Digital fraud can hit you while you’re trying to get out of debt. It can get you when you’re trying to do something good for other people. It can also get to you when you’re seeking additional income in a pinch…

… would you know what to do in this situation?

Knowledge is the key to online fraud prevention. Let’s protect ourselves — and feel better about protecting ourselves — by getting familiar with some of the nasty, rising scams out there, including phishing, email, and text scams. Keep reading to learn more.

How well can you spot digital fraud attempts?

Like a virus that never stops mutating, fraud is always finding new ways into our pockets, and no one is immune from being targeted. Fraud is exponentially on the rise and it’s making many of us more vulnerable than ever. Established forms of fraud, such as romance scams and email fraud, are finding new life and new variations as more and more of us spend more of our lives in the digital realm.

At the same time, our defences may be down because of heightened emotional stress. We know this because you told us.

More than half (55 per cent) of respondents to a recent Interac survey report that, with many people still working from home, they worry that continued isolation is making us more susceptible to fraud. And slightly more than half (52 per cent) fear that we’re at greater risk because we’re spending more time online.

Security has always been a top priority for Interac. We believe Canadians can empower themselves to be the first line of defence against digital fraud, hacking and other breaches of data protection, using our recommended “stop, scrutinize, speak up” approach. “With new pressures on Canadians, they remain vigilant in their attempts to combat these crimes,” says Rachel Jolicoeur, Fraud Mitigation and Strategy Director at Interac Corp.

Here are ten forms of digital fraud we’re seeing make dubious rounds, thanks to real-life stories shared by Canadian authorities and major media outlets. Read on to learn how to spot them and protect yourself.

