Personal finance can be a profoundly personal topic. How we feel about our financial security—our budgets, our savings, any debt we might be paying down—can have a profound impact on our overall sense of satisfaction with our lives. And this connection could present a particular challenge for a generation that has experienced unusually high levels of economic uncertainty.

“Gen Z Canadians can get a good job, they can work hard, they can do everything their parents did and more, and too often the reward remains out of reach,” finance minister Chrystia Freeland said in an April 2024 budget speech.

Key financial stressors facing Gen Z:

- Labor market concerns

- Affordability crisis

- Wage stagnation

- Lack of affordable housing

The good news? There are resources and tips to help you approach saving, spending and shopping in a way that could also help with your peace of mind.

Money habits to help your wallet, and your well-being

Not all spending is the same

The first step in reaching any destination is knowing where you’re starting from, and that’s true for your journey to financial well-being. Start by putting it all down on paper: The fixed costs (paying rent, utility costs, cell phone plans), the big-ticket items (a new car, a major appliance, a vacation), the surprise expenses (vet bills, repairs, replacements). The good, the bad, the ugly, and on and on. Then take a deep breath.

For many people, the easiest way to distinguish between the endless list of expenses is to keep it simple, dividing items into essential spending vs. discretionary spending.

Essential spending:

Staying on top of essentials like paying rent, car payments, insurance and grocery budgeting is the first step in taking charge and managing your money effectively. For many of these fixed costs, Interac products can help keep your spending on track.

Interac e-Transfer is a fast and convenient way to send and receive money. Say you just moved into a new apartment and it’s time to pay that first month’s rent. Instead of paying for and filling out cheques, and then physically having to meet your landlord face-to-face, ask if they accept Interac e-Transfer as a way to send funds directly to their account. You can feel confident knowing exactly when your money is leaving your account so you have an accurate view of your balance. Plus, that money is reaching your landlord or management company in a way that’s fast, secure and easy to track. (Get answers to all your questions about sending and receiving money with Interac e-Transfer here).

Grocery shopping can also be a considerable expense, but there are several things you can do to help take charge of your grocery costs. With Interac Debit, whether you’re shopping in-store or ordering online, you’re spending your money in real time, so you won’t be hit with a surprise bill down the road. This is a great way to grocery shop mindfully, which can help free up money for other areas of your budget, help you stay in charge of your finances and set yourself up for long-term success.

Discretionary spending:

Once you’ve established your essential expenses, anything that’s left over (aside from what you’ve set aside for savings) is your budget for discretionary spending. This could mean travel, dining out, a thrifting trip to freshen up your wardrobe or home decor, or that daily iced latte that keeps you energized throughout the day.

By paying for these purchases using Interac Debit, whether on your phone or directly in app or in browser, you can save time…and you’ll see your spending reflected in real time. For more information on how to add your debit card to your phone, check out this article.

If discretionary spending involves activities with friends or family, you might need to split costs. You can send payments with Interac e-Transfer. And if you’re the one who needs to be paid back, you can request money via Interac e-Transfer Request Money.

Did you know? Don’t fall into the trap of doom spending (as in “doom scrolling”)—a recently-coined term for spending money despite concerns about the economy or political landscape. Doom spending is related to retail therapy, which can be a tool for coping with small-scale personal stresses, but isn’t quite the same thing.

“Doom spending [is] a display of what we call the passive to active flip, with the passive being the many things we may want to change in the world but feel we cannot, and the active being the buying of things,” Dr Dion Terrelonge, otherwise known as The Fashion Psychologist, explained to Vogue.

