Improve customer convenience when buying, selling, and renting homes.

How the real estate buying journey is changing

As the real estate sector continues to transform, digital verification will be essential

Finding ways to enhance digital service delivery has become the new normal in all industries – and real estate is no exception.

Traditionally, real estate transactions are primarily conducted in-person. The industry relies on manual processes, close human interactions, and the exchange of physical documents. Now, home buyers and renters can complete many steps like applying for mortgages and submitting and accepting real estate transactions digitally. The challenge is that with the continued digitization there is a growing risk of fraud throughout the industry.

As the real estate sector continues to transform, digital verification will be essential in delivering better customer experiences. It can also help decrease fraud by confirming that home buyers and renters are who they say they are and confirm their foundational data.

A standard and trusted verification framework that uses authoritative data sources can help provide simple and secure access to services across the entire real estate value chain. With digital verification, brokers and lenders can quickly confirm client eligibility for mortgages. Landlords can verify renters and get access to reliable credit scores and lawyers can streamline client verification to speed up the time to close.

Digital verification can help reduce the risk of fraud, and give home buyers and renters greater convenience. Ultimately, it can help streamline the housing journey while allowing real estate agents and brokers to meet customer expectations quickly and confidently.

The challenges of digital interactions in real estate

Agents, mortgage brokers, and lawyers recognize that digital solutions can help speed up deals and provide home buyers and renters with greater convenience. But sharing sensitive documents like government-issued IDs, income statements, or credit reports through channels like email can increase the risk of fraud.

The increase in virtual transactions has led to a rise in Canadian real estate fraud. Since interactions between clients and real estate professionals are shorter online than they are in-person, it’s easier for fraudsters to avoid red flags.

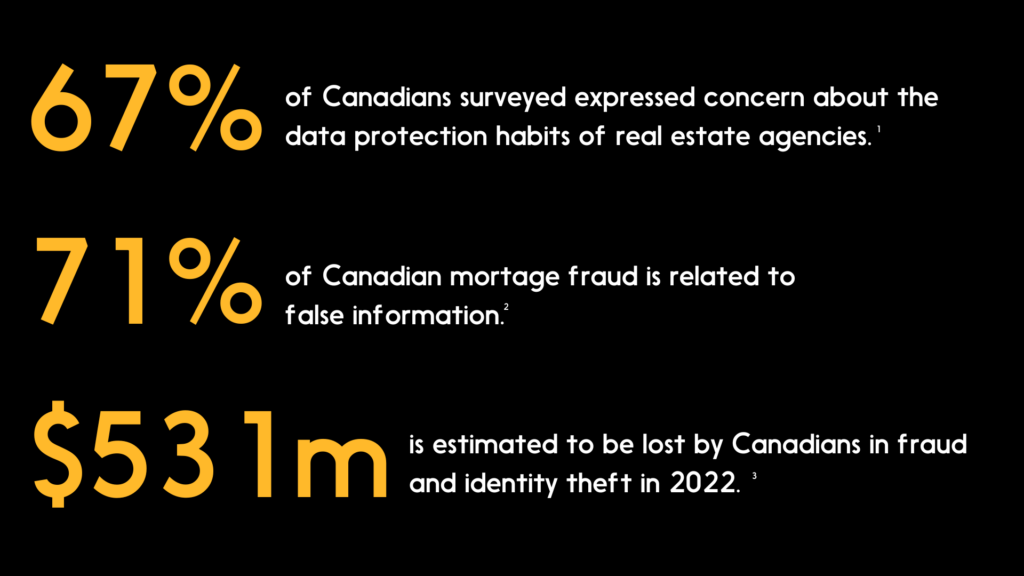

Recent reports indicate:

All parties involved with a real estate purchase need assurance that their data is secure and protected and only verified parties can conduct transactions. Canada’s anti-money laundering guidelines suggest using technology to verify users, 4 while the Law Society of Ontario has made similar recommendations that stress the importance of leveraging technology to verify an individual’s identity. 5

How digital verification can improve the real estate experience

Digital verification can allow all parties involved in a real estate transaction (home buyers, home sellers, landlords, and renters) to securely verify themselves and send and request data digitally.

Digital verification benefits for real estate agencies and brokerages

- Mitigate the risk of fraud: Digital verification tools can provide secure connections to customers’ financial institutions.* Real estate agencies and mortgage brokerages can get convenient access to accurate consumer identity and financial information. Individuals can also be verified that they are who they say they are through their government-issued ID and biometric facial recognition to reduce identity fraud.

- Improve administrative efficiency: Digital verification reduces manual, error-prone verification processes and can help streamline Know Your Client (KYC) compliance requirements for agents, brokers, lenders.