Ten nasty scams

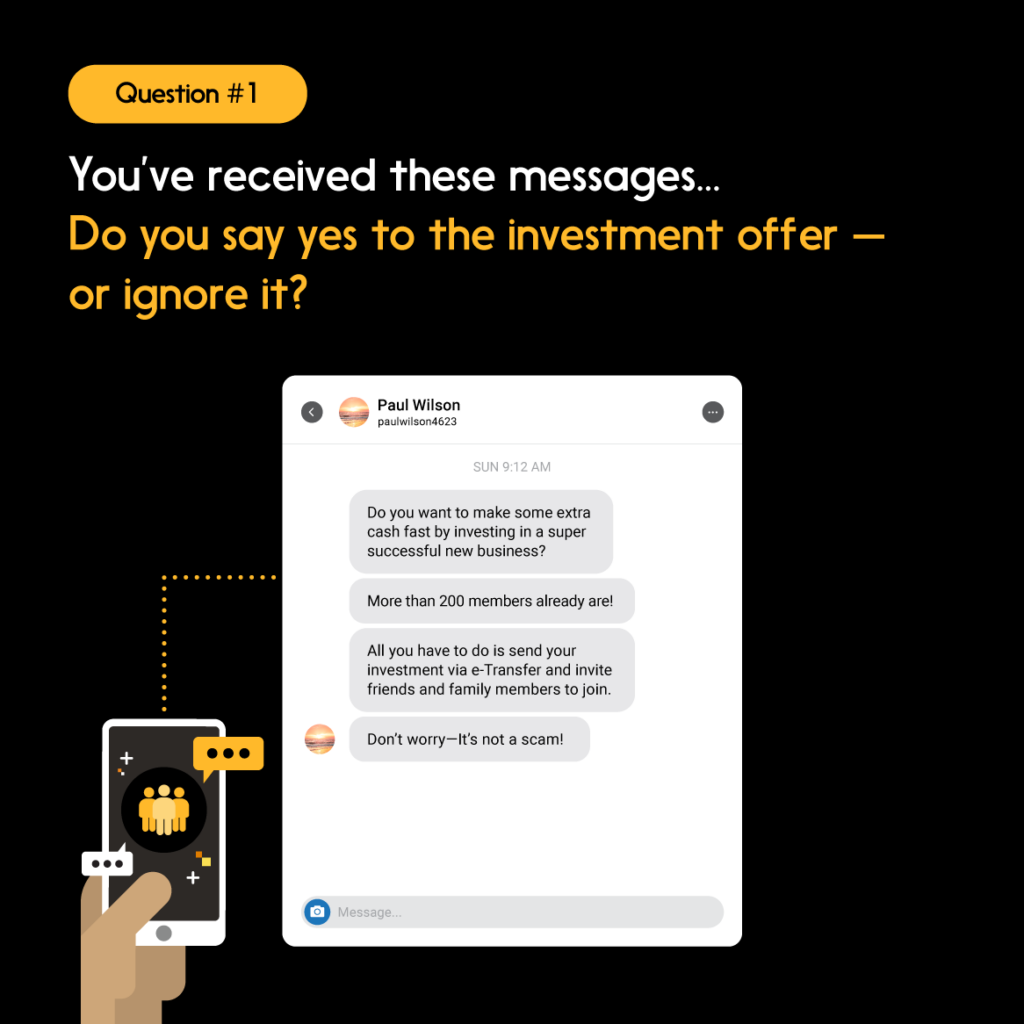

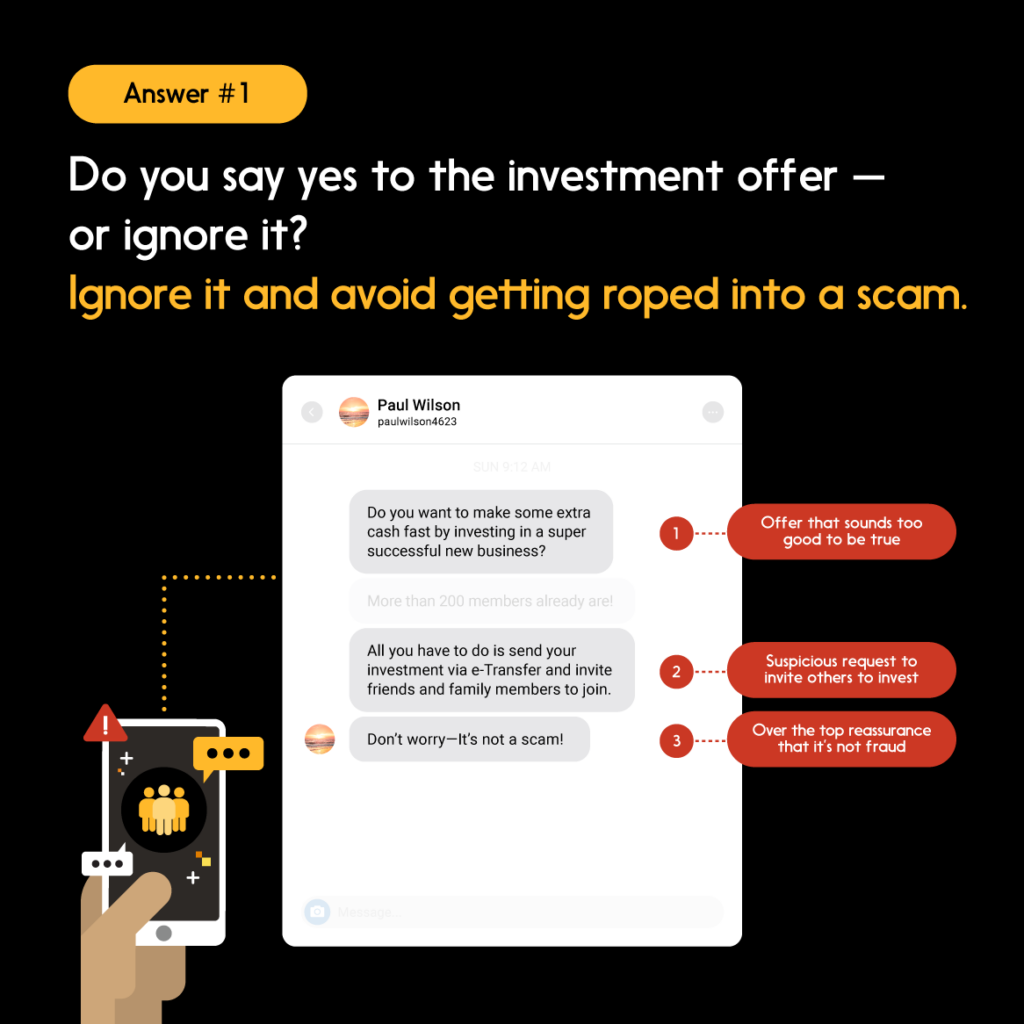

1. Online Ponzi schemes

In these tricky deceptions, unsolicited messages are sent to unsuspecting victims through WhatsApp, Instagram, Facebook and other popular social media platforms. To participate in this fraudulent investment scheme, scammers ask people to send money using Interac e-Transfer to various email accounts to fund their “portfolio”. By logging into a fake “live” dashboard, victims can track their progress and recruit subsequent investors for greater returns. Then, when investors request to withdraw their funds, they ask victims provide an additional percentage of their balance to pay for bogus administration fees.

What to watch out for: The too-good-to-be-true promise of high returns with little risk, along with a steady flow of returns regardless of market conditions. Additionally, always make sure to verify that an Interac e-Transfer request is coming from someone you know and trust.

The example we shared at the top of this article contains at least three red flags – were you able to spot them?

2. Blackmail for Bitcoin

How 2022 is this: blackmail, but they want you to pay them in crypto. The Coquitlam, B.C., RCMP recently issued a warning about a scam involving a menacing letter. The envelope contains a white powder and a threat to report the recipient for drug possession unless they follow the instructions to send a cryptocurrency payment.

What to watch out for: Urgent, threatening messages.

3. Your untrue love

The Canadian Anti-Fraud Centre received 1,928 reports of romance scams in 2021, totaling $64,604,718 in losses, up from 1,546 reports and $28,989,750 in losses in 2020. (If you’re not familiar with romance scams, check out bullet point #1 in this article.) Criminals are increasingly focusing their underhanded efforts on meeting people via social media and dating apps, and then seducing them into pouring their money into phony investment schemes.

What to watch out for: Any potential paramour who asks for money.

