In a world where consumer demands are always changing, Interac e-Transfer for Business is a fast, convenient, and secure tool to level up your payables and receivables. Whether you’re paying your suppliers, distributing tips, or requesting payment from your clients, Interac e-Transfer for Business helps you cut down on time and keep your finances in order, letting you focus on running your business your way.

While the experience is similar to Interac e-Transfer, you can also take advantage of advanced features such as higher send limits (up to $25,000), rich remittance data, real-time transactions, and account number routing. (Note that implementation of these will vary by financial institution and their account type.)

Interac e-Transfer for Business is available through most major financial institutions in Canada. See a list of participating financial institutions here and call yours to ask about availability, how to connect your account, and details on features available to you.

So you have Interac e-Transfer for Business…now what? Here are ways you can start sending and receiving money in real-time with immediate confirmation.

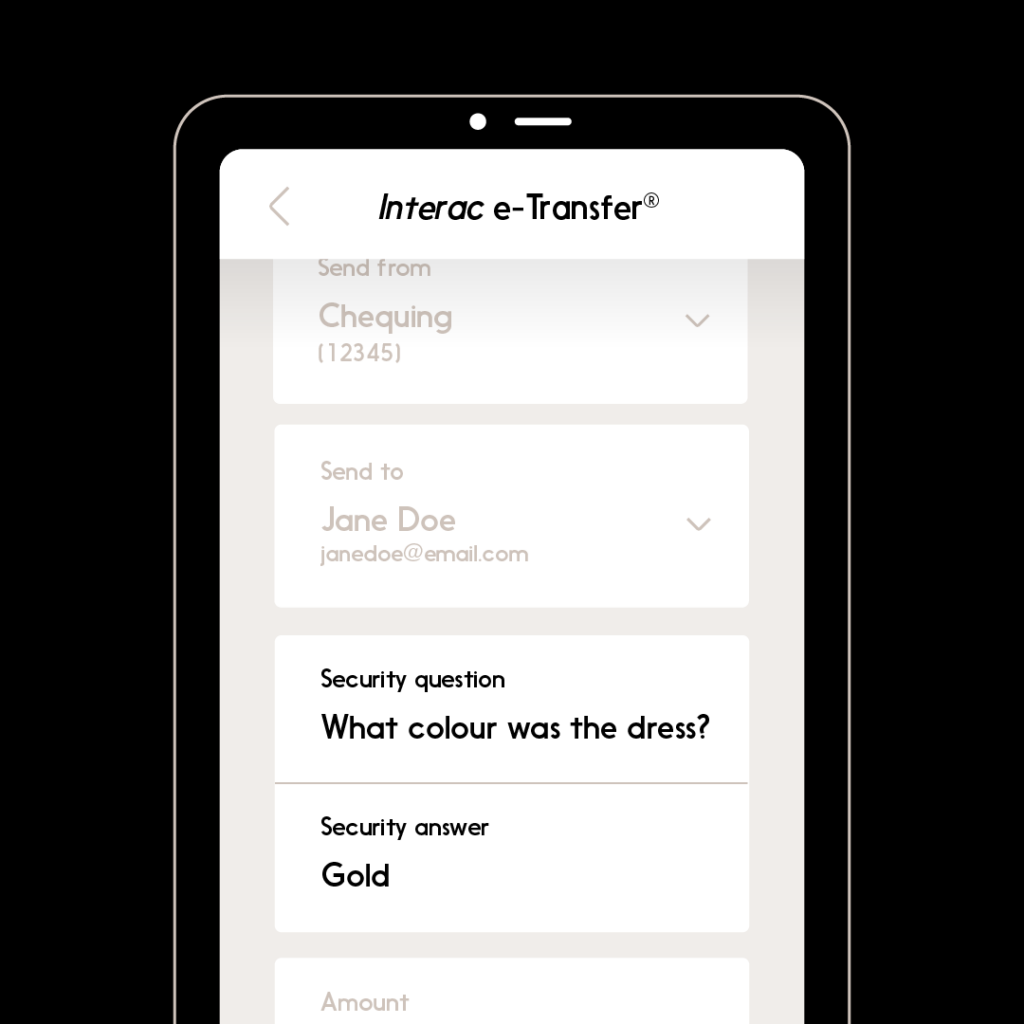

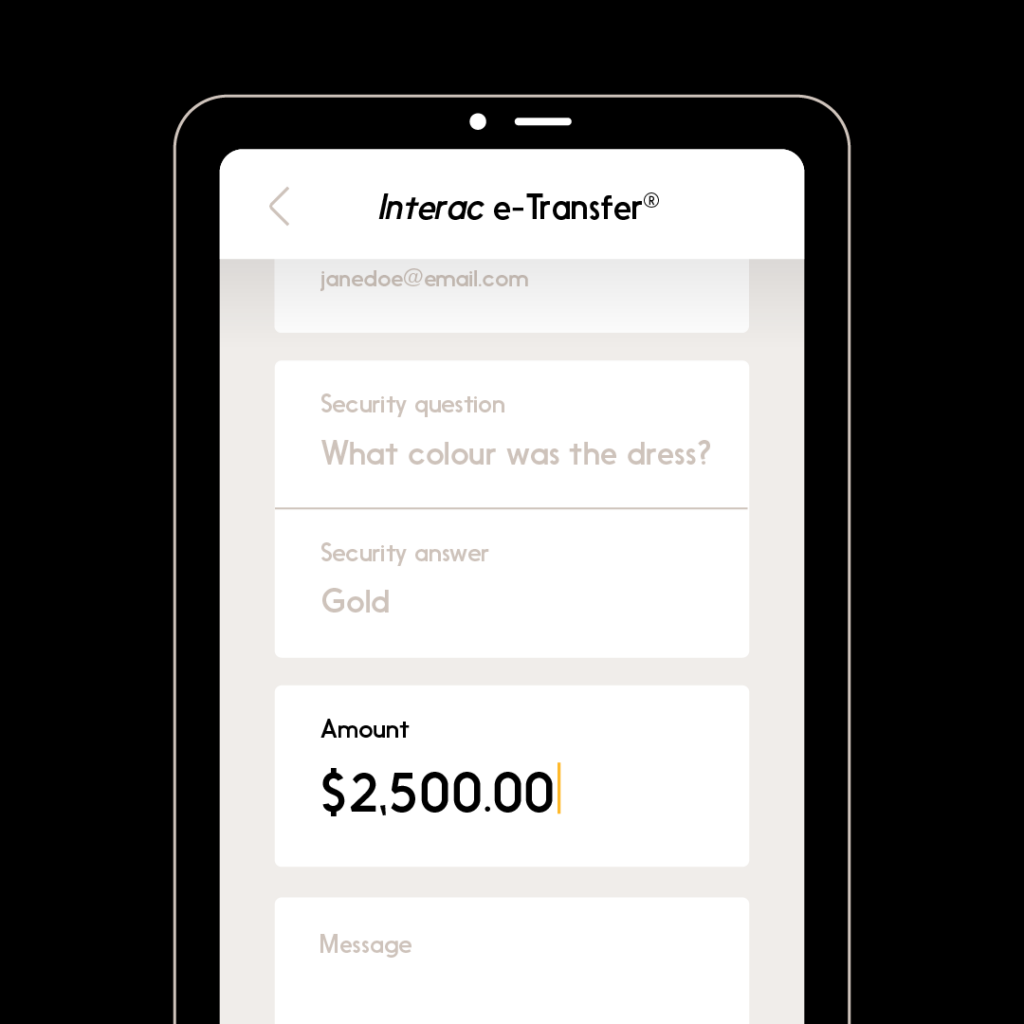

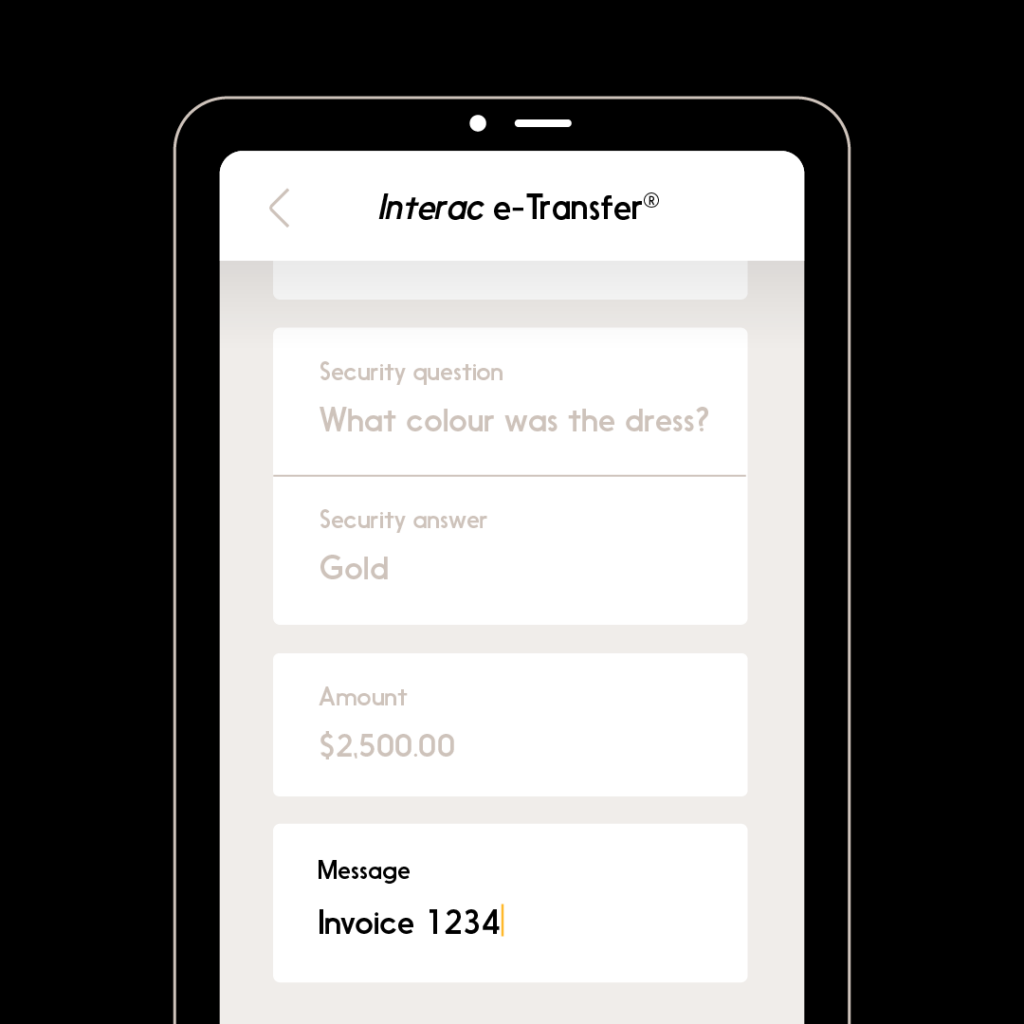

