2022 has been tough for DeFi—an abbreviated term for “decentralized finance”—with a drop from managing hundreds of billions of dollars to only tens of billions amid massive investor losses. Shining a harsh light on many claims that simply failed to hold up when tested by market volatility.

DeFi’s backers see it as a powerful tool to make today’s financial system far less expensive, faster, more fair, and more trustworthy. Others see it as a mirage, or worse, a deliberate ponzi scheme. This Trendsights explores the concept of DeFi and its implications (from a Canadian perspective)— what it is, how it is being used—and seeks to separate clear benefits from the more questionable claims. Despite its bumpy 2022, the tech offers several credible value drivers which if implemented well, could potentially improve the Financial sector for all stakeholders.

DeFi explained

Trust through transparency

DeFi is a category of highly automated and decentralized apps (DAPPs) for financial services built on an open, programmable blockchain. These DAPPs aim to replace people-intensive, slow, and sometimes opaque legacy financial processes with more transparent, efficient, rule-based automation while preserving the all-important trust needed for parties on both ends to feel comfortable.

DeFi differs from other automation approaches in its ability to shift more of that required trust onto the system’s design, rather than on individuals or organizations operating it thanks to how blockchains work.

For example:

- Since blockchain records cannot be changed due to their encryption and distributed public nature, the system depends less on trust in a custodian to protect the records’ accuracy.

- Governance is based on transparent, traceable agreement by stakeholders, within equally transparent decision-making guidelines. Providing clear visibility on why decisions were made and reducing reliance on trust that decision makers are impartial.

This can be a significant competitive advantage given the multi-decade erosion of public trust in institutions and the financial sector in general. It can also be a way for existing trustworthy institutions to amplify their brand differentiation by showcasing and proving this trustworthiness to the world.

Lending example

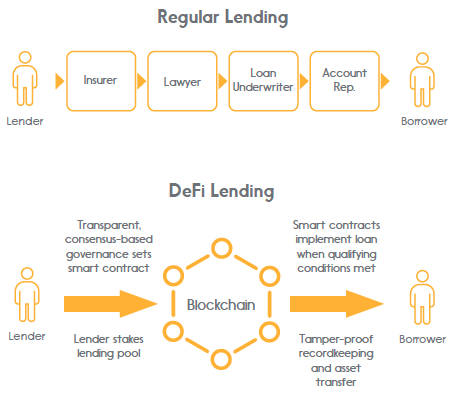

Here is a simplified example of the difference on a lending process. The regular lending process generally involves several people (possibly across several organizations), to manage all the paperwork, do the checks and balances, and bring personal accountability to make the system trustable. However big sections of that (including parts of the trust) can be automated via DeFI.

