Spending most of our time online, whether it’s for work or socializing, means we’re constantly connected and interacting with others. Often our online behaviour doesn’t feel risky in the moment, but the things we post and share over time can be used to discover who we are and how to reach us. More than half of respondents to a 2022 Interac survey reported they experienced at least one fraud attempt per week, and nearly four in 10 Canadians reported the fraudster used personal information to appear as a trusted source, including their full name (61 per cent), address (27 per cent), and date of birth (12 per cent).

Is there more we could be doing to protect ourselves online? Keep reading for five stories of Gen Zs and Millennials who experienced digital fraud, and how they made changes to their risky behaviour online for the better.

The Phishing Catfish

Joan, 21, Café Barista

“I think what saved me was that I could tell something was off. Throwing out a weird link with no explanation is the kind of thing that screams scam. Plus, you shouldn’t really click on links that don’t look familiar anyway.”

“I was on my lunch break at work when I got a text from my friend, Sam. It was just one line – “Is this you in this photo?” – with a link.

I’ll admit, I panicked, thinking I got tagged in something embarrassing that my whole family would see. But it also seemed weird that she would say that and nothing else, and the link didn’t look right. It didn’t lead to any site I recognized.

I double-checked the message and only then noticed it was a fake account using Sam’s info. Same profile picture, same bio, and even some of her pictures. However, the username was slightly off. It had a period in the middle and a number on the end where hers didn’t. By connecting those dots, I knew it was someone trying to use the catfish scam against me. I didn’t respond to the message or click the link, and let Sam know about the fake account. We reported it and made a post with a screenshot of the weird message, warning others not to click any links in messages like that.”

Digital fraud can often exploit our familiarity with an account or someone we know to try and lure us into doing something risky. Despite seven out of 10 respondents to an Interac survey reporting high levels of confidence in their ability to spot a suspicious situation, many of the same people have engaged in behaviours that make them vulnerable — and two in five have clicked a link from an unknown source.

A Portfolio for Personal Data

Pavit, 26, Freelance Photographer:

“I’ve gone and deactivated old accounts I don’t use anymore, cleaned up the ones I do use, and am generally a lot more careful about what I put in my posts and photos online.”

“I’m definitely what you’d call an early adopter. I’m on every new social platform the moment it launches. I use them mostly for my freelance photography business, so I like to get on there and share photos, network, post about events I’m attending, show off some good places to eat and talk about how much I love my dog, Jimmy, of course.

One day I noticed I couldn’t log into my email. I tried my regular password and nope, ‘wrong password’ it said. That’s when I knew something was off. So, I reset it and sure enough, when I was able to log back in, I found my inbox was filled with password recovery emails from a bunch of other sites I use. Someone had broken in and got access to all my other accounts.

I’ll admit, I wasn’t always the best at security. I used a lot of the same passwords across all my accounts and my security answers were all basic things like my pet’s name, where I went to school, and other stuff you can find with a quick browse through my socials. I figured that’s how they got into my email in the first place and tried to reset everything.

It was a pain. I ended up having to dispute a bunch of charges on my credit cards and cancel some orders they made. I still ended up losing some money because of it, so it was a costly wake-up call to try a little harder with my online security.”

Spending a lot of time online means there’s potentially many old accounts and information about you floating around. Even if you don’t remember everything, it’s still available to be used by digital fraudsters. Stay one step ahead and check out the Interac three-step digital health checkup, created by industry experts and the Canadian government to help you lock down and clean up your online accounts.

Shady Landlord & Shadier Payments

Rio, 18, University Student:

“I felt more confident after the experience because I stuck to what I knew and avoided a trap. I still double and triple check everything and always want to see things before I buy them, even if it bugs my friends at times.”

“I wanted to move closer to campus and was searching for an apartment online. I found one I really liked, so I contacted the landlord. He said he could guarantee the unit if I paid the first and last month’s rent. That’s a common enough request, so I agreed, but I asked if I could get a walk-through of the unit first. He suddenly seemed put off by that and said he didn’t want to show the unit until the end of the month. It felt a little fishy so I thanked him and decided to wait.

At the end of the month, I got in touch again. He was still unable to show me the unit, saying he was busy and was going on vacation soon. I told him we could at least sign a rental agreement and I could pay him later, but he insisted that our conversations were enough of a verbal agreement. That’s when the red flags really shot up for me. I was willing to give him the benefit of doubt before, but that seemed really suspicious. So I moved on and found another place. It was definitely not as good a deal or location, but at least I felt confident there wasn’t anything shady going on. Later on, I heard on social media that the landlord I’d been speaking with was eventually arrested for running a rental scam on others. I’m really glad I trusted my instinct and found a new place.

It’s good to trust your instincts. If something feels off or wrong, don’t feel pressured to make decisions quickly or without a proper paper trail. Seven in 10 Canadians we surveyed say they want to know more about protecting themselves from fraud. The important thing to remember is you should always Stop, Scrutinize and Speak up about any situation that doesn’t feel right.

