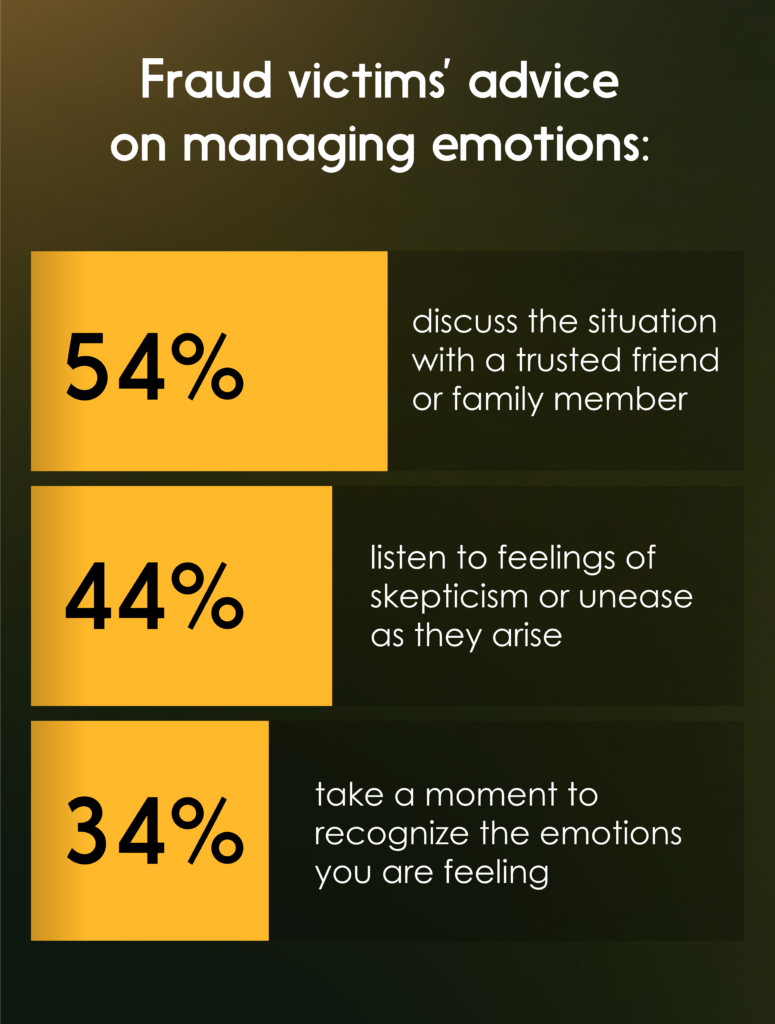

More than half (54 per cent) of fraud victims surveyed agree that knowing what they know now, they would focus on taking charge of their emotions if confronted by a fraud attempt in the future.

Developing strategies in advance to manage your emotions can help protect against fraud. One way to start is with the “Three S Approach”: Stop, Scrutinize and Speak Up.

Stop: Fraudsters hope that you will feel pressured to respond quickly and respond without assessing the situation. If an email, text or other type of message seems unusual, take a moment to stop, breathe, think, and follow your instincts.

Scrutinize: The next step is to look for the telltale signs of fraud. It helps to prepare yourself by staying up to date on the latest fraud schemes and how to spot the red flags. This list of the most common digital scams to watch out for, along with critical tips to prevent them, is a great place to start.

Speak Up: If you suspect fraud, don’t be afraid to speak up. Contact the CAFC. And depending on the type of fraud, you may want to report it to other organizations, your financial institutions or law enforcement. Sharing your story with family, friends, neighbours and co-workers could help prevent someone else from becoming a victim. (To learn more, read the stories of five people who spotted and stopped digital fraud.)

Bouncing back after fraud

Victims of fraud surveyed by Interac were asked to reflect on their experiences and share their own advice for managing emotions when confronted with fraud.

The most common recommendation, suggested by 62 per cent of respondents, was to pause before committing to any action or sending money.

Fraud attempts are part of daily life in our digital world, but with the right approach, we can stay in charge of our emotions and do everything possible to help avoid falling prey. If you’ve experienced fraud, the CAFC has an extensive list of resources to help you determine what to do.

Tips to help protect yourself from online fraud