Authored by: Sohrab Kalra, Goran Vukancic and Pari Vansjalia

Yes, we are in a world where a car can be self-driving but if we were to paint a future where organizations can run themselves, the canvas would be blockchain and the paint itself a Distributed Autonomous Organization (DAO). DAOs take a digital native approach to organizations and decentralize decision making, automate decisions and governance, and enable auditability and transparency out of the box. A pretty picture, isn’t it? If we look back at Web 2.0, however, we realize technology rarely meets society in a straightforward manner. Technology brings potential, society brings behavioural dynamics, and together they paint a rather fuzzy picture. In principle, the impacts of DAOs may be far reaching, extending even to redefining the concept of society and how it is organized, to sovereignty and statehood, and to privacy.

While it is still early days, the tectonic shift in society and the financial industry (money and its movement) that DAOs may bring make it important to explore the concepts behind it and potential scenarios in its evolution. This edition of Trendsights will take you on that journey.

DAOs: Organize the Chain

Organizations introduce efficiency

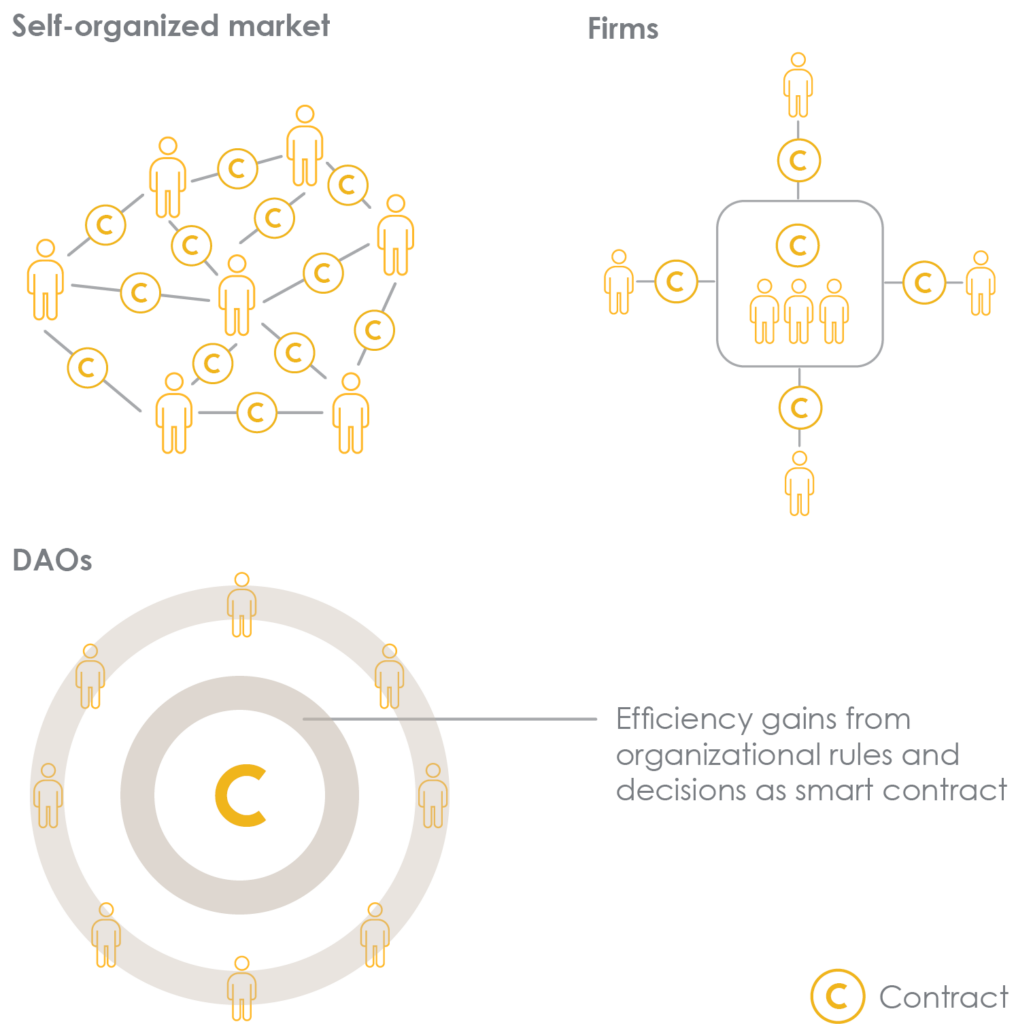

Economic systems define markets as a “self- organizing” chain from production to consumption— the self-organization driven by price discovery to balance supply and demand. Each step in this chain is composed of many agents who transact amongst themselves. For each such transaction costs are incurred to negotiate a price and conclude a contract. The larger the chain, the more the number of these transactions, and therefore the higher the cost of organizing the entire chain.

