Every day, Interac helps Canadian consumers and businesses transact and interact digitally with confidence – whether it’s to pay rent, get paid for freelance work, buy groceries at the point of sale, access government services, order food in-app, or send money to almost anyone with a Canadian bank account.

With organizational roots that go back four decades, and activities that reach every region of this country, Interac has grown along with Canada, and we’re deeply invested in the prosperity, security and vibrancy of Canadian communities. Our commitment to diversity and inclusion has helped us gain recognition as one of Greater Toronto’s top employers in 2023 for the third year in a row, as well as being recognized as one of Canada’s most trusted financial brands for multiple consecutive years and one of the country’s most admired corporate cultures in 2023.

Our primary purpose is to facilitate secure exchanges between businesses, consumers and their financial institutions through exceptional privacy, fraud mitigation, governance and digital authentication expertise. When it comes to money, Canadians completed more than 6.6 billion Interac Debit transactions and 1.18 billion Interac e-Transfer transactions in 2023. To facilitate that activity, Interac operates three main platforms:

- The Inter-Member Network (IMN), through which all Interac Debit transactions move

- Interac e-Transfer, which facilitates money movement between Canadian online bank accounts

- Token Service Provider (TSP), which enables tokenized debit transactions on any device or mobile wallet that supports it (we’ll explain tokenization in more detail below)

Interac also offers its arm of verification and authentication solutions under the Interac Verified brand. This marks a new chapter for Interac as we move beyond payments and into helping Canadians securely engage digitally. Through this new product suite, Interac Verified allows users to verify their data using Interac verification service and Interac document verification service to get access to participating services, as well as authenticate users before gaining access to select government services using Interac sign-in service. With these solutions, Canadians completed 218 million verification and authentication transactions in 2023.

Read on to understand more about how Interac helps Canadians connect, transact and interact digitally every day.