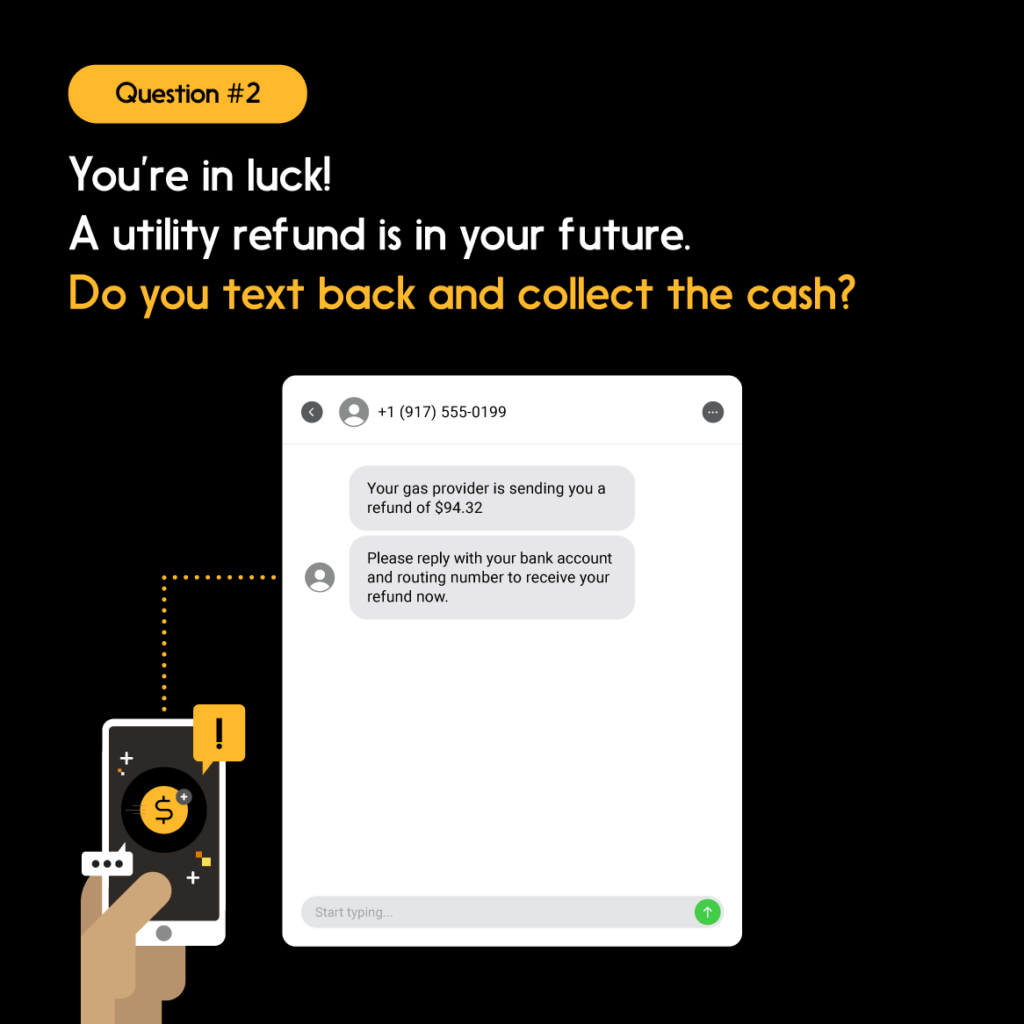

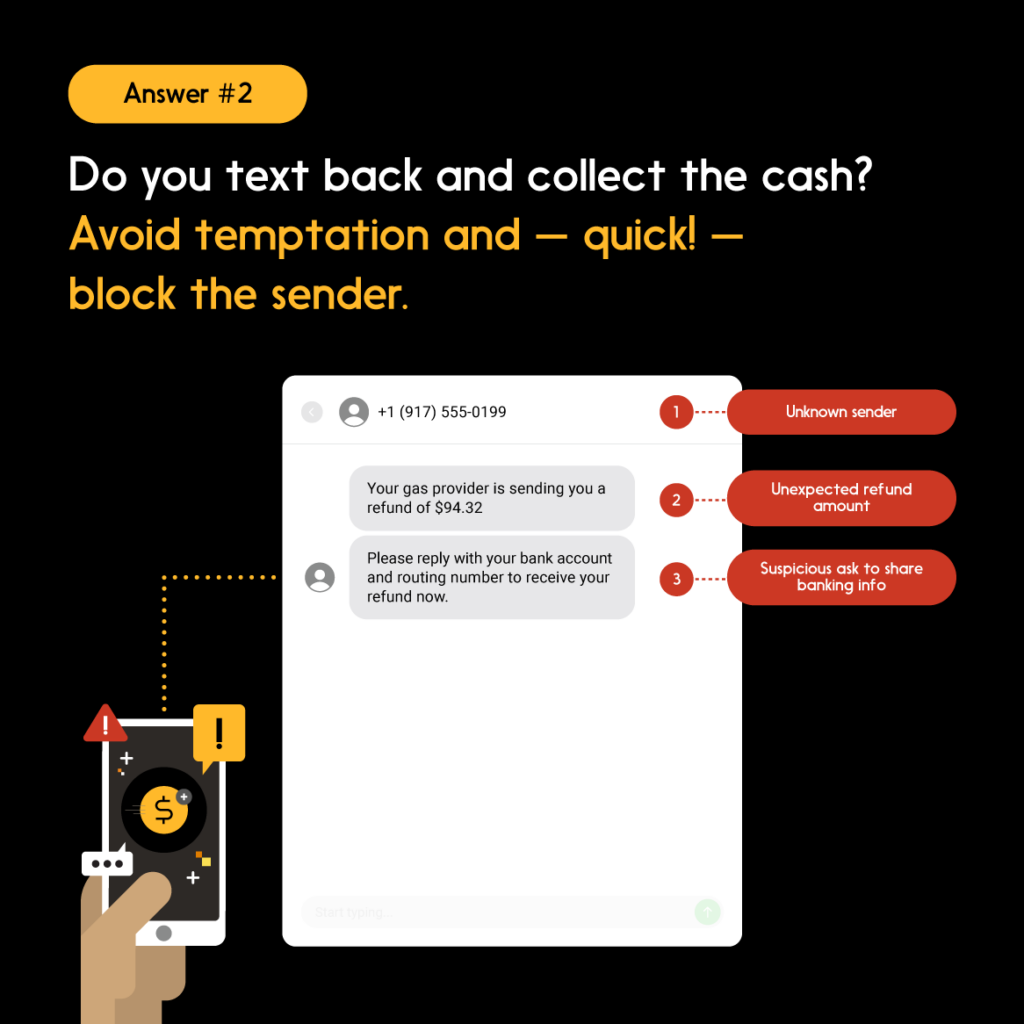

4. Too good to be true texts

Can you spot what’s wrong with this picture?

