The pace of change in the financial world is staggering, and young people are experiencing this more than ever. Despite coming of age amidst economic uncertainty, Gen Z’s buying power is growing at a faster rate than any other generation, according to a 2024 NielsenIQ study. The companies that thrive will be the ones that meet Gen Z’s needs.

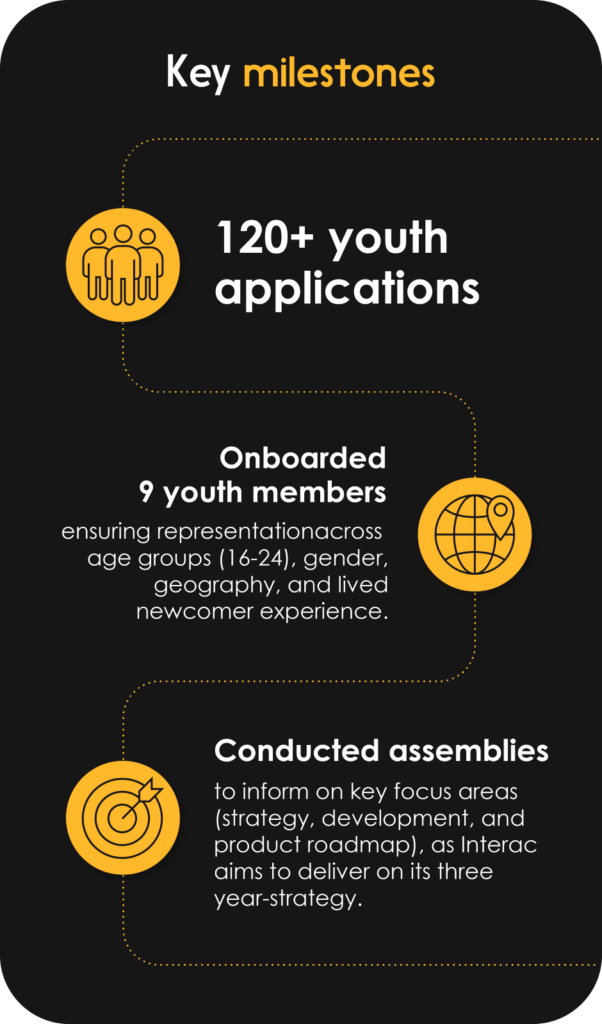

This emphasis on listening to the voices of Canadian youth is at the heart of the Interac Youth Council, which just marked its first year of conversations and collaboration. The initiative is part of a larger effort at Interac to strengthen Canada’s fintech ecosystem and ensure the company is meeting the diverse needs of the country’s future leaders.

The Interac Youth Council consults, advises, and informs Interac on strategic initiatives and helps ensure the voice of the next generation is represented in the evolving financial landscape.

How has this experience shaped the council’s nine youth members… and, in turn, innovation at Interac? They told us in their own words.

Council Participants

- Amy Xia, Ex-Officio Member

- Breezy Prabahar, Co-Chair

- Falhada Farah

- Frédéric Feknous, Secretary

- Justin Langan

- Nabil Anouti, Co-Chair

- Oleksandr (Alex) Zhoravovych, Communications Officer

- Precious Uzoh

- Warner Schaettgen

The power and potential of diverse voices

Across the board, Youth Council participants highlighted how the experience nurtured authentic, diverse dialogue that’s already driving more inclusive outcomes in terms of innovation and product development at Interac.

Interac products are a part of daily life in Canada, and the company recognizes its unique role in creating products that serve all Canadians—coast –to –coast –to coast. Programs like the Youth Council help Interac better understand some of the challenges Canadians are facing and how Interac can play a greater role in supporting them.

