Digital transactions are central to Canadians’ daily lives. But is familiarity leading to trust in the entities and technologies they’re interacting with? How comfortable are Canadians about sharing their personal data?

According to new research from Interac, while many Canadians are willing to share their personal data, they lack confidence and want greater control over how it’s being protected and used. And with major advances in digital information sharing on the horizon, including the realization of a Canadian open banking framework, data sharing will become even more important – not only for organizations that handle customer data, but for the development of the digital economy as a whole.

How can we let consumers know their privacy is being respected and their data kept secure? Any evolution in our digital ecosystem must be built in a way to ensure Canadians feel safe when transacting online. We’ll explain why we at Interac believe building experiences that are rooted in choice and consent is critical for fostering trust in digital transactions.

But first, let’s look at what we’ve learned about the scale of the challenge.

Canadians’ growing concerns around data privacy

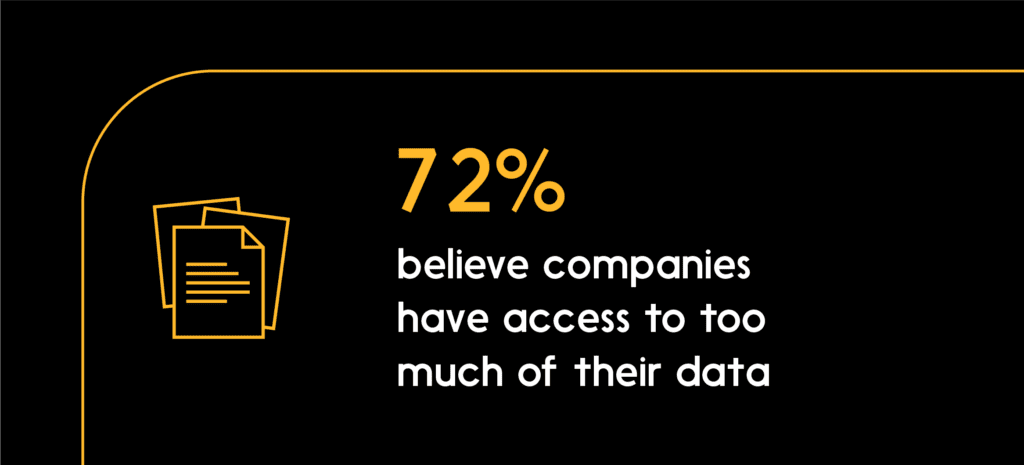

Interac surveyed 1,500 Canadians in January 2024 to take the pulse of consumer confidence in data privacy and personal information management. The findings revealed that people have lost confidence in the privacy of their personal data. Nearly six in 10 Canadians (59 per cent) say they lack the confidence to protect their personal information, and an equal number say they can’t clearly consent to how their personal information is being shared because they don’t understand the terms and conditions they’re agreeing to. Two-thirds say they believe companies are sharing their personal information without their consent (66 per cent).

All in all, 77 per cent feel their personal data is more exposed than ever before.

Our results align with those of a 2023 survey by the Office of the Privacy Commissioner of Canada in that they both reveal what we would call a significant “trust gap”— a discrepancy between Canadians’ digital behaviours and their level of comfort. That poll found that 93 per cent of Canadians expressed some level of concern about the protection of their privacy when transacting digitally.

Familiarity with digital transactions that involve data sharing is not making Canadians more comfortable with them. As it stands now, consumers often have to contend with making trade-offs. For example, they use social media accounts as a quick way to sign into new services (versus creating a new account), even if they may be uneasy about doing so. Interac research from 2023 observed that while 58 per cent of Canadians polled say they use their social media accounts to log in to other online services, only 11 per cent trust these accounts to store their personal information. In other words, people seem to be taking actions that may not make them feel safe, for expediency’s sake.

And the status quo brings risks for businesses and other organizations, too: More than half of the people polled in 2023 (53 per cent) hold organizations primarily responsible for protecting their personal information, and 69 per cent would consider them accountable in the event of a data breach.

