Whether you’re splitting the cost of dinner, going all in on a group gift, or running an errand for a friend, the next time someone sends you money using Interac e-Transfer and chooses to notify you by email, you may notice the message looks different …

As Interac e-Transfer continues to grow in popularity – having passed the milestone of 1 billion transactions in a year back in 2022 – we’re keeping on top of what consumers want, which means we’re always working to enhance your experience of using the service.

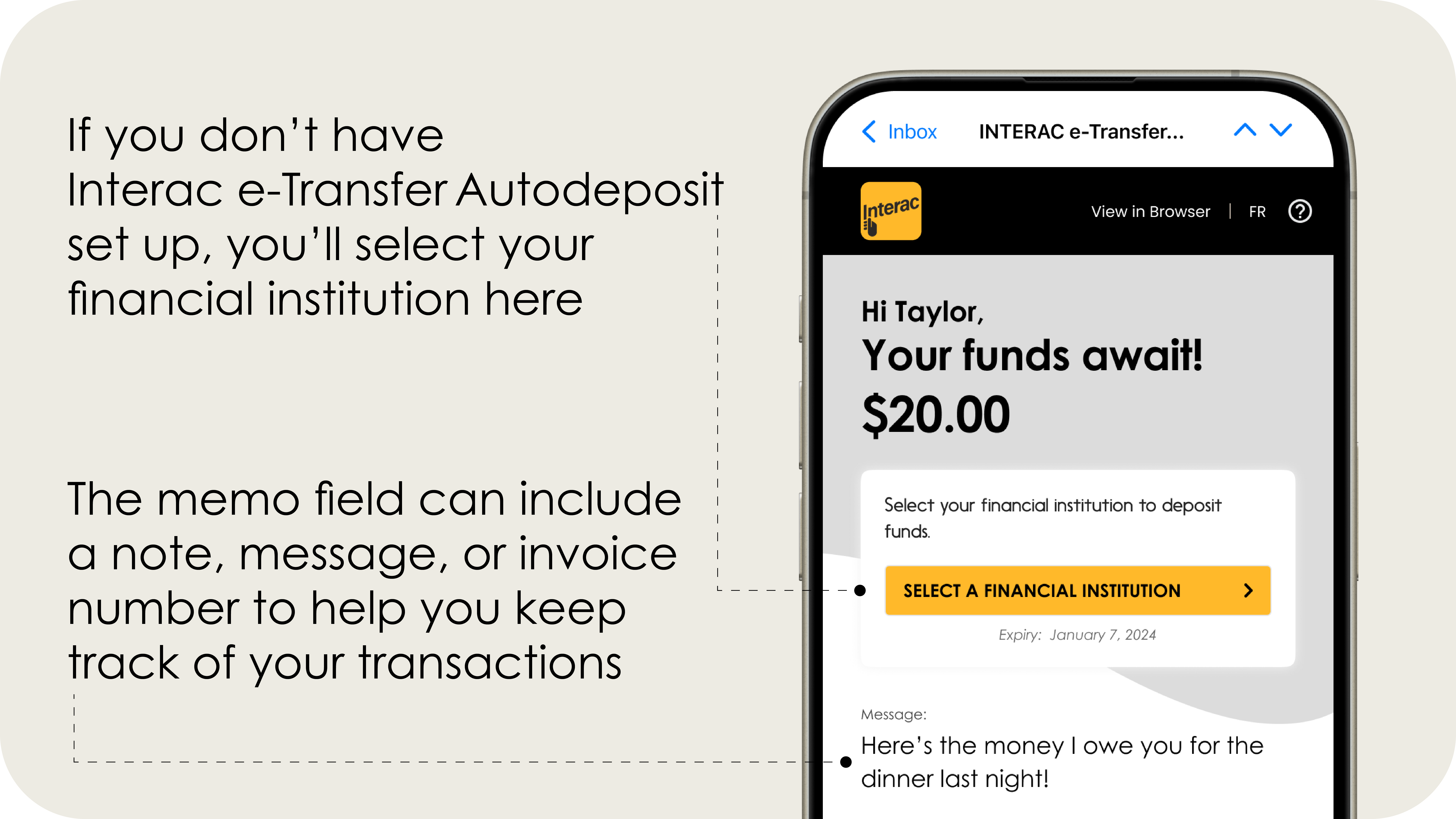

That includes refreshing the look and feel of our Interac e-Transfer email notifications. With up to 10 million email notifications sent daily, we’re pleased to share that we have updated the design to a simpler, more modern look. (And behind the scenes, these changes are helping to lay the groundwork for exciting future upgrades — stay tuned). You’ll notice the difference when you receive funds via Interac e-Transfer and the sender chooses to notify you with an email message (the other option is SMS — a.k.a. text message — if you’ve signed up to receive notifications that way). You’ll also see the new and improved notification design if someone asks you for money using Interac e-Transfer Request Money (again, choosing email as the notification option).

Our newly designed notifications are compatible with any mobile device, meet all Canadian accessibility standards and are available in English and French.

There’s nothing you need to do to receive the updated version of notification emails. And your Interac e-Transfer service will remain secure and convenient.

This is what the new design looks like

Avoid phishing scams — look closely at notification emails

Sure, our new design looks great, but that’s not why you should pay close attention to the visual details of notification emails. Phishing scams are the real reason.

When hackers send emails that attempt to trick you into sharing passwords, answers to secret questions, and other sensitive information, that’s a phishing attempt.

Fake money transfer emails can be part of a phishing scam. To help protect yourself from this tactic, you should always be vigilant when you receive a message that prompts you to do something involving passwords, personal info and/or money. Again, look closely. If you’re familiar with how Interac e-Transfer notification messages should look, you’ll be better prepared to spot a discrepancy. Hackers are often careless with minor details like logo colours, punctuation and spelling. Mistakes — such as dollar signs at the end of a figure instead of the start — are a red flag.

At Interac, we understand the importance of keeping your money transfers secure. That responsibility was made even clearer when the Bank of Canada designated Interac e-Transfer as a “prominent payment system” in 2020, acknowledging the service’s growth and its importance to Canadians and the Canadian economy. That’s why it’s so critical that Interac e-Transfer users are protected by multiple layers of security.

At the same time, we always appreciate users contributing to their own security by staying alert to fraud threats and adopting the Stop, Scrutinize, and Speak Up approach when they encounter something suspicious.

Enhanced email notifications with Interac e-Transfer: Questions and answers

Q: Do I have to do anything in order to receive the new, redesigned email notifications for Interac e-Transfer?

A: Nothing at all. The change is automatic.

Q: Why is Interac changing the look of email notifications for Interac e-Transfer?

A: We believe the new design will provide users with a better experience, and it also sets us up for more exciting enhancements to come.

Q: Why is it a good idea to pay attention to the design of Interac e-Transfer notifications?

A: Phishing scams are common, unfortunately, and hackers often make phony messages resemble the real deal — until you look more closely. If you know what a genuine Interac e-Transfer notification looks like, you may be more likely to spot a fake.

Want to know more about using Interac e-Transfer to make your busy life easier?