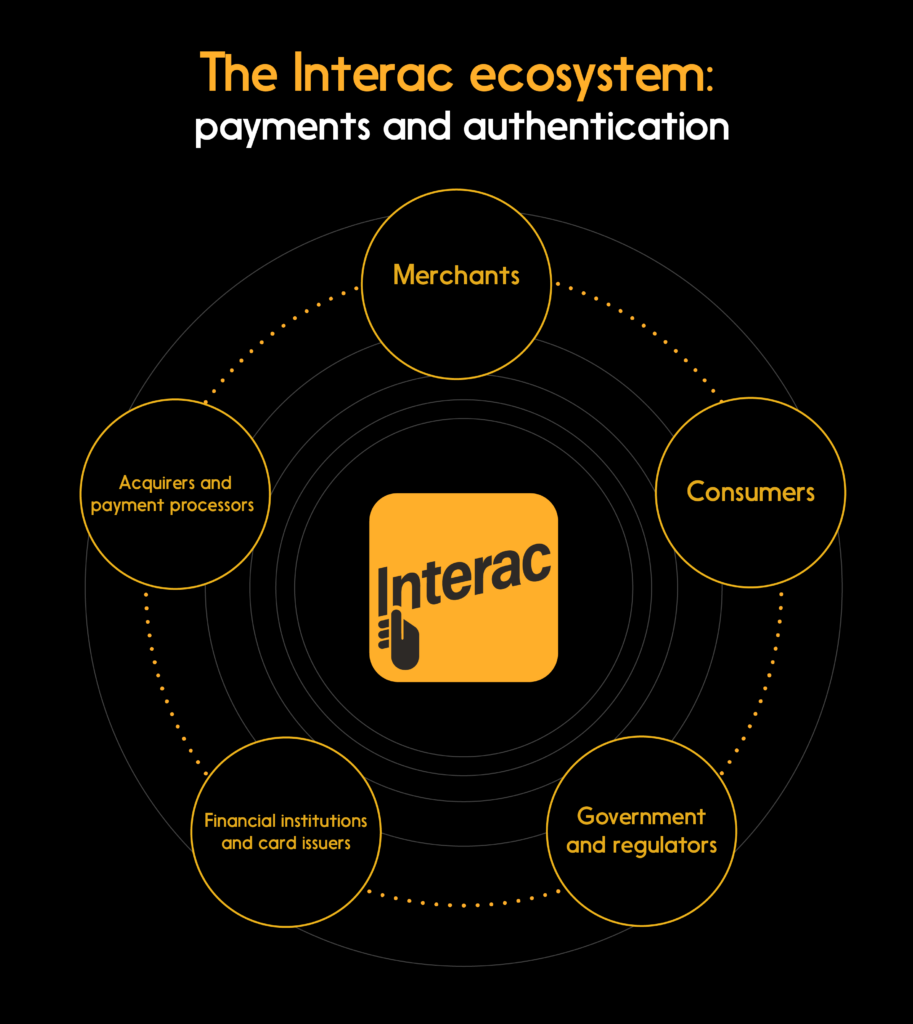

1. The Interac ecosystem keeps everyone connected

Interac stands at the centre of the payments landscape in Canada as a service provider that creates connections and platforms for safe and convenient transactions.

People, companies and organizations across the country look to Interac to foster stability, convenience and innovation. Here’s how we’re connected.

Acquirers and payment processors

Partners in the Interac network. They facilitate relationships between the other players — for example by operating card-accepting devices, such as ABMs and the point-of-sale terminals that process Interac Debit and other card-based payments.

Merchants

Any retailer or organization that accepts card-based payments like Interac Debit is a merchant. They depend on convenient, low-cost, no-hassle payment solutions.

Consumers

Virtually all adult Canadians consumers use Interac Debit and Interac e-Transfer to send money safely and conveniently. They can also use Interac Verified to digitally verify their data where available. All these services outside of Interac Verified are accessed through an issuer.

Commercial customers

Businesses and other organizations both large and small use Interac products and solutions to streamline payments and accounting including Interac Debit and Interac e-Transfer for Business.

Government and regulators

Those who oversee the economy want technologies and systems that foster growth and allow Canadians to transact safely. Interac Verified creates a secure way for people to authenticate themselves online to access participating government and other services. Interac e-Transfer and Interac Debit are both designated as a Prominent Payment System (PPS) by the Bank of Canada (BOC).

Financial institutions and card issuers

Banks, credit unions and other financial institutions provide online banking, issue Interac Debit cards to their customers and provide access to Interac e-Transfer through online banking. Financial institutions’ credentials also form an essential part of digital authentication on the Interac Verified network.