This is where organizations bring efficiency. The creation of an organization replaces many of these market transactions and contracts with a single contract with the head of the organization, who obtains organizational resources in exchange for remuneration and governs them through rules of operation. This reduces the size of the chain and makes organizing it profitable.

An organization thus has three key elements:

- Goals and objectives

- Agents and managers who work to achieve the objective

- Rules of operation and governance

…until they don’t

As organizations grow, some efficiencies are challenged. Costs to coordinate agents and resources grow, reducing the same operational efficiency that initially drove creation of organizations. With growth, organizations also need more rigid structures, thus challenging agility in decision making and the alignment of interests, trust, and engagement amongst agents.

The above inefficiencies also extend to how organizations interact in a market. Organizations can benefit from co-operating in selected aspects where synergies are possible while still competing in others. For example: Non-profit organizations focused on similar social issues can amplify impact by sharing knowledge and operational resources. However, in the lack of economically efficient and open mechanisms to align players, create transparency and pooling of resources—benefits that could be accrued from large scale open collaboration are left untapped.

DAOs: The promise of technology

What the DAO!

Distributed Autonomous Organizations (DAOs) address the above issues through a digitally-native, decentralized, and automated approach.

The basic idea of a DAO is a decentralized digital organization, one that is governed by written rules encoded on a blockchain and not controlled by any single individual or group. There are a few different ways to create a DAO. The most common is to use a smart contract platform like Ethereum. This allows anyone to create a DAO by writing a smart contract that encodes the rules of the organization. Another way to create a DAO is to use a decentralized application (DApp) platform. Finally, it is also possible to create a DAO using a traditional centralized organization. This is done by creating a decentralized application that is used to manage the organization.

Three foundational elements of DAO

For a DAO to be well-structured, it needs to have:

- A purpose: Guides the initial governance rules encoded in smart contracts placed on the blockchain.

- Members: Membership can be Token Based – open and acquired by purchasing tokens or Share Based – closed and requested by demonstrating value such as by doing functional work.

- A voting mechanism: Allows members to bring forth proposals/ changes and defines the voting structure with all records public on blockchain.

Areas seeing the emergence of DAOs

While DAOs can have many applications, some areas emerging as early adopters are:

The DAO promise: Efficiency, democratization and trust

Automation

Firstly, automation offered by DAOs can enable efficient scaling and operation of organizations and services. If a service and its governance rules are well defined, they can be codified into smart contracts and executed automatically. This allows for creation of ‘micro-services’ which can be offered and consumed in an automated manner allowing efficient scaling as well as reducing errors and bias. ‘InsurDAO’ is an example of insurance DAO that offers automated micro-services to DeFi* protocols to create and sell insurance to its members, automatically adjust premium pricing and manage the funds. DAOs will thus start to emerge and create benefits in sectors with defined rules first.

*DeFi is a category of highly-automated and decentralized apps for financial services built on an open, programmable blockchain.

Democratization

Secondly, DAO’s can increase democratization in creation and running of organizations by allowing people with similar interests to align, pool capital, generate ideas and involve every member in decision making. This flips the traditional hierarchical situation where one member or entity takes decisions and actions on behalf of rest. Since members have a stake in the DAO, they are rewarded to collaborate and be good actors. Channelized properly, this can allow for diversity of thought as well as collective accountability in the future that organizations create both for themselves as well as the stakeholders.

Trust & Transparency

Thirdly, DAO’s can enable at scale alignment of interests, trust and transparency. For example, charitable donors often demand transparency and control in utilization of donated funds. Cost effective democratic decisioning at scale allows a charitable DAO (such as The Big Green DAO) to involve more members in fund allocation decisions. Additionally, greater trust and accountability is created as DAOs enable a public view of fundraising, grants, and expenses and smart contracts enable Auditing and Tracing out of the box.

Broader shifts that DAOs may drive

Increased digitization of money

The use of tokenization and proliferation of DAOs can accelerate adoption of other components of Web 3 such as digital currencies, NFTs thus creating a halo effect. Additionally, as DAOs allow efficient capital pooling at scale, it can emerge as a newer asset class accessible to retail investors and enabling active participation in capital deployment for them. Smart contracts can also potentially automate asset management and processes such as performance monitoring, asset allocation and compliance.

