The pandemic of 2020 has quickly and profoundly changed Canadians’ living and spending habits. Consumers were already shifting more and more to digital payment methods for purchases and money transfers before March. But the pace of change has rapidly accelerated since then as Canadians have adapted to physical distancing and found ways to manage their financial anxiety.

In response to these new realities, consumers are embracing more convenient ways to pay — and they’ll continue to shift to digital transactions even after the eventual COVID-19 recovery.

Canadians choose Interac products around 18 million times per day to pay and exchange money, and the data from these transactions paints a unique picture of the rapid changes taking place. Because Interac products are integral to the functioning of the country’s economic life, the way they’re being used tells a story about how real Canadian consumers are responding to the pandemic.

As well, a survey of 900 adults from across Canada tells us in more detail how consumer behaviour and habits around contactless payment, money transfers and other digital transactions are evolving during the pandemic. It also shows that financial anxiety and uncertainty are driving a preference for transactions that let consumers track real money spending in real time.

In the big picture, digital payment tools have been a lifeline for Canadians during a challenging time. From spending more time at home, to watching our money closely, to supporting local businesses, here are five growing trends in Canadian consumer behaviour and digital transactions during the COVID-19 pandemic so far:

1. Financially anxious consumers are keeping a close eye on their spending

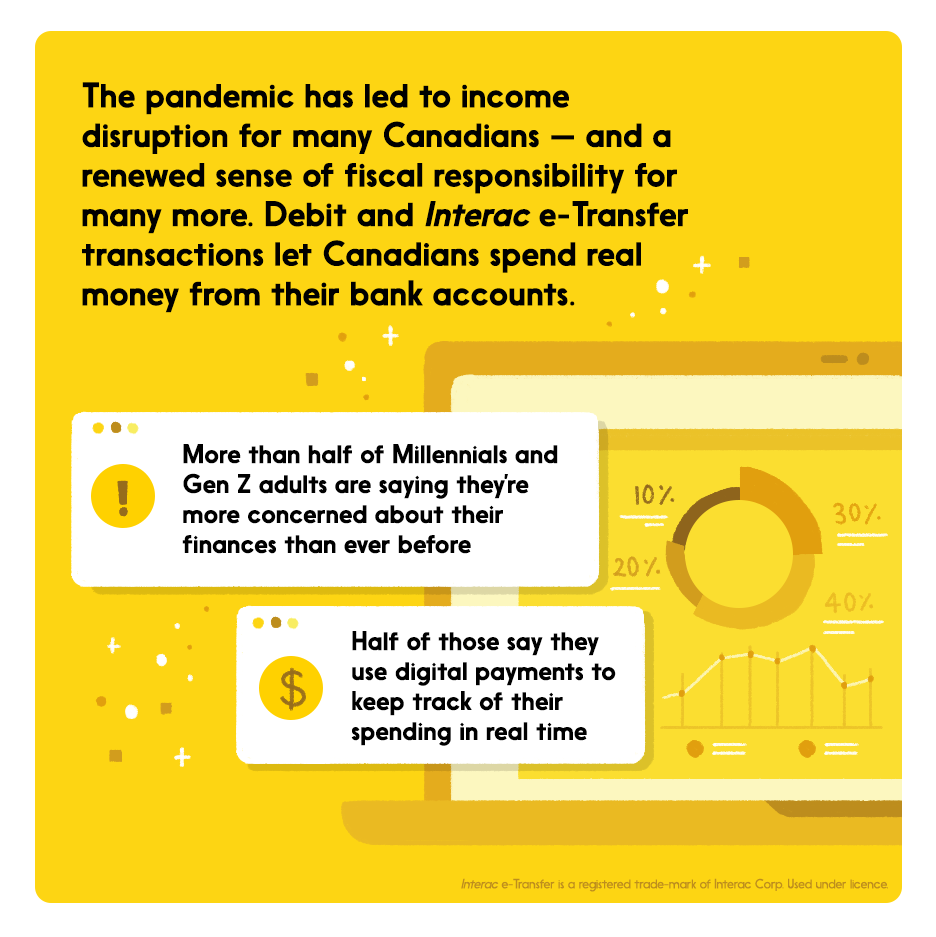

The shift to digital payment solutions isn’t just about convenience: Canadians are using them to make sure they’re being financially responsible, too.

Forty-four percent of respondents said they’re keeping a close eye on spending — for example, by paying using Interac Debit and Interac e-Transfer transactions so they can make their purchases with real money in their bank accounts, while tracking their balances in real time. That’s why seven in 10 Millennials and nearly two thirds of Gen Z believe Canadians should have the option to use debit no matter where they are checking out.

Forty-four per cent of respondents also say they’re less likely to make an impulse purchase than they were before the onset of the pandemic. More than half (54%) say they’re spending more on essentials and less on things they don’t need.

Looking to the future, six in 10 Gen Z adults (65 per cent) and a similar number of Millennials (72 per cent) are planning to control their spending and make their finances more resilient in case another crisis occurs after the pandemic.

2. Canadians are paying digitally by default

More time at home and in-store shopping restrictions have forced Canadians to change habits almost overnight —more than half of Canadians (53 per cent) report using digital payments more frequently during the pandemic, and many said they’ll continue to do so in future.

The digital shift is especially noticeable among younger generations. Close to two-thirds of Millennials (64 per cent) and almost six in 10 Gen Z adults (58 per cent) have increased the frequency of their use of digital payments during the pandemic.

Looking ahead to after the pandemic, Canadians between the ages of 25 and 34 are most likely to say they don’t want to go back to using cash — 72 per cent of them agreed, versus 60 per cent of all Canadians

3. Canadians are using the Interac e-Transfer platform to share costs

Canadians have increased their use of the Interac e-Transfer service since the start of the pandemic in Canada. Since mid-March, 69 per cent report using the Interac e-Transfer platform at least twice a month, up from 42 per cent pre-pandemic.

Consumers use the Interac e-Transfer service for various interactions, from paying rent to splitting grocery costs. For businesses, the use cases can also include paying suppliers and employees and taking payments and deposits from customers.

4. More Canadians are using the Interac e-Transfer service to support friends, family and neighbours

Our data shows that Canadians have been stepping up to help each other out — and they’re using Interac e-Transfer as a way to stay connected while spending more time apart.

A significant number of people report running errands for neighbours, friends and family (53 per cent said they’ve offered to do so). Sixteen per cent of Canadians have also shown someone else how to send an Interac e-Transfer transaction — and an equal number of people report using the product to send and receive money for the first time during the pandemic.

5. Canadians are supporting local businesses through digital payments

Vibrant main streets are at the core of communities across the country, and Canadians are eager to see them through the pandemic. Three-quarters say they want to support local businesses now more than ever, and 65 per cent believe businesses that don’t facilitate digital payments will struggle.

From shopping at local retail to paying tradespeople, Interac data shows some of the ways Canadians are supporting their local economies through digital transactions.

Digital transactions and the coming COVID recovery

What have we learned? Consumer behaviour has changed rapidly and will continue to do so as Canadians respond to circumstances they’ve never experienced before. Digital spending habits will continue to evolve even after COVID recovery, as life goes back to normal.

There’s one constant through all of it: Canadians are looking for choice in how they transact — and their choices are increasingly digital.