Improve the customer experience with faster, convenient, and secure verification processes

New technologies make it possible for insurance providers to serve customers across more channels, boost efficiencies, and drive growth.

Digital transformation is reshaping the Canadian insurance sector and how providers interact with customers. Insurance companies and new InsurTech start-ups across the globe are leveraging some of the latest technologies to serve customers across more channels, boost efficiencies, and drive growth.

Meanwhile, many insurance providers (both traditional and InsurTech providers) face roadblocks when developing fast, secure, and customer-centric experiences. Many of these challenges centre around data.

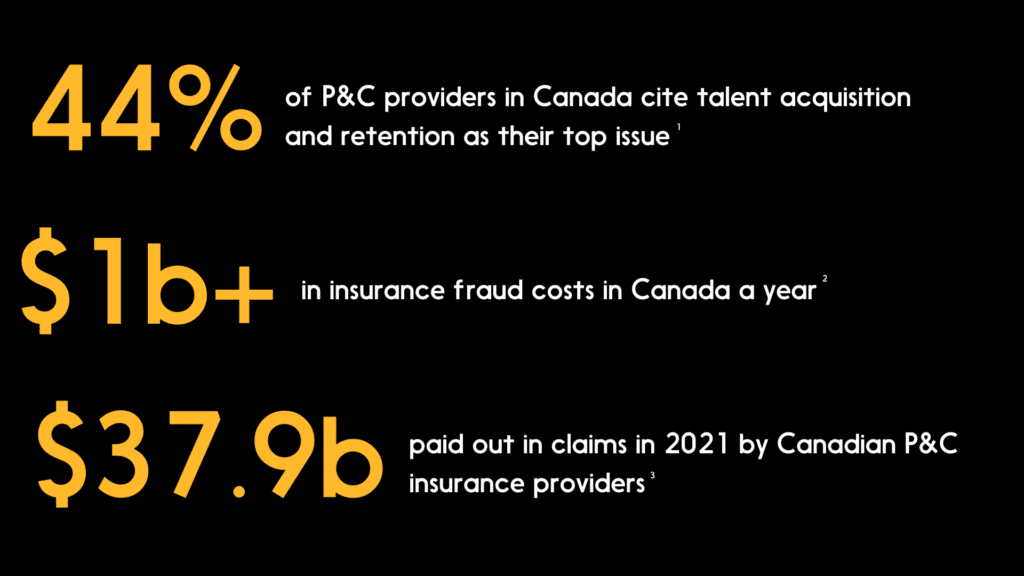

Insurance providers spend a lot of time collecting and verifying data. For example, they may verify customer IDs when processing property, casualty, life, or health insurance claims. Many of these processes are still manual, which can be time-consuming and inefficient. Since 44% of surveyed Property and Casualty (P&C) providers in Canada cite talent acquisition and retention as their top issue,1 they may not have enough resources to handle these manual tasks.

Manual processes are also inconvenient for customers, especially when they must bring documents to their insurance provider in-person. If they can’t find time during office hours, they may choose another provider that offers more flexible digital verification options.

Insurance providers also need access to a significant amount of sensitive data, such as personal or financial data including date of birth, address, driver’s license number, and more. When this kind of data is left unsecured it can lead to sensitive information ending up in the wrong hands.

Insurance providers collect data to efficiently process claims and best serve their customers. However, many providers recognize that traditional models of collecting personal documents to verify data are outdated and can be less secure. They need a more efficient way to verify and protect customer data – especially as they compete with the new InsurTech players

Balancing the customer experience with data security

Many insurance processes, from managing auto insurance claims to providing life or health benefits, require accurate data verification. Insurance providers must verify customer data to offer the right coverage, prevent fraud, and maintain trust. However, traditional verification methods are inefficient. As the digital landscape evolves to offer customers faster and more convenient services, insurance providers need to modernize their verification processes to meet new demands.

With traditional verification, customers often need to bring multiple forms of paperwork to their insurance providers in-person. Then, personnel must compare photo IDs with customers’ faces to ensure they match, cross-check the presented documents for discrepancies, and sometimes even contact third-party institutions or references for further validation.

In today’s digital landscape, relying on in-person or paper-based processes to verify a customer’s data no longer make sense. These tasks come with stringent validation requirements that can take days or weeks to complete – resulting in prolonged and frustrating customer experiences. And with the skill shortage1 within the insurance industry, providers may not have the resources to dedicate to these processes.

Security is also a top concern, as customer data is an insurance provider’s most valuable asset. If compromised, it can present severe financial and reputational repercussions. Security concerns can also hamper the customer experience, which ranks higher in priority in 2023 amongst insurance providers than traditional priorities such as growth.4

Insurance providers must balance several priorities: giving customers greater convenience while protecting their data. To do this, they can leverage digital verification technologies.

The difference digital verification can make

With digital verification, customers can quickly and securely verify their data without meeting with an insurance agent in-person.

A trusted digital verification solution enhances security when customers sign up for new services. With digital verification, insurance providers can lower the risk while improving the customer experience and driving business growth.

Digital verification benefits for insurance providers

- Enhance trust and privacy: Place digital trust at the forefront of insurance services, ensuring customers can choose how they verify their data.