Expansion of fiduciary mandates

Societally, DAO’s can broaden the organizational fiduciary mandates by enabling adoption of stakeholder theory as the approach to organizational management. Stakeholder theory, proposed by Edward Freeman, takes a broader approach than the Shareholder theory in suggesting that organizations mandate should be to generate value for all stakeholders such as shareholders, employees, partners, customers, etc. A natural challenge in enabling stakeholder theory is connecting capital, decision-making and stakeholders in a cost-efficient manner. DAOs can alleviate that and allow stakeholders to become active members, be a part of decision-making and reap benefits from the evolution of organization.

DAOs: But wait…Society!

Societal dynamics of change and decision making

To fully understand how DAO’s and society can interact, we need to consider how technology drives change in society and how individuals make decisions.

Technology typically follows diffusion as a model of change. It starts with the few people who have access, follows through to early adopters and then reaches the masses. Diffusion thus is not democratic but selective; and many innovations tend to diffuse from higher to lower status groups. Therefore, there is a built-in inequity in how technology starts shaping change in the society, and the deeper the technology impact (think back to introduction of mobile phone) – the more predominant this divide becomes.

Behavioural drivers also impact how individuals engage in decisions. Individuals do not always make decisions and choices rationally. While interest, and intent impact decisions our cognitive biases and limited rationality (e.g., feeling more comfortable in a set routine, finding inaction to be easier, feeling overly positive about a choice previously made, etc.) it also leads us to make decisions based on imperfect information or even decisions that are not in our best interest.

Additionally, governance involves decisions that either progress or resist change from status quo. How individual agents of an organization vote on these decisions is not independent but rather conditioned by sociological factors and norms. How supportive a social environment is of change sometimes conditions the very possibility of change, particularly when social norms are at play. The information, opinions, arguments and stories we are exposed to also shape these norms.

Lastly, co-operation between agents in an organization depends on whether the institutional rules provide the right incentives to the agents. These rules change what the optimal economic behaviour is for the agent trying to maximize their own material payoff. Therefore, it can be expected for each agent to influence and create rules that will benefit them.

These behavioural dynamics are well illustrated in the events that followed the merger of TribeDAO with decentralized lending protocol Rari capital. The merger was followed by a hack of $80M. Initially, members overwhelmingly voted to make the community whole and hash out details later. However, as the specifics were proposed, the members voted it down with most of the “no” votes coming from members of TribeDAO. This highlights how DAO voting can be irrational at times, driven by self-benefit, and can create dissent and complicated situations.

The promise of technology meets the dynamics of society

Democratization Spectrum

The premise of DAOs enabling democratization hinges on balancing power amongst stakeholders in the organization by decentralizing decision making. However, this premise can be challenged by the voting method in a specific DAO. For example, a DAO may rely on token-based voting where one token equals one vote— allowing members with more tokens to have more influence and diluting true democratization.

Protocol Politicians Arise

As highlighted in the previous section, people are not always rational. Psychological and sociological factors such as decision fatigue or social norms can lead to DAO members voting based on what is popular or acceptable. This allows members with populist narratives (and tokens) to more easily influence and control decisions of DAO that benefit them, giving rise to protocol politicians. Members vote for the protocol politicians’ values instead of their own, recreating the central powerful authority DAOs sought to eliminate.

Transparency vs Anonymity

The transparency that DAOs enable through open smart contracts and visibility of actions builds trust, but the anonymity of each member challenges this. It not only opens the possibility of a DAO being used for undesirable purposes, such as coordinating violence, but also leaves DAO vulnerable to fraud and security risks. Smart contracts and wallets have been hacked in the past, putting every DAO member at risk—in 2016 The DAO was hacked of more than 3.6 million Ether; while cybersecurity can now substantially mitigate these risks, the technology to bypass such security is also developing rapidly.

Room For Subjective Interpretation

As smart contracts are automated, each situation is dealt with in a “black and white” manner leaving little room for subjective interpretation of rules. For example, doctors often must consider the patient’s will, their caregiver’s will and treatments available; a smart contract might not make the best decision here due to the subjective nature. While certain sectors may deal with less subjectivity and uncertainty, organizations can not completely avoid these situations where subjective interpretation of rules is required.