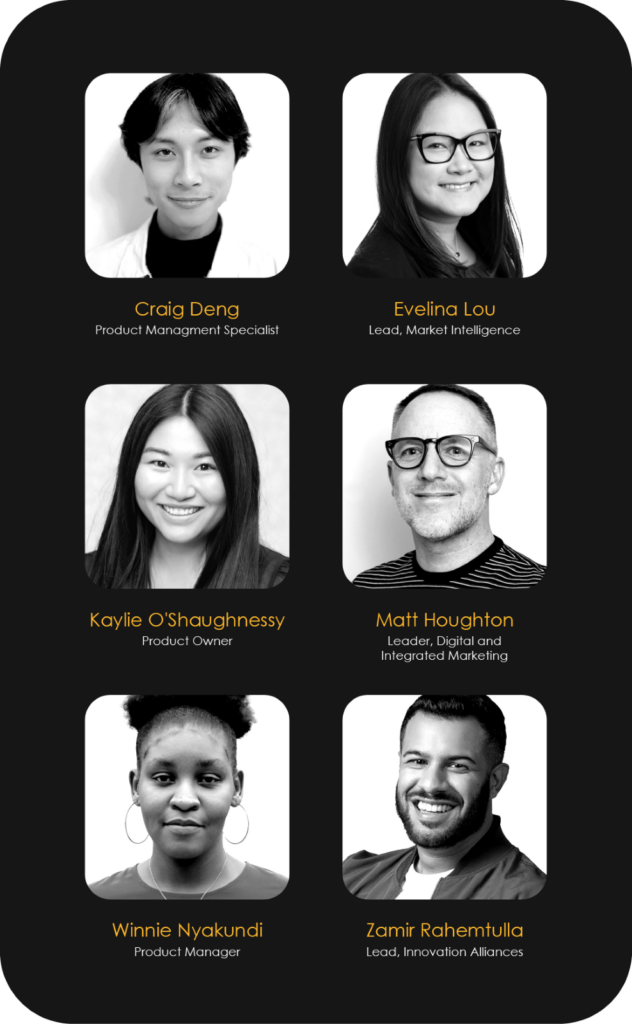

The Youth Council’s participants demonstrated a strong commitment to making “the financial ecosystem more inclusive of future generations’ needs,” Craig noted. Evelina concurred, citing “how engaged and thoughtful these young participants were when it came to their finances.”

“I was truly surprised by the significant impact of personal cultural backgrounds, life stories, and unique perspectives on our shared concepts,” Falhada shared.

Building on Falhada’s reflection on the impact of individual perspectives, Zamir noted a similar diversity in how young people develop their financial literacy.

“Approaches to financial literacy and confidence vary significantly among youth,” observed Zamir. “I was surprised to learn how some of them spend their time and attention, particularly in discovering and utilizing new information and tools to build their financial confidence.”

‘New possibilities’ for ‘what could be’

Many of the participants said the work allowed them to imagine new, bold goals for their own futures, from taking on leadership roles, to driving change in their communities, to embracing the power of their own voices.

“Working alongside a diverse and driven team allowed me to see new possibilities for growth and leadership,” Alex shared. “It deepened my commitment to creating impactful, people-centred solutions and inspired me to pursue opportunities where I can actively contribute to meaningful change. I now feel even more motivated to develop my skills in ways that will empower me to make a positive impact in my career and community.”

While Alex emphasized the impact of the experience on his leadership development, Warner focused on the broadened career horizons it provided.

“Seeing some future career possibilities and pathways, and interacting with professionals, allowed me to gain an understanding of what could be in my future,” Warner reflected.

Evalina stressed how impressed she was with the participants’ engagement and approach to their finances and long-term goals.

“Even in their teens, some are already thinking far into the future, trying to understand where they are situated, and exploring opportunities to get ahead through means like investments,” she said. “Not only are they motivated to put themselves in a strong financial position, they are proactive in seeking out new information and carefully considering it from different angles.”

Falhada said the experience had a profound impact on her, making her more motivated and more determined to drive meaningful change.

The “sense of mutual respect and encouragement reinforced my belief in the power of my opinions, ideas, and perspectives to be heard loud and clear,” she stated. “The Interac Youth Council not only helped prepare me for the future but also empowered me to take charge and actively shape it with purpose.”

Innovation at Interac: ‘Challenging conventional thinking’

One of the key goals for the first year of the Youth Council was to help inform how Interac meets the needs of Canada’s changing population with its products and processes. And it all starts with innovation.

“Innovation to me is about finding fresh solutions to existing problems and challenging conventional thinking, to enhance the way we live, work, and interact with the world,” Winnie shared.

“Innovation means driving progress with people at the heart of every effort,” Alex stated. “It’s about creating solutions that enrich lives and uplift communities, making the world more accessible, efficient, and equitable for everyone. True innovation serves the greater good, transforming challenges into opportunities and continuously pushing us forward.”

This spirit—and passion—of innovation was infused throughout the council’s assemblies and discussions.

“Innovation means the passion and search for new horizons,” Warner explained. “Innovation means risk and taking a chance on yourself and those around you. Innovation, to be put simply, is faith in something new.”

Insights and impacts

For Interac, the Youth Council model created an opportunity to have direct discussions that inform strategy and decision-making going forward. The learnings from each assembly will be directly translated into actionable insights, giving Interac the flexibility to build, design, and validate alongside a diverse group of people throughout the process.

For example, Craig noted that “the insights gained from the program have helped Interac e-Transfer product teams understand our customers better and design with them in mind, leading to a more people-first development and business perspective.”

Gen Z is a key audience, so hearing from some of them firsthand was incredibly informative in “understanding what resonates with this cohort and how to reach them,” noted Evalina. (Case in point: rumor has it that the word “delulu” was used repeatedly during discussions, to the bafflement of some of the Millennials present and the amusement of all.)

Beyond the opportunity to learn some new slang, the experience provided Interac with a deeper empathy for and understanding of some of the challenges facing young Canadians. This will directly inform solution design and development.

“Their insights will play a crucial role in shaping how Interac develops and markets its products,” Zamir explained, “ensuring they remain relevant and inclusive for younger demographics.”

Looking ahead, the continued collaboration between Interac and the members of the Youth Council will be important in navigating the evolving financial landscape and addressing the needs of future generations. Fostering an environment of open dialogue and creative problem-solving helps to position Interac to lead the way in connecting Canadians to the possibilities of the digital economy.