- Help supercharge customer acquisitions: The opportunity to convert more customers with a simplified onboarding experience that makes it easy for them to verify foundational data points, such as their personal and financial information.

- Prevent fraud:Mitigate the risk of fraud and help insurance providers streamline Know Your Client (KYC) processes. Digital verification also transforms the First Notice of Loss (FNOL) process by confirming that legitimate policyholders are filing claims.

- Optimize business processes: Reduce time spent on manual processes by verifying customers’ mobile numbers and identity data from their banking profiles.

- Reduce administrative costs: Avoid unnecessary expenses of verifying customers’ data manually before remitting funds or setting up pre-authorized payments for insurance premiums.

Digital verification benefits for customers

- Give customers an easy and convenient experience: Better digital access makes it easy for customers to access insurance services, file claims, and submit documents.

- Provide customers with greater choice: With digital verification, customers have the option to change their policies or make inquiries through easy and verified access to an online portal – instead of submitting documents in-person.

- Strengthened security: Advanced digital verification is more secure than emailing or faxing photos of IDs.

- Swift onboarding: Empower customers to register for services quickly using a desktop, mobile browser, or mobile app.

Digital verification in action

Here are six ways digital verification can give insurance customers a more convenient and secure experience:

Reimagine data collection

Situation: Traditional claim submissions are time-consuming, requiring multiple meetings and data collection steps.

Solution: Digital verification accelerates the verification process. Customers can quickly and easily verify their data without visiting an office in-person. Meanwhile, insurance providers don’t need to manually verify customer data before starting the claims process.

Remove barriers to physical insurance proof

Situation: Customers often juggle multiple physical documents for proof of insurance.

Solution: With digital verification, customers can confirm their identifies via their desktop or mobile device – no need to bring documents to their insurance provider in-person.

Mitigate the risk of fraud

Situation: Fraud, including unverified people making claims, burdens Canadians and the industry with extensive costs. In fact, insurance fraud has been stated to cost Canadians over $1 billion, annually.2

Solution: Digital verification tightens verification processes and reduces the risk of fraud. For example, insurance providers can quickly confirm direct deposit and account holder information before remitting funds.

Seamlessly onboard customers at scale

Situation: Onboarding hundreds or thousands of new group benefits customers can be time-consuming.

Solution: Digital verification allows customers to quickly confirm their data when registering for group benefits and accessing online portals. Providing customers with fast digital access can also lower the insurance providers’ support costs when they onboard customers at scale.

Process claims faster

Situation: Lengthy verification and paperwork submission processes can slow claim handling and impact the customer experience.

Solution: Customers can quickly verify their data using their desktop, mobile browser, or a standalone mobile app to help speed up the claims process.

Ensure the timely delivery of travel insurance

Situation: Paperwork and delays can prevent customers from receiving insurance in time for their trips.

Solution: Digital verification can help make provisioning travel insurance faster for traveling Canadians, visitors, and international students.

How Interac Verified can help

Interac Verified enables businesses to digitally verify customer data to deliver faster, more efficient, and convenient access to online services. Future-ready authentication and verification solutions can empower insurance providers to simplify onboarding experiences, help protect against fraud, minimize manual processes, and streamline KYC compliance processes.

Interac Verified provides customers with two future-ready verification options:

Interac document verification service helps insurance providers digitally confirm their customers’ identities using a biometric liveness check and accepted forms of government-issued identification.5 It simplifies onboarding experiences, reduces manual processes, and helps streamline compliance.

Interac verification service helps insurance providers simplify their customer onboarding experience with a digital process to verify customer data. Customers have the choice to use their existing login credentials with a participating financial institution6 for faster verification of their data – while reducing manual processes, minimizing errors, and streamlining compliance for insurance providers.

Digital verification for modern insurance

The digital landscape for insurance is shifting, prioritizing efficiency, convenience, and security. But without the right tools, insurance providers can face increased risks when trying to meet customer expectations. They may also have trouble maintaining market share as more innovative InsurTech companies enter the playing field.

With Interac Verified, insurance providers can effortlessly balance customer experience and security to gain a competitive edge. It’s not just about protecting data – it’s about optimizing convenience, building trust, and streamlining processes for faster and more efficient outcomes.

Digital verification promises a secure, compliant, and customer-centric approach, preparing you to redefine your insurance operations for the digital age.

Explore how digital verification can improve your customer experience.

1Canadian Underwriter, “Perfect storm”: How Canada’s P&C insurance industry feels about 2023, 2023.

2IBC-BAC, Vigilance is key in fighting insurance fraud, 2021.

3IBC, FACTS of the Property and Casualty Insurance Industry in Canada, 2022.

4Gartner, Gartner Survey Finds Insurers’ Focus Will Shift from Growing Revenue to Improving Customer Experience & Operational Efficiency in 2023, 2023.

5For full list of government-issued documents eligible for verification by the Interac document verification service, visit: https://www.interac.ca/business/our-solutions/interac-verified/interac-document-verification-service/#which-id-types-are-accepted

6For a list of participating banks or credit unions that can be used to log in or access the Interac verification service, visit https://www.interac.ca/business/our-solutions/interac-verified/interac-verification-service/#which-financial-institutions-can-be-used-to-log-in-or-access-interac-verification-service