Personal Incentives & DAO Stability

The efficiency-driven and democratized nature of DAOs, can also find itself challenged by the low barrier of entry for a DAO as it can lead to extreme fragmentation and reduction of collaborative benefits. Since rules of smart contracts are open, anyone can recreate a DAO with minimal effort. This lowers the incentive for members to stay committed in case of a conflict resulting with them breaking off and starting a DAO with minor differences thus decreasing stability as an organization. Very high fragmentation of DAOs with similar purpose and protocol can reduce available capital, member contribution and productivity. In an extreme scenario, it could breakdown collaboration as each person becomes the sole stakeholder in their own DAO as sovereignty falls to an individual level. This organization structure and level of personalization may not be feasible and could hinder new innovations.

Legality of Decisions

Lastly, the legality of on-chain decision by DAO presents an unresolved question as well. For example: A proposal was introduced and passed within a gaming DAO to break an agreement with their business partner. DAO members sought that the partner was not adding value and voted to terminate the agreement. However, while the DAO nullified the contract — the legal agreement between the holding company of DAO and partner remained valid, with the partner alleging that no condition existed for the gaming DAO to cancel the contract “regardless of how this has been presented by them to the community”.

Scenarios for the Future

While we cannot predict the exact future of DAOs, using weak signals and emerging trends we created four scenarios for the future.

1. Democratization demand increases & DAO challenges are solved

To fully realize the potential for democratization and transparency, governance and security protocols in a DAO need to ensure balance of power and prevent misuse. If that is realized, adoption of DAOs will increase drastically. This will lead to an implementation overdrive driving demand for infrastructure, advisory and support services and impacting skill sets in demand. Economically, DAOs would emerge both as alternative investment assets as well as automated managers of asset classes and thus will impact money movement. This will impact financial services industry as the model relies on the savings & investment money heavily. As more and more investments move to the digital organizations, digital currencies will gain traction as tokens become the unit of value exchange. Lastly, driven by a highly democratized DAO structure, and low barriers to starting a DAO – those whose incentives are not met, will easily break away to start newer DAOs thus creating higher fragmentation in societal organization.

2. Democratization demand increases & DAO challenges are not solved

In this scenario, the battle between the technology capability and the incentive- driven nature of society would be on display. DAO uptake will be driven by demand for democratization, but the issues around governance and security would create headwinds in realizing them fully. Therefore, the landscape will settle at utilizing DAOs for specific use cases initially, particularly those which are more easily codified. Additionally, a hybrid approach with human oversight and partial decentralization and automation of the rules where possible could take shape. There will be a constant push and pull between true democratization and abuse for personal gain and power which will raise questions on the true nature and promise of DAOs. A narrative of fraud versus security will surround DAOs—and either society will generate ideas to improve DAOs and mitigate their risks, or DAOs will start to signal their DOA (Death on Arrival).

3. Democratization demand decreases & DAO challenges are solved

Society’s perception around democracy itself may change. If there is a change in views, would DAOs still be valuable to society as enablers of democratic decisioning? Other than the democratization aspect, DAOs are a way for organizations to enable transparency, easily involve stakeholders and automate actions. Therefore, they will remain a valuable organization structure for certain niches, for example, charities can collect direct donations and be transparent about where the funds are being allocated like the Charity DAO. On the flip side, the future of Web3.0 is intertwined with DAOs and the lesser need for DAOs could also mean a lesser need for NFTs, DeFi and tokenization. This could either uplift adoption of DAOs or could turn Web3.0 into a fad. Regardless of the demand for democratic decision making, it does not guarantee that use of DAOs will abate: democratization is not the only use and certain aspects of Web3.0 are intertwined and reliant on the success of DAOs.

4. Wild card scenario: autonomous DAOs

DAOs could experience a wild card scenario that completely transforms the way they operate and interact with the world. For example, a breakthrough in artificial intelligence could proliferate autonomous DAOs that are able to make decisions and operate completely independently of human intervention. In this scenario, DAOs could become the dominant form of organization, interacting with each other and creating complex networks that could make decisions and execute tasks without human input. This could lead to a new era of corporate governance, in which most decisions are made autonomously based on data and algorithms, rather than by individuals. It could also have far-reaching implications for the global economy, as DAOs become key players in the creation and exchange of goods and services. This wild card scenario could also pose significant risks and challenges. It could raise questions about accountability and traceability, as it becomes more difficult to determine who is responsible for the actions of these organizations or how a given decision was made.

Final Thought

DAOs have the potential to change the status quo; whether the change is positive or negative depends on how we apply and interact with the technology as a society. The onus is on us!

Did you miss our latest Trendsights reports? Catch up now.