The holidays may be one of the busiest times of year for small business owners, but the challenge to serve customers, handle operations, and stay cash flow positive exists all year round.

With economical, easy-to-use payment solutions within reach, you can level up your business game when it’s crunch time, skip the headache of payment reconciliation, and stay in charge.

When you embrace digital payments, you also free up more time to meaningfully connect with customers and employees—and enjoy more moments of calm amidst the hustle and bustle. The best part? You can feel confident knowing you’re in control of your money.

Payment solutions built to help your business thrive

At Interac, we’re constantly evolving to help businesses across Canada keep pace in changing times. That’s why our payment solutions are designed to help your company stay ahead of the curve. From customer purchases to paying employees, to invoicing and depositing, using Interac payment solutions helps small business owners safely simplify and speed up all types of payments.

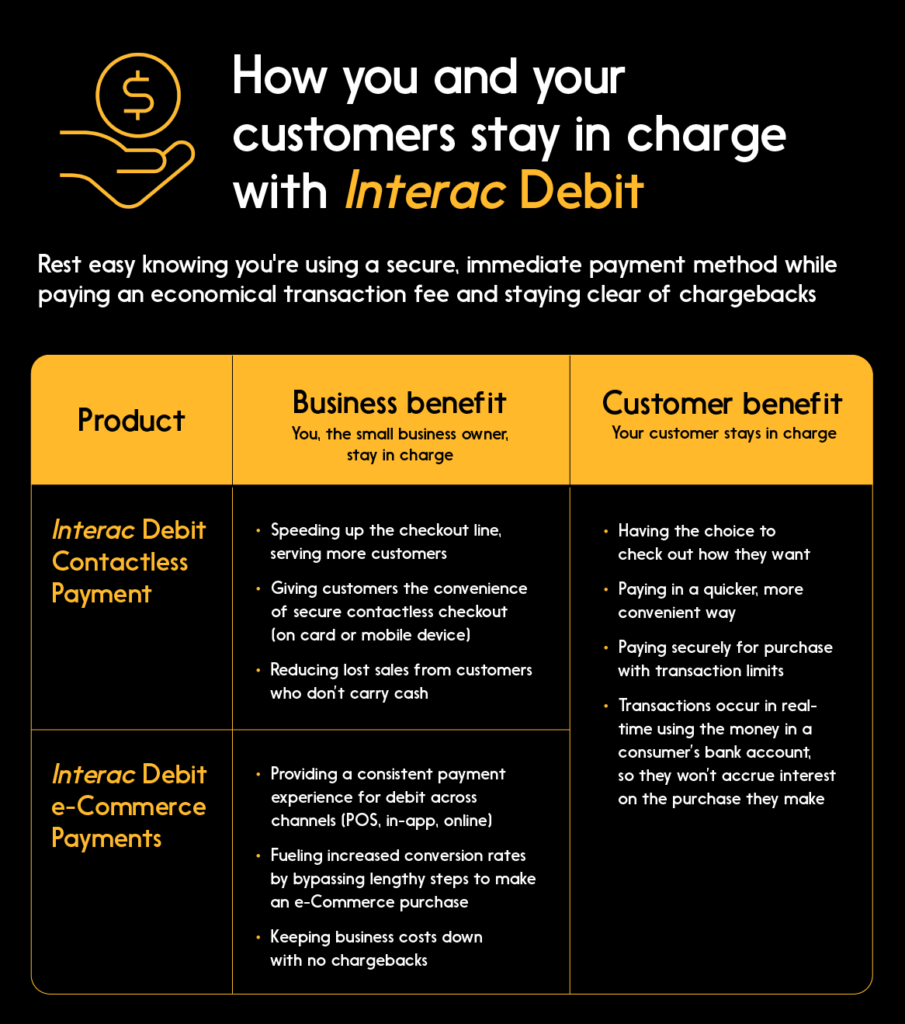

How you’re in charge with Interac Debit

When you give your customers the choice to check out with their own funds through Interac Debit, you get the confidence of knowing they’re using a secure payment solution you can trust. With Interac Debit in your financial toolbox, you’ll steer clear of chargebacks, too. There are no unexpected expenses and no financial worries. Plus, each Interac Debit transaction is low cost, with only a single flat economical fee—regardless of purchase price.

How contactless payments keep you in charge

Accepting digital payments is more critical than ever to small businesses. Why? Studies show more and more Canadians want quick and convenient contactless payment options everywhere they check out.

Accepting contactless payments directly on smartphones is a secure, seamless way to speed up the checkout line, serve more customers, and increase sales from people who don’t carry cash.

With contactless payments, customers simply tap their debit card or mobile phone to pay on a card reader, terminal, or directly on an eligible smartphone. This not only enhances the customer experience, but also frees up employees to focus on driving sales and building relationships.

Additionally, Interac Debit contactless payments often have a low fee compared to other payment methods, making it an economical choice, especially during the holidays. And who doesn’t love that?