The challenge is clear: Most Canadians surveyed feel their data is overexposed and lack confidence in their ability to protect it. They have concerns around data sharing that aren’t being met, and there are indications that their misgivings are growing.

Expectations around consent and transparency

We’ve seen that many Canadians aren’t comfortable with how they’re sharing data digitally. How can organizations change the narrative and start building trust and transparency through digital experiences, as opposed to eroding it?

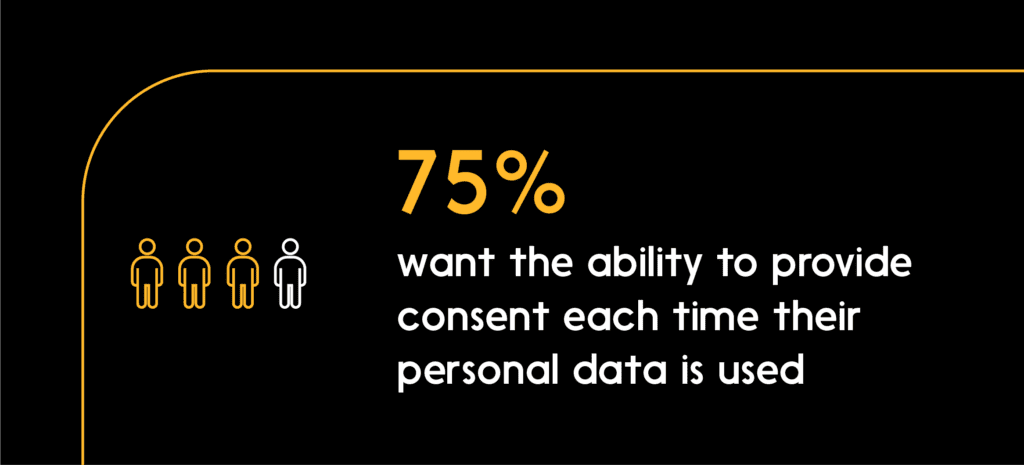

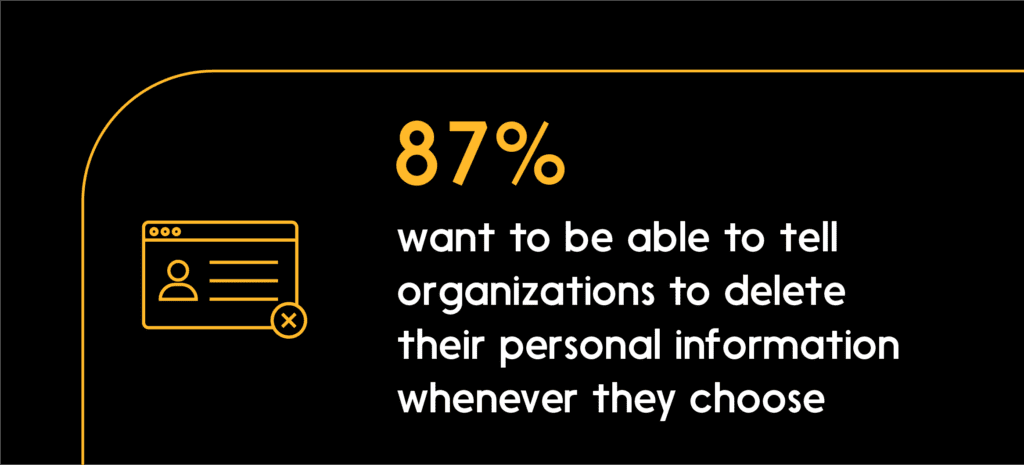

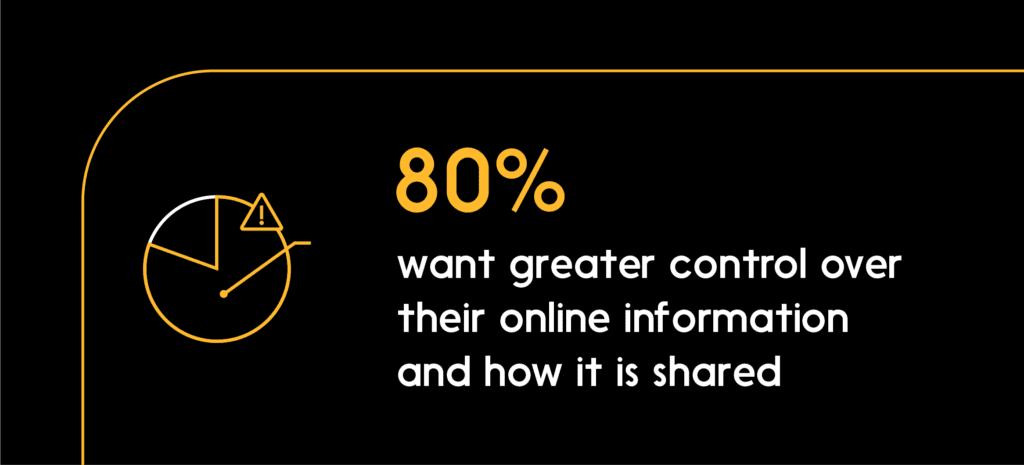

The latest Interac data suggests consumer trust can be built through experiences that ensure their data is safe, and being used in ways they approve of. Four out of five Canadians polled say they want more control over their online information (80 per cent). Three-quarters (75 per cent) say they want the ability to give consent for data sharing each time they use a service, rather than one-time consent . And a large majority, 87 per cent, want to be able to tell organizations to delete their personal information whenever they choose.

In other words, offering users choice and simple informed consent could hold the key to fostering consumer’ trust around data sharing. That insight could prove pivotal as Canada prepares to introduce open banking.

What the survey said about Canadians and open banking (a.k.a. consumer-driven banking)

In its 2023 Fall Economic Statement, the federal government announced its intention to introduce legislation that will pave the way for an open banking framework for Canada (or what it calls “consumer-driven banking”).

Open banking gives consumers and small businesses more control over how they share their financial information, making it easier to switch banks, apply for new financial products, and other advantages.

Through its latest research, Interac explored what could make Canadians feel comfortable using open banking when it arrives. The first fact to note is that awareness of open banking is low so far; 59 per cent had never heard of it before taking part in our survey.

