National Bank will be the first bank to pilot the new international remittance solution

TORONTO, May 22, 2019 – Mastercard and Interac, two trusted global and domestic payment networks, today announced a collaboration to offer Canadians a fast, simple and secure way to send money internationally. By leveraging Mastercard Send, a push-payments service that powers a faster, better, smarter way to send money cross border, the Interac e-Transfer platform will allow customers to send money from Canada to bank accounts internationally, starting with Europe. National Bank will be the first bank to pilot the new international remittance solution for its personal banking clients.

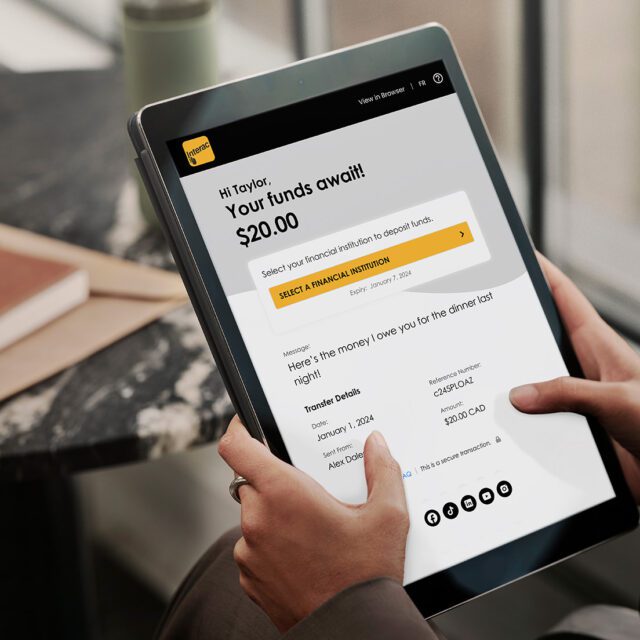

Canada is a large market for international payments, due to its diverse population and number of businesses that operate in an increasingly global marketplace. According to the latest data from World Bank, $24.5 B in remittances were sent from Canada to other countries.1 With Mastercard and Interac’s combined offering, Canadians will be able to simply log in to their mobile or online banking services and send funds securely globally using the familiar Interac e-Transfer brand.

“Consumers and businesses today operate globally. Whether it’s travelling abroad, sending money to family or friends overseas, or purchasing products from a business in another country, the ability to move funds across borders quickly, easily and securely is becoming a must-have,” said Ramesh Jayakrishnan, director of Push Payments for Mastercard in Canada. “Financial institutions need cost-effective and trusted solutions to meet their customers’ expectations. This new offering will connect banks to Mastercard Send to help improve customer experience and future-proof their cross-border payment service, all while using the existing Interac e-Transfer platform.”

“Interac e-Transfer is the go-to way to move your money securely in Canada, as represented by the millions of people who use it each day for their personal and business affairs,” said Peter Maoloni, vice president, Product & Platform Delivery, Interac Corp. “We think this offering with Mastercard and National Bank to offer a cross-border solution that will leverage the trust and reliability of the Interac e-Transfer brand, will be a game-changer in international remittance – making it easier for financial institutions to connect to the networks, and for their customers to move their money internationally.”

“We’re delighted to team up with two trusted brands to launch a new digital solution that will speed up cross-border payments. This innovative offering meets a growing need to send funds quickly and securely and will have a positive impact on our clients. We look forward to deploying this valuable addition to our current digital banking experience,” said Gabrielle Cournoyer, vice president, Cards & Payment Solutions at National Bank.

The Mastercard and Interac solution will be made available for other financial institutions in Canada, where if implemented, they can choose to enable their customers to send money internationally to bank accounts, and eventually mobile wallets and cards.

About Mastercard

Mastercard (NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. Our global payments processing network connects consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. Mastercard products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MastercardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.

Note to editors:

Mastercard Send helps power some of the industry’s most innovative payment products. For developers, Mastercard provides financial institutions with an easy-to-use API, one of more than 35 APIs available through the Mastercard Developers portal. Backed by the Mastercard network, banks further benefit from simplified settlement as well as Mastercard’s network and compliance expertise.

About Interac Corp.

Interac Corp. is a payments and digital information exchange that operates an economical, world-class debit payments system with broad-based acceptance, reliability, security and efficiency. The organization is one of Canada’s leading and most trusted financial brands and is chosen an average of 16 million times daily to pay and exchange money. For 35 years, Interac Corp. along with its predecessors, Interac Association and Acxsys Corporation, has provided payment solutions and access to money on secure, interoperable, reliable and efficient shared platforms through debit cards, mobile wallets, online money transfer, ABMs, in-app and online purchases. These solutions include Interac e-Transfer, the fast, secure and convenient way to send, request, and receive money to anyone in Canada. Interac Corp. has a diverse group of shareholders that include banks, credit unions, caisses populaires, payment processors and merchants. A leader in the prevention and detection of fraud, the organization has one of the lowest rates of fraud globally. Visit newsroom.interac.ca or follow @INTERAC on Twitter.

About National Bank of Canada

With $263 billion in assets as at January 31, 2019, National Bank of Canada, together with its subsidiaries, forms one of Canada’s leading integrated financial groups. It has more than 23,000 employees in knowledge-intensive positions and has been recognized numerous times as a top employer and for its commitment to diversity. Its securities are listed on the Toronto Stock Exchange (TSX: NA). Follow the Bank’s activities at nbc.ca or via social media such as Facebook, LinkedIn and Twitter.

Media contacts:

Mastercard

Hyunjoo Kim

416-479-3213

Interac Corp.

416-869-2017

National Bank of Canada

Marie-Pierre Jodoin

514-394-4209