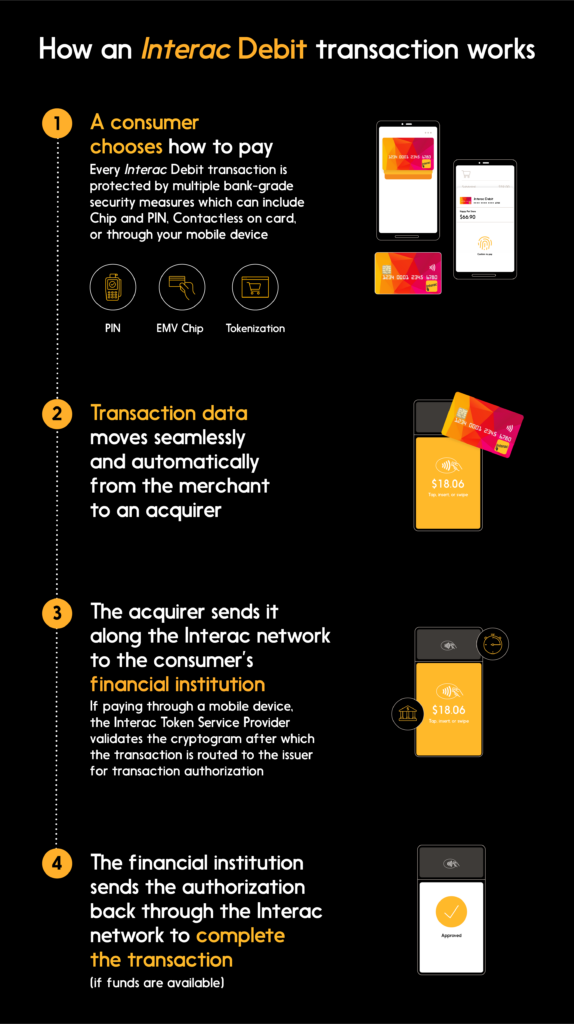

2. How an Interac Debit transaction works

Interac Debit is a feature of daily life across the country, enabling Canadians to make 6.6 billion debit transactions in 2023.It provides Canadian businesses and consumers with a safe, reliable and convenient way to pay—one reason nearly half a million Canadian merchants leverage the low-fee, no-hassle benefits of offering Interac Debit.

Some of these security measures, including transaction limits, and the Interac Zero Liability Policy, apply to Interac Debit transactions.

Other security features are associated with particular products and services. Interac Debit contactless payments, for example, uses EMV secure chip processing to store and process data securely. This protects consumers against fraudulent activity.

The Interac network verifies mobile contactless and in-app transactions in part by creating a secure “token” that stands in for sensitive account information. Thanks to tokenization, the consumer’s confidential card information does not have to live on their mobile device. Nor is it transmitted through the air, seen by an employee, or stored in the merchant’s systems. The token, even if intercepted, would be useless to hackers.

Learn more about how fees work for debit transactions.

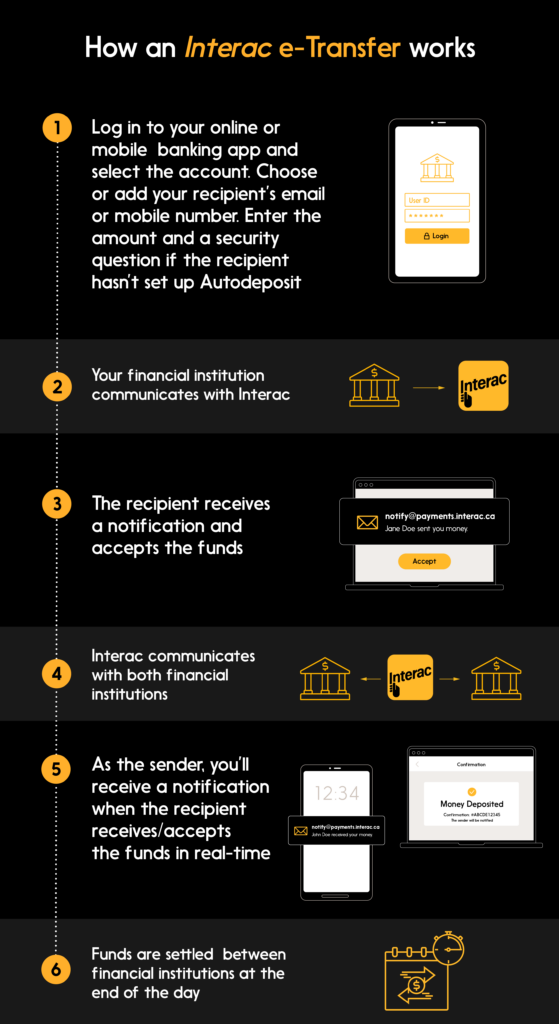

3. How an Interac e-Transfer transaction works

Interac e-Transfer transactions are a fast and convenient way to send money to anyone with a Canadian bank account, securely from your bank account with a participating financial institution. They’re a great alternative to cheques and cash, offering speed, security and convenience to consumers.

You can access Interac e-Transfer through your participating financial institution, which provides the portal, and sets the fees and transaction limits.

Transfers are almost instant from a consumer’s point of view, but they can take up to 30 minutes depending on your financial institution. The diagram below shows you how it all works — for the consumer, and behind the scenes.

While the Interac e-Transfer transaction itself is protected by bank-grade security, effective fraud prevention also depends on consumers ensuring that their email accounts, smartphones and other access points are protected by strong passwords and other measures. Read more security tips here, which include signing up for Interac e-Transfer Autodeposit through your financial institution.