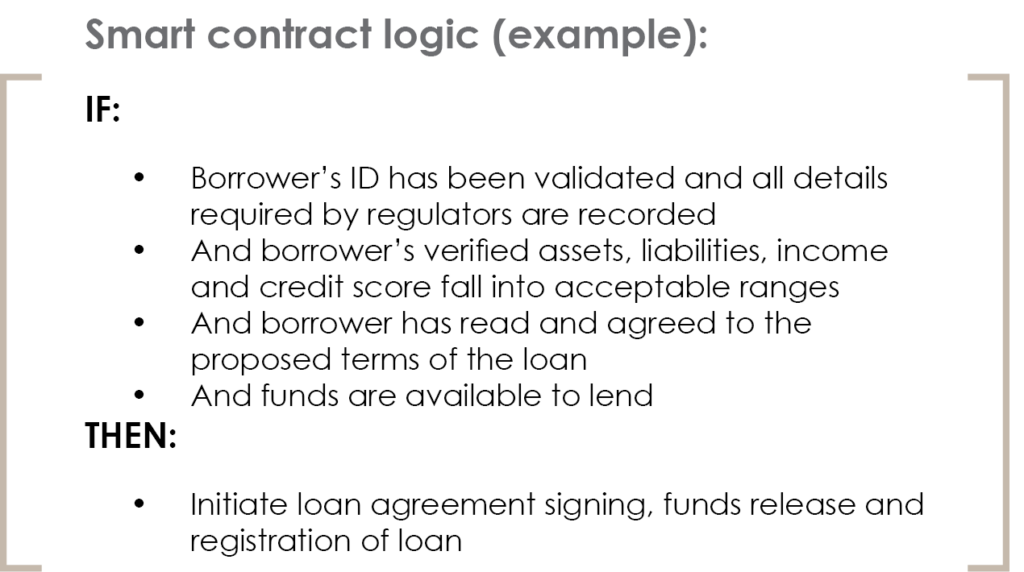

The programmable smart contracts at the core of DeFi are combinations of “If conditions are met, then take this action” rules. For a loan underwriter role, a smart contract logic might look something like the example below.

This does not imply that banks, law firms, or insurers simply disappear in a DeFi future. However there is significant opportunity in re-imagining how their unique value can be made more scalable and efficient in a financial world that includes DeFi.

Comparing lending processes

DeFi: How it’s used

Use Cases

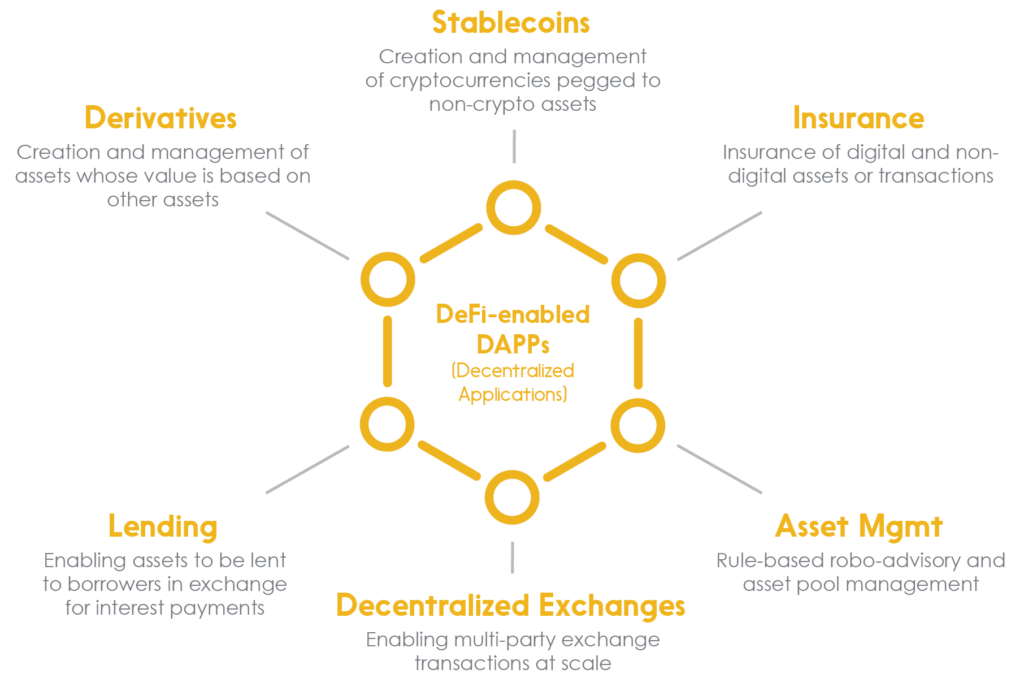

Many of the traditional offerings in the financial sector are being replicated through DeFi and more are constantly being explored. The more a process can be converted into a set of clear, consistent rules which trigger actions based on reliable, secure, and standardized input data, the more suited it is to being automated in DeFi. The more a process requires adaptation and creativity or has many edge cases (rare but different from the norm in some important way), the harder it is to automate in DeFi.