How you’re in charge with Interac Debit e-Commerce Payments

If your small business is online, giving your customers the option to pay using Interac Debit e-Commerce Payments gives you the confidence that comes with using a secure, convenient payment solution. That’s because Interac Debit e-Commerce Payments use state-of-the-art fraud protection to protect you and your customers.

Another advantage: You won’t incur any authentication costs with these safe, real-time transactions on your side, and there’s no private data to store.

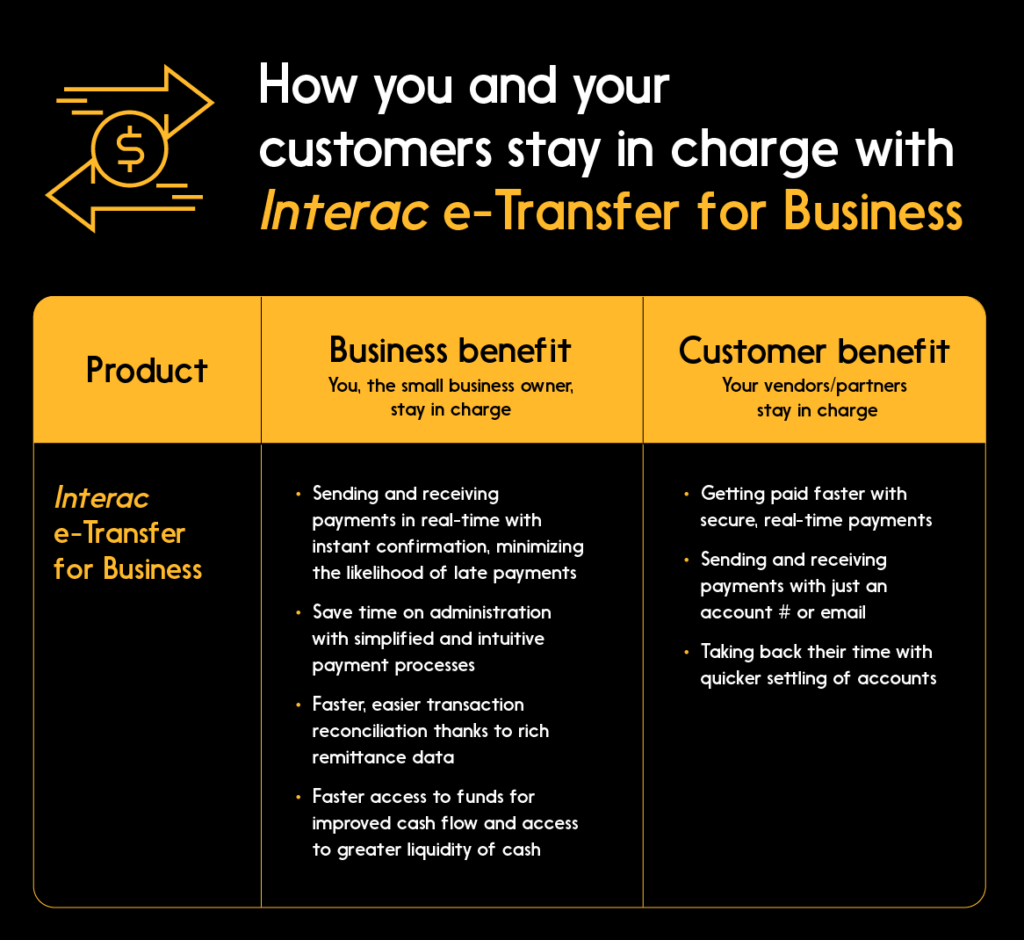

How you’re in charge with Interac e-Transfer for Business

We get it. Quick money transfers are the lifeline of business cash flow. That’s why more companies are moving away from traditional payment methods like cheques and EFTs. They take time away from serving your customers and expanding your business.

With Interac e-Transfer for Business, the speed of business is now. You’re equipped with faster, smarter, and safer payment solutions that put you in charge.

By digitizing your online and in-person business payments, you can save time and energy on payroll and cheque reconciliation. To digitally pay employees and vendors, all you need is a phone number or an email address, along with a Canadian bank account. It’s that easy, and creates a digital “paper trail” that makes tracking transactions simple.

With rich remittance data, higher transaction limits, and fast money transfers with instant confirmation, Interac e-Transfer for Business meets the needs of Canadian business owners.

The power of staying in charge with digital payments, all year

At Interac, we want to help small business owners be in charge all the time. We’re proud to support hard-working businesses across the country as they transition to digital payments.

When you digitize your payments and processes with Interac, you help your customers stay in control by spending their own money in safe, secure ways. And you’re spending less time on cheque reconciliation and payroll activities. That means more time to focus on things that matter more to you—like growing your business and getting more out of life.

Be in charge and get Interac payment solutions working for your business today.