“Mindful spending” isn’t an oxymoron—at least, it doesn’t have to be. That’s because more and more people, especially Gen Z, now recognize that sticking to a budget and staying out of debt isn’t just good for your wallet, it can be good for your well-being.

Financial concerns are often a significant source of stress: In a 2023 study by Forbes, 54% of respondents said they “often” or “always” feel stressed because of their debt and 60% said their financial stress has led to disagreements in their personal relationships. Interac research showed similar trends: In a 2023 Interac study, Gen Z adults polled were more likely to report feeling stressed, anxious and overwhelmed about their financial situation than any other generation polled.

So it makes sense that more people are embracing mindfulness—the quality or state of being conscious or aware of something—and its potential to improve certain aspects of their lives, including their financial well-being.

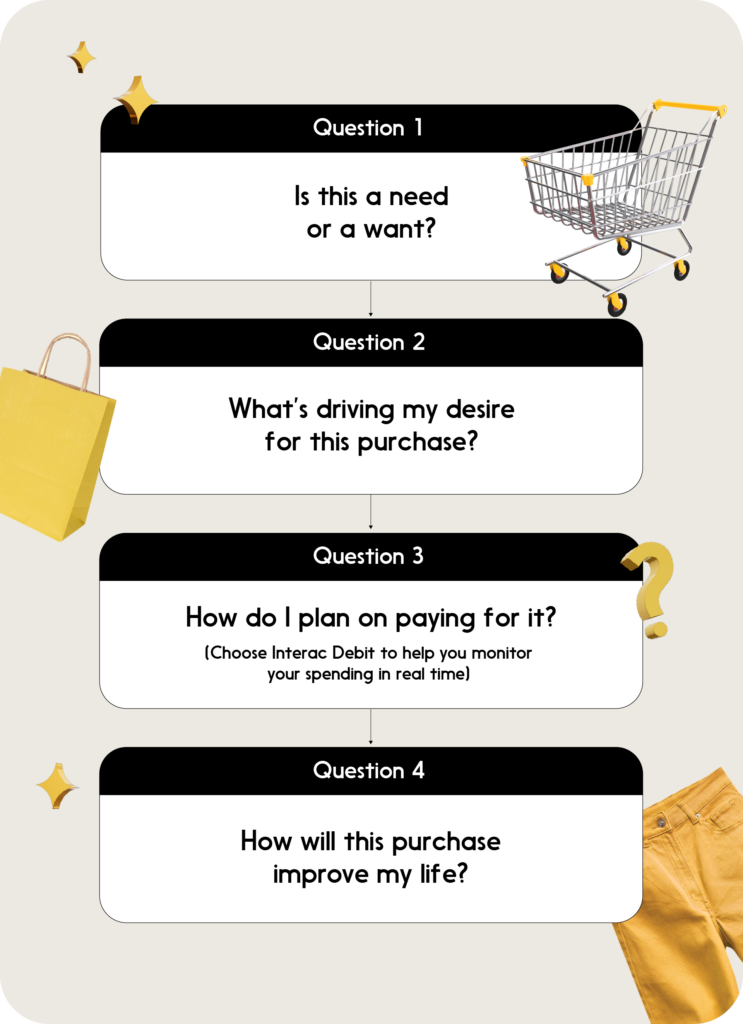

Being a mindful, savvy spender doesn’t have to take the fun out of shopping. It can be as simple as asking yourself a few key questions before making major—or even minor—purchases.

Financial mindfulness: Figuring out the ‘why’ before you buy

1. Is this a need or a want?

Not all purchases are created equal. Regardless of your financial situation, different items fall into different categories: the things you need, the things you want, and everything in between.

Some needs are immediate and obvious (paying rent, grocery budgeting etc.), but other purchases require more thought. It may be easy to talk yourself into “needing” something in the moment, and we’re all susceptible to the lure of sales, or peer pressure, or even feeling influenced to spend without necessarily knowing why.

Ask yourself: Do I own something similar? How will I wear/use/display this item? How long will I be able to use this?

If you’ve decided to make the purchase, Interac Debit can help you stay in charge by using your own money, straight from your account and authorized by your financial institution. By using your own money in real time, you’ll have an accurate picture of how purchases fit into your budget (or don’t). That means you can say goodbye to surprise bills and stay on top of your spending.

2. What’s driving my desire for this purchase?

You don’t have to look much farther than phrases like “doom spending,” “retail therapy” and “panic buying” to understand that shopping can be a common reaction to stress or a way to cope with emotions. And we’ve all experienced the “shopping high.” That’s one reason financial experts and therapists alike advise “hitting pause” before making a purchase.

“A mindful approach can give us the opportunity to take a step back to ensure that the financial decisions we make can clearly align with our personal values,” Conscious Economics’ in-house Financial Therapist Aseel El-Baba previously explained to “In the Know.”

This approach can help you be present and in control of your financial decision-making. And with convenient and secure payment processes through Interac, you can execute those decisions with confidence.

Did you know? According to an Interac poll, Gen Z is more likely (70%) to frequently use debit to manage finances (Interac Debit makes that simple when shopping, because you always know where that money is coming from, and you’re only spending what you actually have).

3. How do I plan on paying for it?

At first glance, this might seem like a simple question. Either you have the funds, or you don’t, right? But there are many ways to look at whether you “can afford” something:

How will the purchase impact your bank account—immediately and in the near- and long-term? Does your account balance accurately reflect your available cash, or do you have automatic payments that will be withdrawn? Will this impact your ability to spend money elsewhere? Are there hidden costs associated with this purchase?

It’s easy to lose sight of your budget while online shopping and to fall into the trap of mindlessly adding to cart out of boredom or stress. Choosing Interac Debit as your default payment method on your phone or digital wallet can help you monitor that spending in real-time.

Plus: Asking yourself these questions is a great way to start cultivating financial mindfulness, but don’t be afraid to also embrace “loud budgeting”—vocally framing your choices and boundaries with friends and family. Interac products can help you stay accountable to your own goals, because you’re only spending in real time, so you can always see how much money you actually have.

4. How will this purchase improve my life?

People typically plan for or research big ticket items like a car, a major appliance, or a vacation. But it’s those small expenses—often the so-called impulse buys—that can add up quickly, causing you to lose sight of your overall savings strategy. It’s particularly important to reflect on how a potential purchase may improve your life or help solve a problem.

Being mindful about purchases helps ensure you’re spending your money on things and experiences that contribute to your quality of life (as opposed to simply your quantity of possessions). That’s why financial mindfulness and soft saving—prioritizing current experiences over future saving—aren’t mutually exclusive. When you’re intentional about your financial decision-making, you have more freedom to dedicate funds to those present-day priorities. Becoming a conscientious consumer is a key first step on the road to reaping the benefits of budgeting that go far beyond the bottom line.

Learn how Interac can help you stay present and in control of your financial decisions