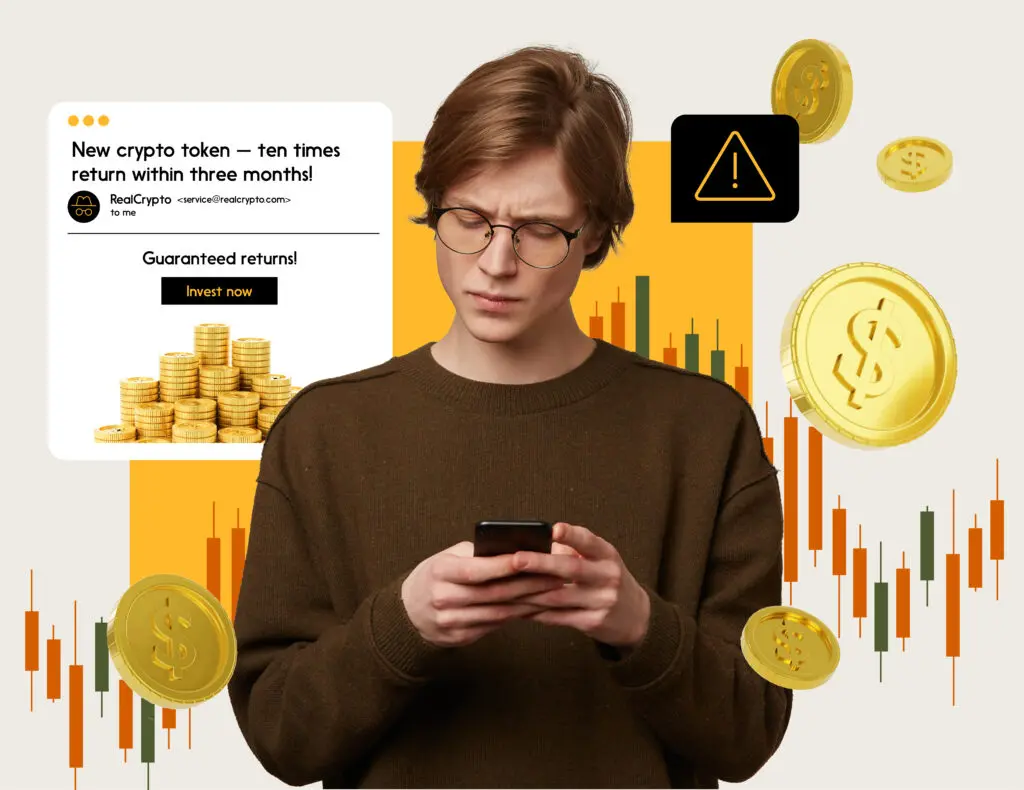

Avoiding the Rug Pull

Ben, 24, Retail Manager

“While I’m always looking for ways to make some extra money, when it comes to investing, I’ll stick with trusted sources from now on.”

“Right off the bat, let me just say, this wasn’t my proudest moment. I’ve got a good, steady job that pays well, but everyone wants to make some extra money if they can, right? So, I had been researching stuff to invest in. One day, I got emailed a newsletter talking about this new crypto token coming out soon. They were making all these big, exciting claims offering guaranteed returns and making ten times my investment within three months, which in hindsight, is pretty unlikely. But at the time I was thinking, it looked professionally put-together. It even had actual investors I recognized quoted on their site. I figured I’d try it out and put in a bit of money. If it turns out to be a dud, well, I wouldn’t be losing too much anyway. I signed up, deposited some money, and purchased the tokens.

Everything seemed to be going well after that. In fact, according to the dashboard on their site, I was making some steady gains. Really healthy returns off my small investment. That convinced me to put in more money over time and before I knew it, I was putting in a few grand from each paycheque. It was slowly adding up, but the returns still looked good, and I was waiting and waiting to see just how high it could go. And then one day I tried to login and the whole site was gone. Nothing left. There was no contact information or anybody to reach out to. The site, and my money, was just gone.”

A ”rug-pull” is a popular new type of scam where fraudsters use marketing tricks to get people onboard with a new investment. After a certain threshold of money comes in, they then disappear with it all, leaving no recourse for the retail investor. Beware of these “too-good-to-be-true” investments promising high reward with little risk and a steady flow of returns regardless of market conditions.

The Great Job Fraud

David, 25, Delivery App Courier:

“There’s a lot I’m still learning, but I know it’s good to be careful, to go slow, and not trust something just because they have what you want.”

“I’ve been in Canada for close to a year now and I’m really enjoying it. I’d like to stay long term. While looking for a job in my field, I’ve been working as a delivery driver. Often, I’ll receive text messages about job offers, and sometimes they look good and sometimes I can tell they’re not. There was this one time I got a text about a job doing data entry. It said I could work from home for a few hours a day while still making good money. That seemed like a great deal because I wanted something more stable, day-to-day. I had never heard of this company, so I double-checked the company’s website, and it looked professional and legitimate.

I contacted the recruiter saying I was interested. They forwarded my information to their ‘HR Agent’ who texted me questions about my experience, qualifications, technical knowledge, things like that. It only took about an hour, but I answered them all and they seemed very warm and friendly in their responses. Then they started asking for more personal information, like my address, birthdate, SIN number, and banking details. This felt odd because they still hadn’t confirmed I got the job. When I asked if I was hired, the agent said I needed to answer all their questions first. That this is how it was done in Canada. That didn’t seem right to me, so I stopped responding to their messages.”

An offer for a new job opportunity can be exciting, and sometimes that excitement can stop us from taking a moment to assess what’s really being asked of us. As newcomers arrive in Canada, scammers know they may be unfamiliar with the occupational and financial landscape. Some of the top scams they face include fake job postings, phishing attempts, and scammers disguising themselves as representatives of official government institutions.

Having safe online habits means protecting yourself and each other

Falling victim to digital fraud can be hard. Recognizing the behaviour that may make you more vulnerable is an important step towards better protecting yourself and others online. We all have a role in being more proactive about our safety online, and in turn, helping reduce the spread of digital fraud.

Disclaimer: Names, characters, businesses, places, events and incidents in this article are used in a fictitious manner and any resemblance to actual persons or actual events is purely coincidental.

Now it’s your turn. Want to learn how to spot more trending scams?