The graphic below illustrates six of the more common use cases so far:

DeFi: Benefits and risks

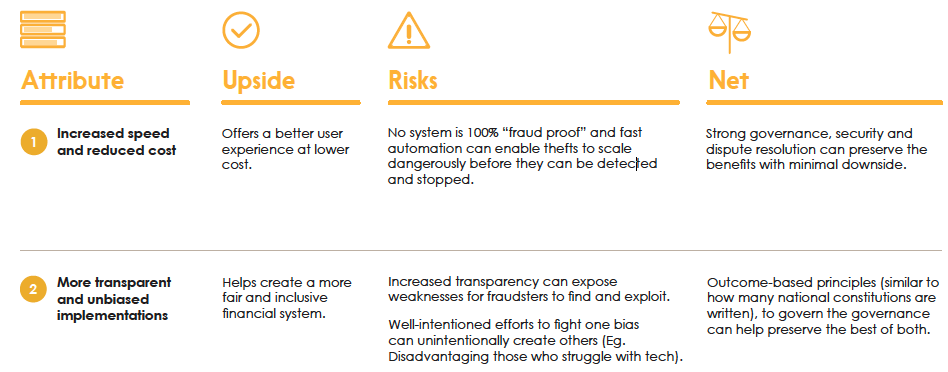

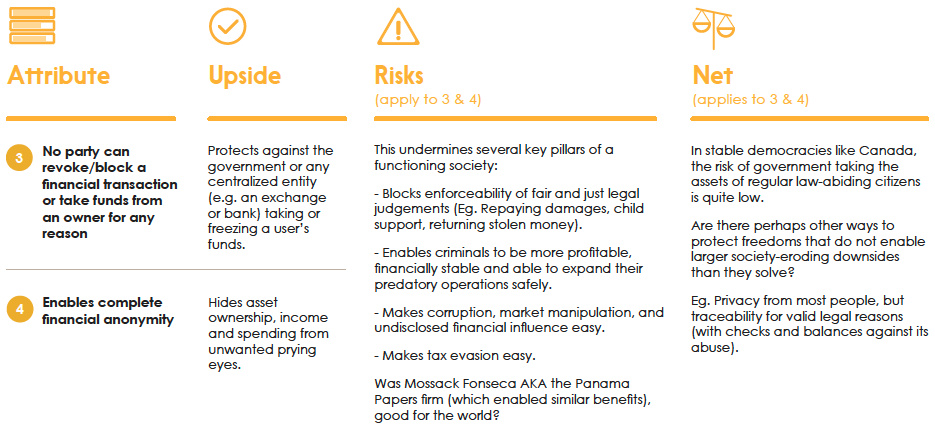

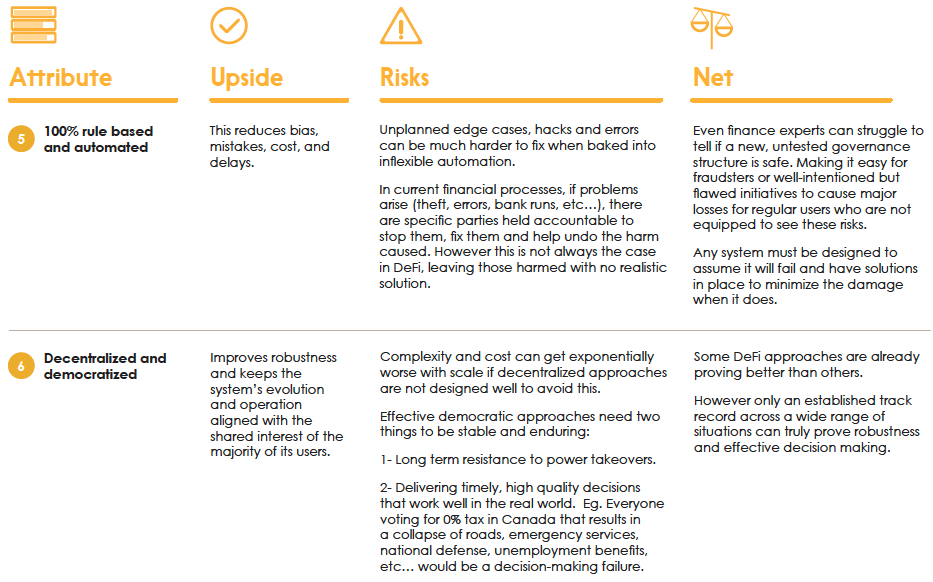

Assessing six ways DeFi might (or might not) be better than today’s financial system