And if something ever goes wrong with an Interac e-Transfer transaction, please contact your financial institution to troubleshoot any transactions in progress. The contact information is usually on the back of your Interac Debit card.

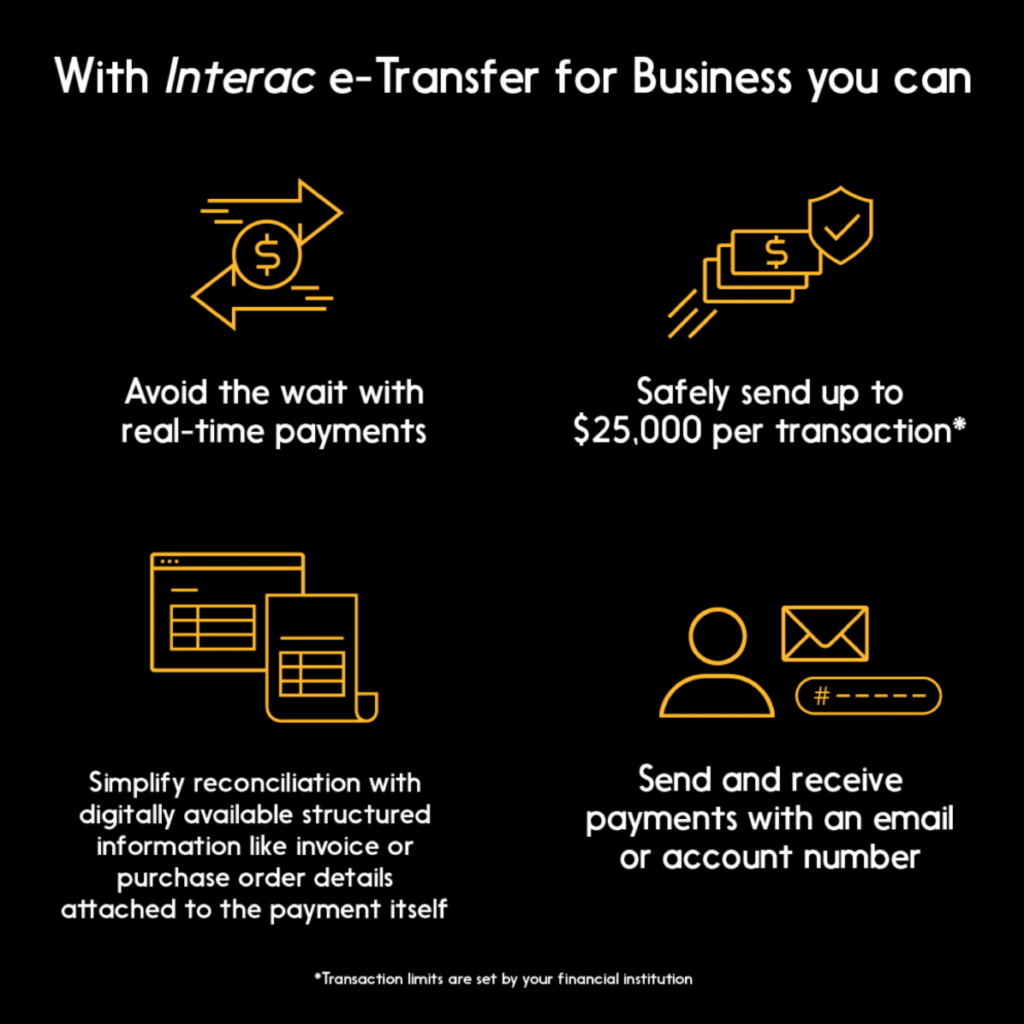

4. Interac e-Transfer for Business

Interac e-Transfer for Business is similar in most respects to the Interac e-Transfer service that Canadians have been using for decades, but it has enhanced features built for business payments.

It features higher transaction limits up to $25,000 per transaction (which are set by financial institutions), fast money transfers with instant confirmation and rich remittance data, which allows you to reconcile transactions with less paperwork.

Learn more about Interac e-Transfer for Business.

To learn more about the Interac products and services discussed here, including Interac Verified, please visit this page.