In a way, this presents an opportunity to educate consumers: The results showed that explaining how open banking could work makes a difference in their outlook. Once they’re made aware of the benefits, a majority see the appeal of open banking – for example, to potentially give them greater control over their financial data (65 per cent see the appeal), protection from risky practices like screen scraping (60 per cent), and the ability to securely access and share their data (54 per cent).

Canadians also have expectations about how they’d like to interact with open banking. These include the ability to revoke consent and stop their data from being shared at a moment’s notice, which nearly half (47 per cent) of those surveyed viewed as confidence-enhancing. This reinforces our belief that simple informed consent will be vital considerations for consumers as they decide whether to try open banking when it arrives.

Canadians want a future of trustworthy digital experiences

Canadians value their personal data, and they expect it to be handled with the utmost care. That’s why new innovations should aim to deliver simple and user-centric solutions which enable a more trustworthy digital experience.

With any new technologies that involve sharing data, consumers will benefit from transparency and education. Organizations ought to explain how data is to be used, by whom, and so on. At Interac we believe digital services should operate with individual choice at the centre and empower users to choose which organizations can use, access or share their information with participating services.

The consumer position is rational and understandable. Canadians are expected to give up highly valuable information to connect and access services in the digital economy, but too often these transactions erode trust by being one-sided and lacking in transparency for the user about how their information will be stored, used or shared. It’s only reasonable for Canadians to expect clarity on how their data is used and what they’re agreeing to when they provide consent.

There’s a great deal of promise in the digital economy: a future of greater convenience, innovation and productivity. To ensure Canadians walk through the door, governments and businesses need to ensure they’re creating experiences that offer transparency and build trust.

What can Interac do for your organization?