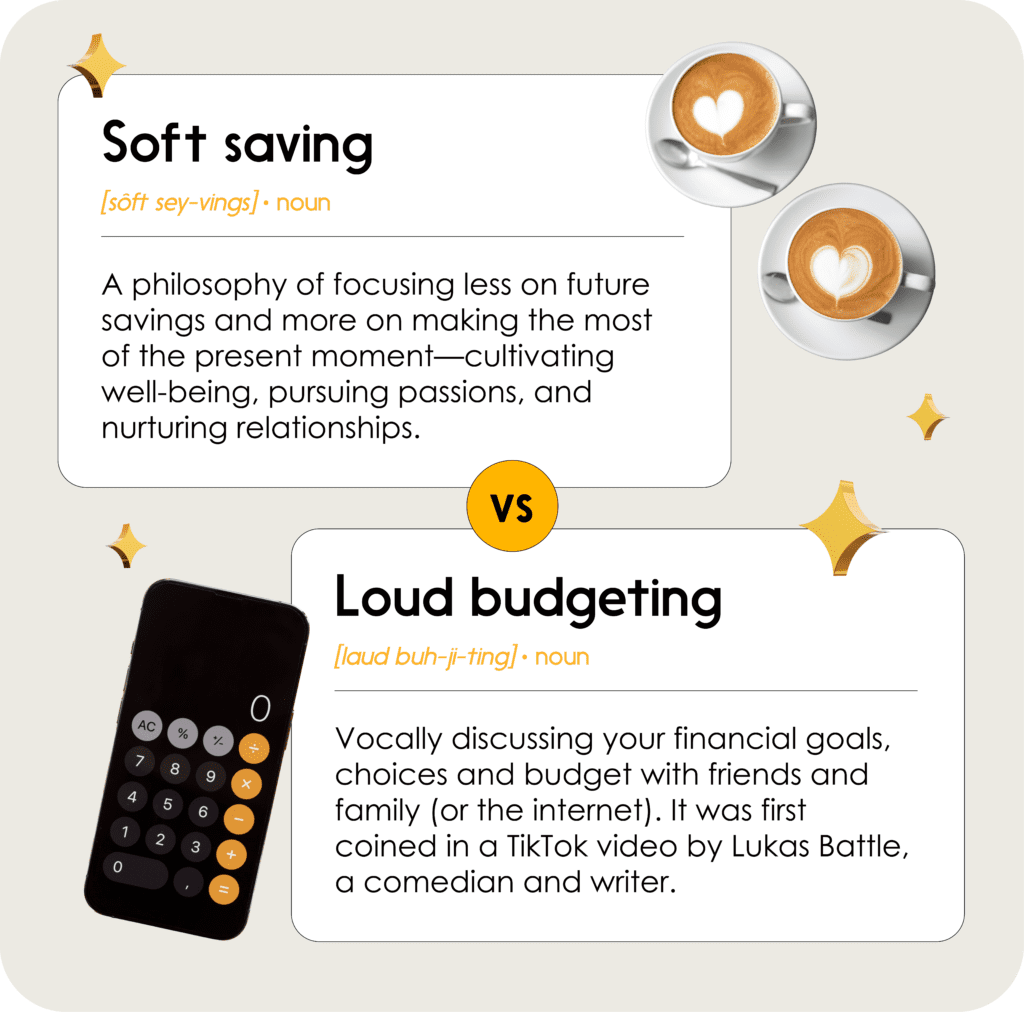

Soft saving: Spending now vs. Later

Is anyone in your life embracing a “soft saving” approach to managing their money? This might be an unfamiliar term, but it describes a philosophy of focusing less on future savings and more on making the most of the present moment—cultivating well-being, pursuing passions, and nurturing relationships.

Dr. Gillian Mandich, founder of the International Happiness Institute of Health Science Research, notes that autonomy—a sense of financial independence through staying on budget—could be the decisive factor in our emotional response to spending on many purchases, not simply the dollar figure.

“What we see from the research is that autonomy is more of a predictor of our happiness than how good looking we are, how popular we are or how much money we have,” she says. “When we’re spending our money, it can be a very empowering experience when we do it intentionally and deliberately.”

A mindful approach can help you be present and in control of your financial decision-making, and convenient and secure Interac payments can help you execute those decisions with confidence.

For more on how to create a mindful approach to managing your money, check out Mindfulness & Money, the free educational video resource from Conscious Economics and Interac.

Loud budgeting: Speak out about spending

The term “loud budgeting”—vocally discussing your financial goals, choices and budget with friends and family (or the internet)—was first coined in a TikTok video by Lukas Battle, a 26-year-old comedian and writer.

Battle told The New York Times that loud budgeting is about setting “financial boundaries without being uncomfortable or embarrassed.”

Social media has certainly contributed to making it acceptable, even trendy, to talk about money. And experts agree that verbalizing your financial goals is a great way to take control. After all, financial anxiety is often the result of expenses that are either outside of our control or surprising ones such as the “set-it-and-forget-it” subscription services or Buy Now Pay Later items.

Did you know? Gen Z has been dubbed the “debit-first” generation for their focus on avoiding debt (Interac Debit makes that simple when shopping, because you always know where that money is coming from).

When someone else talks about their finances, others often feel seen and inspired to act (are you checking on your subscriptions right now?). By taking control of your finances, taking a mindful approach to money and taking steps to balance future savings with present experiences, you can work to build a life that works for your wallet, and your well-being.

Get more advice on taking charge of your finances with Interac