- Enhance digital access: Removes roadblocks for home buyers and renters who are not able to meet in-person (i.e., overseas, or out-of-province customers). Digital verification can accelerate processes by allowing customers to verify themselves quickly and confidently while reducing the administrative overhead.

Digital verification benefits for home buyers

- Gain greater convenience: Enables home buyers to have the choice to complete identity verification digitally instead of having to complete the process in-person. It also eliminates clunky and physical exchange of paperwork or emails required for approval from mortgage providers, real estate lawyers, and other parties involved in the deal.

- Protect customer privacy: Gives home buyers and renters more choice in how they share their data – digital verification tools can be more secure than the use of email to exchange verification documents.

- Guard against impersonators: Digital verification securely and accurately confirms customers’ details to minimize the risk of fraud.

Digital verification benefits for the rental market

- Give renters peace of mind: Digital verification provides a more secure and convenient alternative to emailing or faxing photos of IDs and can give renters peace of mind when sharing their data.

- Speed the rental application process: Landlords can quickly verify renters and key criteria, such as credit scores and proof of income.

- Save renters’ time: Digital verification makes it faster and easier for renters to submit required documents (i.e., credit scores) to landlords.

Digital verification in action

Here is how digital verification can work when a customer purchases a home:

User Journey

Digital identity will allow for electronic verification and remove the need for physical documents, radically transforming housing transactions. Currently, users are often required to prove their identity multiple times to a lender, legal authority, and real-estate agent.

Step 1: Mortgage Pre-Approved

Jessica has decided to purchase her first home. She contacts several banks to get a pre-approval. They request a statement of earnings, perform a credit check, and request to validate her identity. Jessica approves sharing her government-issued documents (i.e., driver’s licence), and financial data (i.e., income statements). Jessica is then issued pre-approval.

Step 2: Offer to Purchase

Jessica has found a suitable home. She submits an offer to purchase with her real estate agent, who has also requested to verify her data and receive proof of pre-approval. She grants her agent access to her digital assets related to the real estate deal. Jessica also uses digital verification when she signs her purchase agreement remotely.

Step 3: Mortgage Approval

Jessica’s offer to purchase the property is accepted. Digital verification makes it easy for her to confirm her data while finalizing her mortgage. She uses digital verification when sharing data about her account balances with her brokerage, so they can guide her regarding her down payment amount and mortgage terms, such as interest rates, loan type (fixed or variable), early repayment options, and more.

Step 4: Closing the Deal

Jessica is approved for the mortgage and schedules a meeting with her lawyer to transfer the title and complete the real estate transaction. Her lawyer also verifies Jessica’s identity and data prior to finalizing the paperwork.

How Interac Verified can help

Interac Verified offers a suite of verification and authentication solutions from a brand Canadians trust. Real estate agents, brokers, lawyers, and landlords can choose to confirm customer identity and verify customer data to improve digital experiences and remove the need for physical documents and in-person interactions, all while meeting compliance requirements. It also gives home buyers and renters an easier way to verify their identities without needing to bring physical documents in-person – offering greater choice for more convenient experiences.

Interac Verified provides all involved parties with two future-ready verification options:

Interac document verification service helps businesses digitally and seamlessly verify their customers’ identity through capturing photos of their accepted forms of government-issued ID and completing a biometric liveness check. It allows real estate professionals to give home buyers and renters a convenient option to verify their identity and protect the business against identity fraud.

Interac verification service offers a secure and convenient way for customers to verify their data by establishing a connection with a trusted partner, like their financial institution.* Real estate industry professionals can conveniently confirm requested customer data and give their clients a better user experience, while protecting their businesses from potential misrepresentations.

Elevating real estate interactions

Modern real estate transactions demand more than just convenience – they require security, trust, and adaptability. As real estate services continue to shift online, real estate agents and brokerages need to be equipped with tools that allow them to verify accurate client information simply and reliably.

Interac Verified can help redefine how real estate agents, mortgage professionals, landlords, and lawyers handle digital verification. It can enhance the customer journey, drive business forward, and help real estate professionals navigate the evolving landscape with confidence.

Take the next step of embracing digital verification in real estate. Experience the transformative impact of Interac Verified for yourself.

Sources:

*For a list of participating banks or credit unions enrolled in the Interac verification service, Get in touch with the Interac Verified team – Interac

1Capterra, Data protection in Canada’s housing market: 67% of home buyers show concern, 2021.

2Equifax, Fraud rates spike in tough economic climate, 2022.

3Canadian Anti-Fraud Center, Recent scams and fraud, 2023.

4Government of Canada, Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime Strategy 2023-2026, 2023.

5Law Society of Ontario, Virtual Verification with Authentication, 2023.