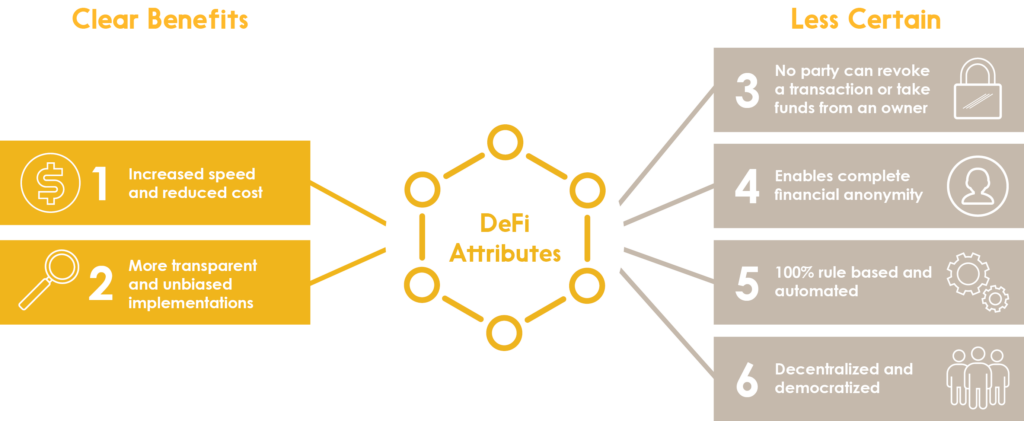

There are some benefits that present clear opportunities for improvement vs current legacy approaches—in these cases, these benefits open opportunities for new use cases, products and services.

However, there are proposed benefits that are less certain and may actually create more risk than upside. In the next few pages, we explore the net benefits of these attributes.

Two attributes show clear benefits vs legacy approaches, making them the most likely drivers of near term disruption:

The value of the remaining four attributes are less clear because along with the upsides, they can also introduce significant downsides that may prove worse than the original problem being solved:

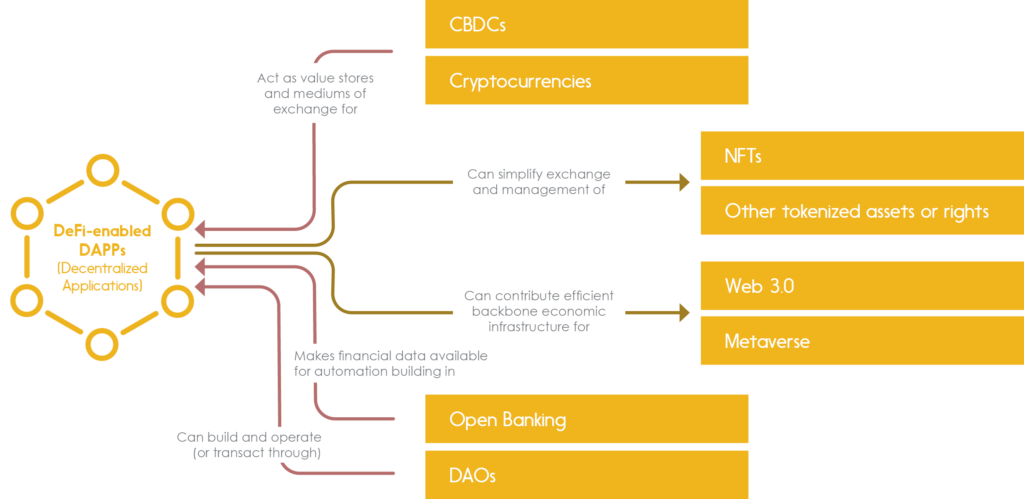

DeFi: Innovation context

How it integrates with adjacent innovation themes

DeFi: What broke with DeFi in 2022?

