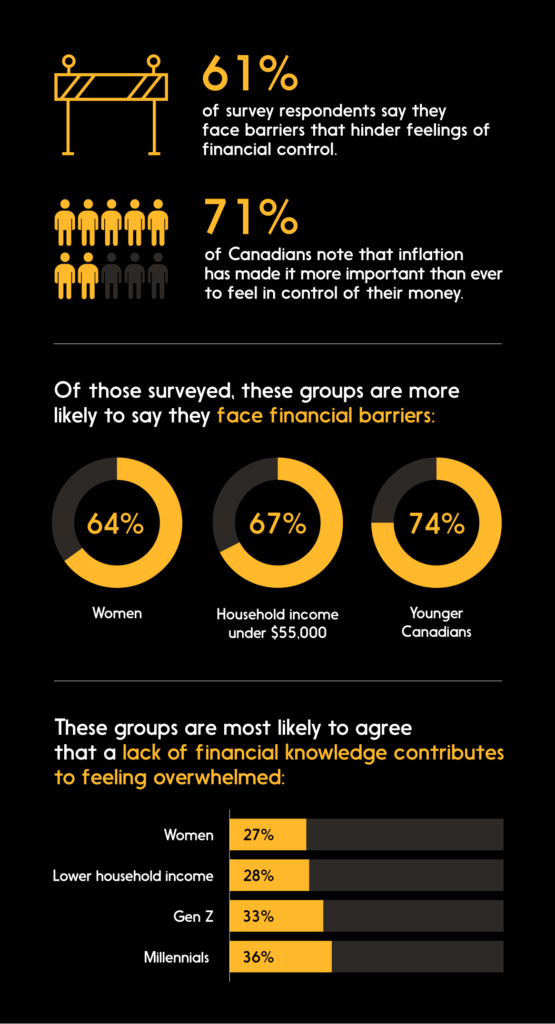

The results are in for the financial confidence survey commissioned by Interac this fall, and as the world steps away from the uncertainty of the pandemic, we see that cracks are showing in the financial confidence of Canadians, with 61 per cent of survey respondents saying they face barriers that hinder feelings of financial control.

The survey asked 1,500 Canadian adults from different ages, household incomes, genders, locations, and education levels how financially confident and in control they are feeling about their finances. The results provide some interesting insights into some of the common issues threatening the financial confidence of Canadians and what can be done to raise it.

Finding the cracks in financial confidence

Overall, as current financial issues such as rising inflation have been impacting many, more than 7 in 10 Canadians (71 per cent) note that it’s more important than ever to feel in control of their money.

Unfortunately, the cracks in feelings of confidence begin to show as we go deeper into the data as younger Canadians (74 per cent among Gen Z and Millennials), those with a household income under $55,000 (67 per cent), and women (64 per cent) are more likely to say they face financial barriers than other demographics.

Among the barriers faced is a lack of knowledge around financial terminology. Women (27 per cent), Gen Z (33 per cent), Millennials (36 per cent), and those with a lower household income (28 per cent) are among the most likely to agree that a lack of financial knowledge contributes to feeling overwhelmed.

The importance of outreach, awareness, and education

Fortunately, through this data we definitely see room for significant growth in how financial education can be spread so even more people feel confident, in control, and in the know when it comes to their finances. Digital tools, financial experts, and significant educational outreach in the communities that need it most can come together to help seal the cracks in financial confidence and control found in the data.

With the aim of ensuring that everyone has access to financial education, Interac has developed partnerships dedicated to raising financial literacy for everyday Canadians.

“Our research indicates that Canadians, now more than ever, are in need of solutions to help knock down barriers and reinforce financial confidence during these uncertain economic times,” says Daria Hill, Vice President, Marketing and Communications at Interac Corp. “Anxiety during these challenging circumstances is high and further complicated by uncertainty in markets, making it a priority for us at Interac to invest in programming and resources that can help to strengthen financial resilience in Canadians, especially among more vulnerable groups.

How we’re helping

Interac & Conscious Economics

The most recent partnership is Mindfulness & Money for Canadians, which offers a free, foundational digital learning platform to support the development of financial wellbeing skills through the lens of mindfulness, to Canadians coast-to-coast-to-coast. Created in honour of Financial Literacy Month and led by Conscious Economics CEO and founder Rhiannon Rosalind, the curriculum features a wide range of diverse voices who are business owners, experts, and thought leaders in their respective fields who bring their lived experiences to the information they’re presenting. With a lens on mindfulness, the course aims to reach Canadians looking to build their Financial confidence with a focus on mindful spending, self-love, and financial therapy. This is the second series of Mindfulness & Money following the free digital curriculum for diverse entrepreneurs that launch in September.

“Mindfulness & Money delivers programming from experts and community leaders who have lived the same experiences as many of the Canadians most in need of accessible financial resources,” said Rhiannon Rosalind, Creator and CEO, Conscious Economics. “Through this partnership, we hope to provide Canadians from all backgrounds with the financial programs they need to feel empowered in today’s economy.”

Interac & ACCES Employment

The push for financial education doesn’t just stop at the practical level, however. Through our work with ACCES Employment, Interac and our employee are invested in making the Canadian FinTech landscape larger by providing mentorship and employment opportunities for newcomers to Canada looking to be involved in the industry. Workshops, classes, and talks are all held to bring a better understanding of the Canadian financial sector and empower newcomers to add their diverse talents to FinTech jobs.

Interac & HeARTwork

And as the data from the survey shows that 64 per cent of women face barriers around their finances, the need for financial education among women is more important than ever. That’s why our work with HeARTwork, a grassroots project from Conscious Economics, designed to capture real stories and experiences of diverse women within the labour force, aims to close the gaps in understanding so more women in leadership can move boldly within the Canadian economy.

Starting the conversation

While educational resources are essential in creating a more informed and confident view of money, the path to better financial literacy can start by simply having an open and honest conversation with friends.

In the survey, four in 10 Canadians said they comfortable with financial advice coming from family.

Because we tend to tie our finances to our emotions and mental health, we know that sometimes talking about money can be seen as scary, or even taboo. But simply starting a conversation about your financial situation with someone you trust can help ease the stress we may feel and create a strong support network through the shared experience. And through that shared experience the pool of information grows wider, ensuring that we have more tools to help us be in control of our finances and that we don’t have to navigate the waters of financial uncertainty alone.

“My best advice is to start any conversation about money with your own personal observations about yourself and your own relationship with money,” says Rhiannon. “Rather than asking people directly about their circumstances, instead use the superpower of vulnerability to create a safe container by opening up about your own worries, struggles, or areas that excite you and see what happens.”

Strong knowledge = stronger confidence

The practical conclusion from the data in the survey makes it clear that the key to a higher level of financial confidence and a sense of control over money is a strong foundation of knowledge. The more we know, the more we’re able to make decisions with certainty. And as money is such an intrinsic part of our day-to-day lives, making financial tools and education more available and accessible will lead to an empowered individual and strong national confidence.

“Financial education is important for all people, period,” says Rhiannon. “Money is at the centre of our societal value system. It is the tool we use most to measure value, exchange value, and earn value, and thus it is fundamental to understand”.