Today, everything is just a click away on our phones — even text fraud. Financial scams by SMS text, also known as smishing, are becoming much more sophisticated and, unfortunately, easier to fall prey to. Smishing scammers attempt to defraud recipients by texting them about everything from alleged unpaid traffic fines to tempting yet nonexistent cash prizes, and practically every tricky fraud scheme in between. Some even pretend to be your friend by casually asking you to hang out. The scammers’ aim? To lure unsuspecting people into sharing private identifying information or even convincing them to invest in sketchy schemes.

What to watch out for: Strange, out of the blue texts that appear to be from legitimate businesses or (fake) casual friends. When in doubt, don’t text back. Block and report suspect texts as junk instead.

Protect yourself from smishing by not responding to texts from unknown numbers, not clicking on links in texts that are suspicious and never sharing sensitive personal or financial information via text. In addition to not responding, you can report suspicious texts and other fraud attempts to the Canadian Anti-Fraud Centre via 1-888-495-8501.

5. Please hang up

If you’re like millions of other people, you may have added a telephone number to your Facebook profile. Even if none of your friends use it to look you up and give you a ring, the number can still be scooped up by a hacker and added to a database on the dark web. That’s what happened to a reported half-billion (yes, billion) people earlier this year. Having your phone number available to would-be fraudsters can put you at greater risk of fraud attempts.

What to watch out for: Any of your personal details that may be sitting out in the open online. You can increase your chances of not becoming the victim of fraudsters by not providing your phone number, address, age, and the names of your loved ones on your social media channels.

6. Employment scams

Lots of people are seeking new employment opportunities in today’s world, and therefore more susceptible to job scams and identity theft. These typically involve getting the target to send an image of a sensitive document to verify their identity. Or the fraudster will demand an “application fee.” Remote recruitment has become increasingly more common in the post-pandemic environment, with remote hiring continuing to be strong. Data projections estimate that 25 per cent of all professional jobs in North America will remain remote throughout 2022, and that number is expected to increase through 2023 — and that’s making it even easier for scammers.

What to watch out for: A new employer asking you to deposit your own money into a cryptocurrency machine or account, or one who asks for personal details, like a copy of your driver’s licence.

7. Work-from-home scams

Those of us who already have jobs have to be watchful as well.