The end of a boom cycle has put new models to the test

Most people do not realize how much of the stability and trustworthiness we enjoy from our current financial system has come from hundreds of years of painful lessons on how not to do things. An evolutionary trial by fire of crashes, thefts, bank runs, and system failures has baked in this resiliency.

Many parts of today’s financial system can and should be improved by leveraging new technology, yet matching the right technology to each goal is not a trivial thing. It is dangerously easy to unknowingly break important functions by making enhancements without fully understanding why the “old” part was designed the way it was.

Most of these old approaches are in place to maintain stability when things don’t go right—which is exactly what happened to DeFi in 2022. After a peak and then a reversal of growth in asset prices, customers, and profitability, some business models like TerraUSD simply stopped working. TerraUSD was an attempt to “peg” a cryptocurrency’s value to the US dollar by increasing and decreasing the supply of that cryptocurrency.

It was supposed to be backed by US dollars that investors contributed in exchange for a very generous 20% return.

However with the reversal of growth, it became nearly impossible to generate the return promised to investors, and more people wanted to take money out than put it in. This started a death spiral of ever-worsening financials and trust. Without the backstops and buffers built into the mainstream financial system, the business collapsed—taking a lot of client money with it.

DeFi’s crisis was worsened by fraudsters successfully pulling off major heists—Ronin ($615.5MM) and Poly Network ($602.2MM) for example—that further undermined trust in the ecosystem. As more money fled, the pressure on remaining players got worse. This contagion, or “domino effect”, is common in financial ecosystems that lack appropriate and timely counterbalances. Like a healthy person whose air supply gets interrupted for too long, even otherwise sound businesses can be taken down by such dynamics.

DeFi: Looking forward

Value creation opportunities

This presents an opportunity for organizations and individuals who have expertise on existing systems to bring value, approaching DeFi as a way to do what they do best in a more efficient and scalable way. Advancing both the DeFi ecosystem and their own offerings.

- Bankers & underwriters can leverage their extensive underwriting, security, regulatory management and risk management expertise to help design stable DeFI products (potentially around non-crypto currencies), that can deliver faster, more trusted service at lower cost than legacy offerings. Alternatively they can amplify their trusted brands by showcasing their trustworthiness through DeFi’s transparency or help a stable implementation scale through their access to low-cost capital.

- Lawyers can offer data-driven integrations between legacy legal registration systems and the DeFi ecosystem to maximize the speed and extent of automation. With fall back options to more “manual” offerings when conditions for full automation are not met (Eg. A lawyer personally steps in when an automated asset ownership check fails).

- Insurers can offer insurance on DeFi so participants are covered in the event of fraud, errors in smart contract coding, etc… They might also offer insurance for the same risks they do today (home, auto, life, etc.) more efficiently by creating their own DeFi DAPP. Leveraging their expertise in risk assessment and mitigation towards creating faster, more cost-effective products.

DeFi: Final thoughts

Many brilliant minds are hard at work devising and experimenting with systems and governance structures to find the balance that complements the new with the best of the old, so the odds are good that DeFi and its descendants will change the future of finance—perhaps, on the way, discovering that 100% automation is not always the right path.

Today, the position of DeFi is similar to the early days of aviation, where most planes were designed and built by relatively small teams, and safety depended on the expertise of the individual builders. If you are considering getting on someone else’s DeFi “plane”, safety cannot yet be assumed. How confident are you that the build team had both the expertise and rigour to not miss something important? Caution is advised.

As in early aviation, the opportunities for riches, impact, and fame are many. Yet there remains much trial and error to demonstrate what will work sustainably. One thing is clear, though: expertise in the principles that have proven over centuries to work well in financial engineering will be as valuable in DeFi as physical engineering expertise was in making early airplanes safe.

The ideal DeFi innovation team combines the skills and insights of both the disruptor and the incumbent—and opportunities abound for anyone willing to assemble and lead one.