You know what they say: money doesn’t grow on trees. The same could be said for the skills and confidence it takes to manage that money, especially if you’re planting your proverbial financial tree on unfamiliar ground.

Moving to a new country can be a great adventure and a chance to embrace new opportunities, but it’s also an inherently overwhelming experience that upends almost every area of your life, including how you feel about your finances. A certain degree of uncertainty is to be expected when adjusting to a new financial system, a new currency, and possibly even a new language.

There’s no one-size-fits-all solution when it comes to building that financial confidence. It’s important to recognize that everyone brings their own unique set of circumstances and experiences to the table, and to embrace the need for individuality and flexibility in terms of solutions and support.

Breaking barriers to financial confidence

According to a recent survey conducted by Interac, those who have lived in Canada for less than two years exhibit a slightly lower level of financial confidence (82 per cent) compared to the overall average among adult Canadians polled (86 per cent).

Of course, barriers to financial confidence exist for the general population—the survey found that the most common of these challenges include a lack of budgeting or investment knowledge and coping with an unexpected life event. But notably, newcomers to Canada are more likely to say they have experienced at least one economic barrier that prevents them from feeling financially confident (85 per cent vs. 58 per cent of the general population). This makes sense, as different countries have different cultural norms around finances, and it reinforces why it’s so important to meet newcomers where they are and find a “common currency” for boosting financial management.

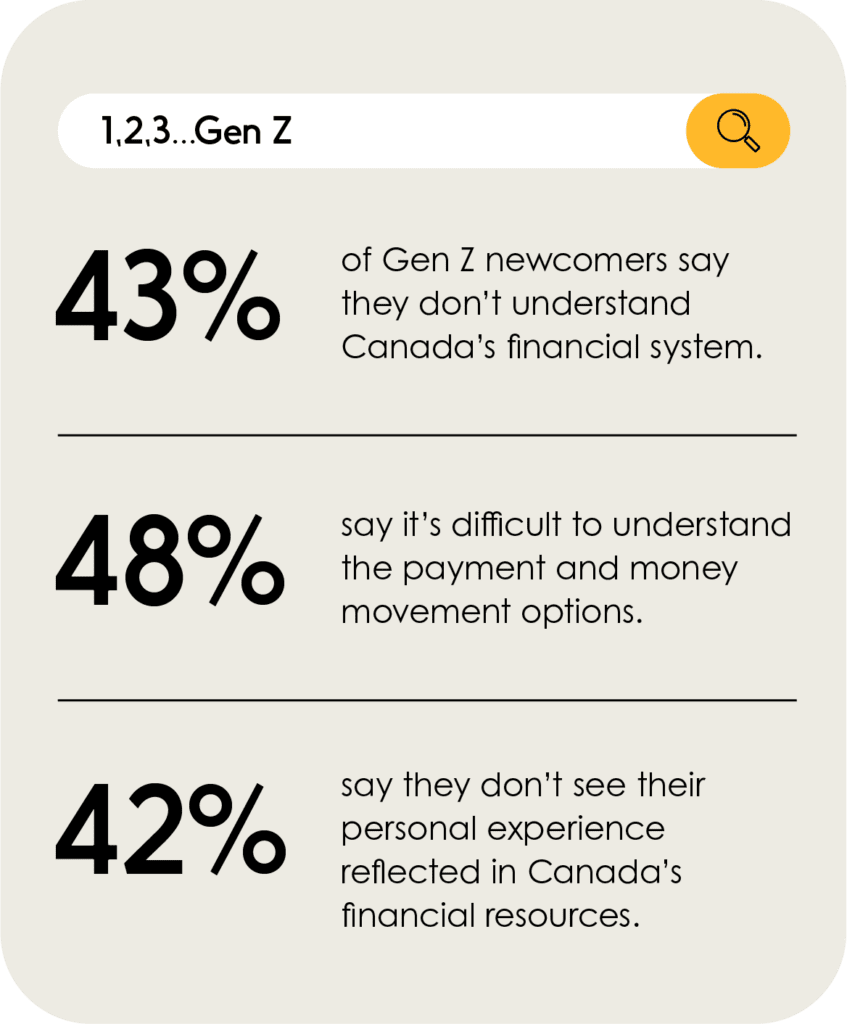

The barriers to financial confidence that exist for newcomers can seem especially daunting—from facing employment challenges to learning to navigate an entirely new financial system and currency to facing employment challenges. (According to the survey, four in five newcomers to Canada still convert costs before making large purchases to assess value – even after 5+ years.)

A varied and versatile toolkit

A key first step in the journey to financial confidence is helping newcomers develop an understanding of the Canadian financial system and products and services. According to the survey findings, newcomers to Canada desire a comprehensive approach to improving their financial literacy and boosting their financial confidence, including access to a variety of tools, resources, and connections.

To that end, more than four out of five respondents (82 per cent) said that they would benefit from forming connections through events like workshops or information sessions offered by Canadian financial institutions. Respondents also indicated that access to tools such as online courses about Canadian banking basics (81 per cent), or budgeting apps for Canadian expenses (77 per cent) would be valuable.

“Newcomers are calling for tailored support, with 54 per cent believing that financial resources should be designed by newcomers,” said Lauren Mostowyk, Head, Integrated Marketing & Communications at Interac. “This is why we’ve focused on providing comprehensive support systems through our collaborations with Credit Canada and ACCES Employment. These partnerships provide mentorship from experienced newcomers and free access to a tailored blend of resources, so we can help empower newcomers to build a strong financial foundation.

There are a number of online resources that can contribute to a “financial toolkit” for newcomers, such as services provided by the Canadian government (particularly around benefits, credits, and taxes for newcomers).

Credit Canada’s Butterfly app, sponsored by Interac, offers tailored digital solutions for newcomers. It’s a multilingual resource that empowers newcomers to take control of their finances, offering practice tools and information, from budgeting basics to tips for protecting yourself against fraud and real-time currency conversion.

Interac offers an extensive set of resources for newcomers including:

- From Dollar One for newcomers interested in starting a business

Interac is also involved in a number of community education and outreach efforts, and offers a number of mentorship opportunities.

Mentorship matters

Mentorship is a familiar experience for newcomers, with a growing number of organizations and non-profits offering this type of service. And among survey respondents, half of newcomers (51 per cent) have either had or currently have a mentor.

Notably, a high percentage of those with a current mentor (80 per cent) believe mentors would be helpful in understanding financial systems and investment options, and in addressing other relevant barriers.

Those with a mentor say they helped them navigate communicating in English or French (89 per cent), their lack of understanding of the value of Canadian currency versus their home currency (86 per cent), and how to protect themselves from fraudulent financial scams (83 per cent).

A mentor may also be able to advise on day-to-day financial logistics, from grocery shopping to paying rent. For instance, newcomers may not be aware that Interac e-Transfer can be used to pay for rent, subject to landlord acceptance, and easily send and receive funds using an email address or mobile phone.

Mentors can also help newcomers navigate government resources like IRCC (Immigration, Refugees and Citizenship Canada). Even better, accessing and managing your IRCC account – including checking your work visa status and other key services – is now streamlined with Interac verification services. This solution allows you to securely access select government services using your familiar online banking credentials.

In fact, four in five newcomers with a mentor say that all new Canadians would benefit from having one, demonstrating the proven value of mentorship in navigating an unfamiliar financial system.

A foundation of trust

Many newcomers might not be able to rely on their personal networks and might struggle to know where to turn for trustworthy advice. That’s one main reason why mentorship can be a key element in a suite of tools that help this group learn to thrive financially in Canada.

Want to build your financial literacy through the expansive portfolio offered by Interac?