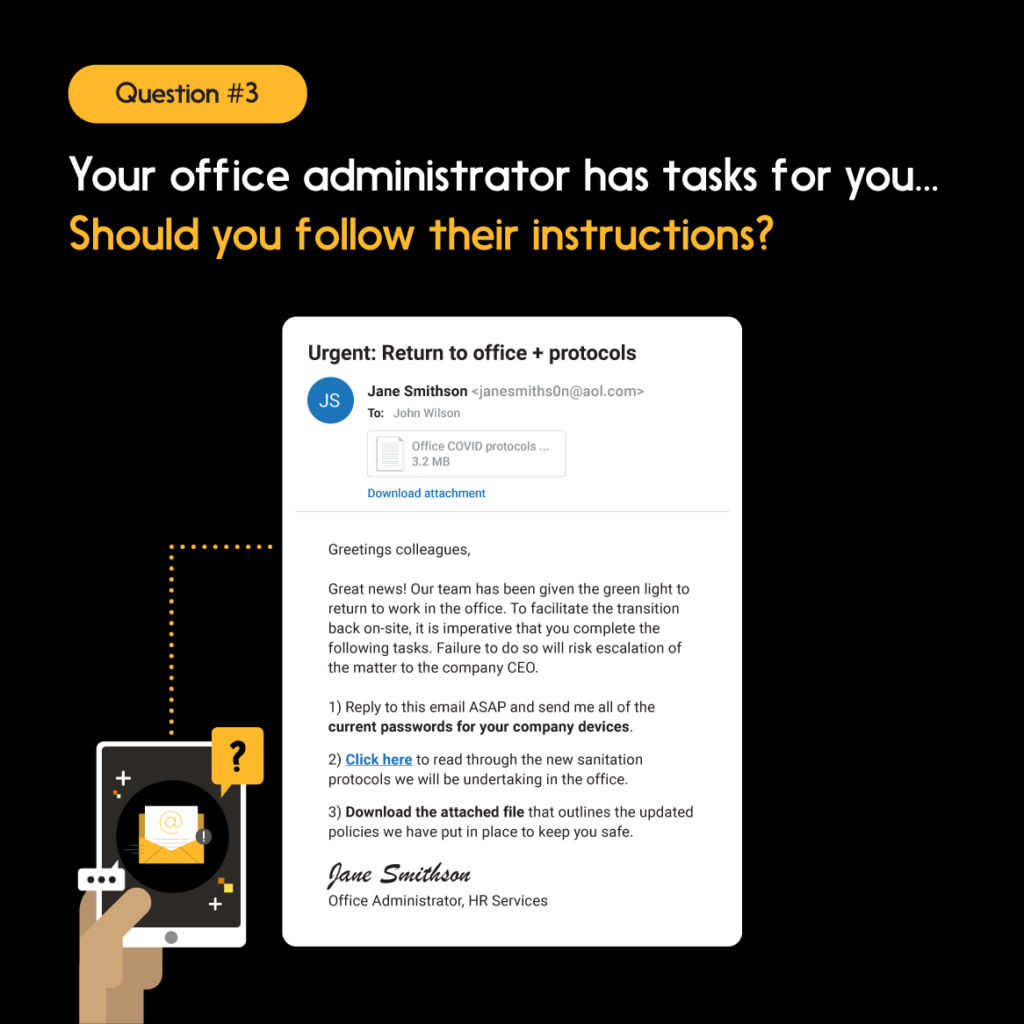

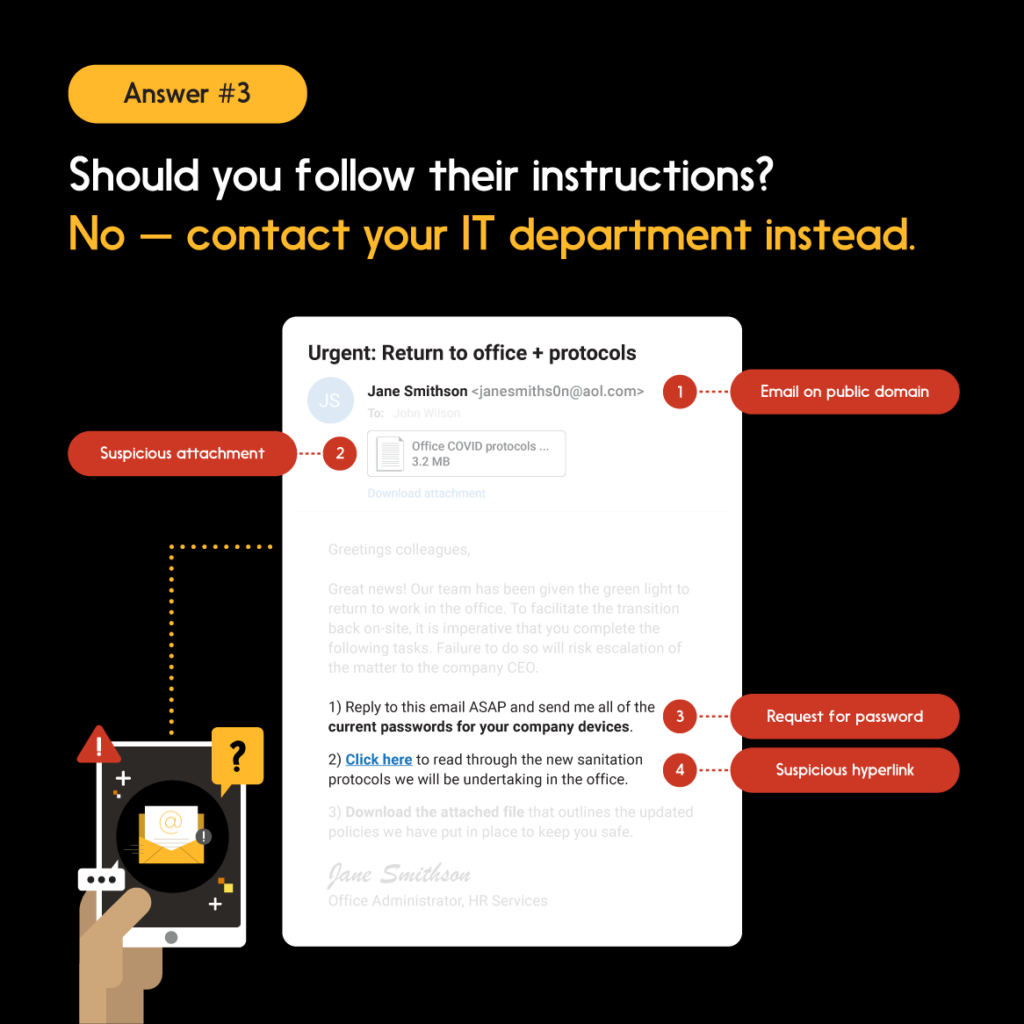

Hackers have been targeting an increasing number of remote workers with spam and phishing scams. They’re using sophisticated techniques like sending WhatsApp messages that appear to come from coworkers, many of which are personalized and not easily recognized as spam. If you fall for it, you could end up downloading harmful malware (or ransomware, an even worse form of malicious software).

What to watch out for: Emails that claim to be from your colleagues (or your boss) that direct you to external websites — check the URL carefully by hovering over it before you click. Contact your IT department when in doubt.

This email looks like a possible phishing scam. The email address uses a public domain rather than a corporate domain, which is common for phishing emails. Also, it attempts to have you reveal your password and download files that can be malicious.

8. Fraudulent ‘landlords’

A fake apartment scam tricks you into paying a deposit (typically first and last month’s rent) for an apartment that the recipient doesn’t actually own. Police have warned residents that rental fraud has increased because fraudsters are concocting more sophisticated excuses as to why they can’t meet a prospective tenant or show an apartment in person.

What to watch out for: ‘Landlords’ who provide suspicious reasons why a rental unit can’t be viewed in person, plus asks to send money without permitting a visit to the apartment, or before allowing the rental agreement to be signed.

9. Fraudulent lenders

Many Canadians have benefited from the growth of online private lenders — and that may be especially true now, given how many people are in a tough financial spot. But there are also fraudsters with slick-looking websites who take advantage of the situation by offering phony loans. Send an “activation fee,” they promise, and you’ll get the money. The problem: The loan isn’t real, and the fraudster will vanish after receiving the funds.

What to watch out for: Upfront “activation fees,” as well as terms or interest rates that seem a little too easy. As one fraud victim in Quebec told a reporter, “It was too good to be true.” And indeed, it often is.

10. Bank investigator fraud

Increasingly bold fraudsters are contacting unsuspecting victims via phone calls claiming to be representatives from financial institutions, online merchants and, yes, even law enforcement agencies, according to a 2022 report from the Canadian Anti-Fraud Centre. For example, criminals impersonating bank investigators convince victims that they’re helping law enforcement investigate alleged fraud. Assuring unsuspecting victims that they’ll trace the money and return it to the account, they may ask victims to withdraw large amounts of cash from the bank. The criminals posing as investigators might also ask victims to meet in a parking lot to hand over the money. Victims could even be asked to deposit fraudulent checks and wire money to fraudsters.

What to watch out for: Disruptive calls from fraudsters in which they ask for your assistance catching a bank employee who they say is stealing money from your bank account. Your best move: Don’t give them a fighting chance. Hang up—and hang on to your private banking info.

Fighting fraud together

We know Canadians are anxious about fraud, but we hope you’re feeling a little more confident in your knowledge and digital security.

If you think you may have been a target or victim of digital fraud, report it to your local police force as well as the Canadian Anti-Fraud Centre.

Finally, fighting fraud only works if we pull together. If you know someone who may be feeling vulnerable or especially anxious about their data protection, please share this article with them.

We take fraud prevention and cybersecurity very seriously. Learn more about email fraud and phishing scams.