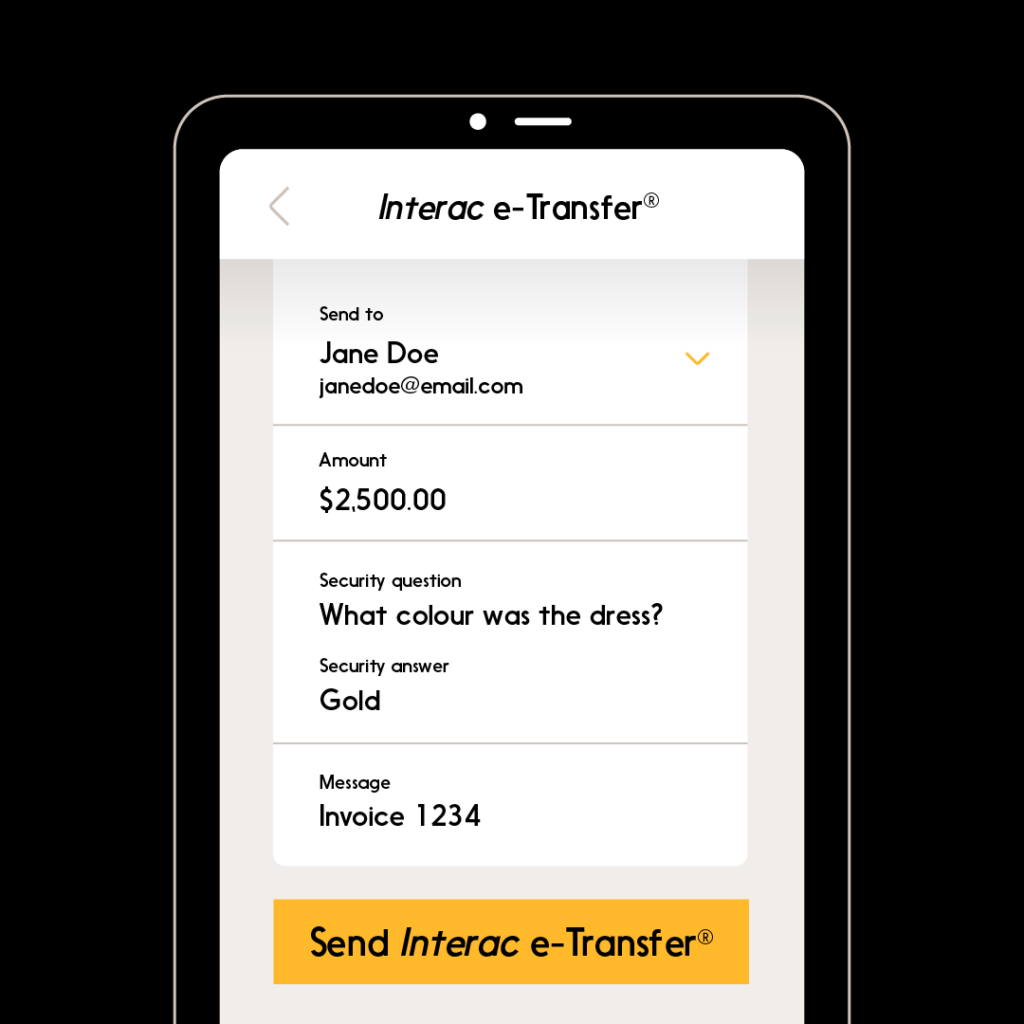

*Note that images and user screens displayed are for illustrative purposes only, appearance will differ based on the participating financial institution. Consult your financial institution for more information.

Before you start, you’ll need:

- A Canadian bank business account with Interac e-Transfer for Business enabled

- An email address, mobile telephone number, or account number

- Access to online banking through your financial institution

To Send Money with Interac e-Transfer for Business:

-

Sign in to your financial institution’s online banking service.

-

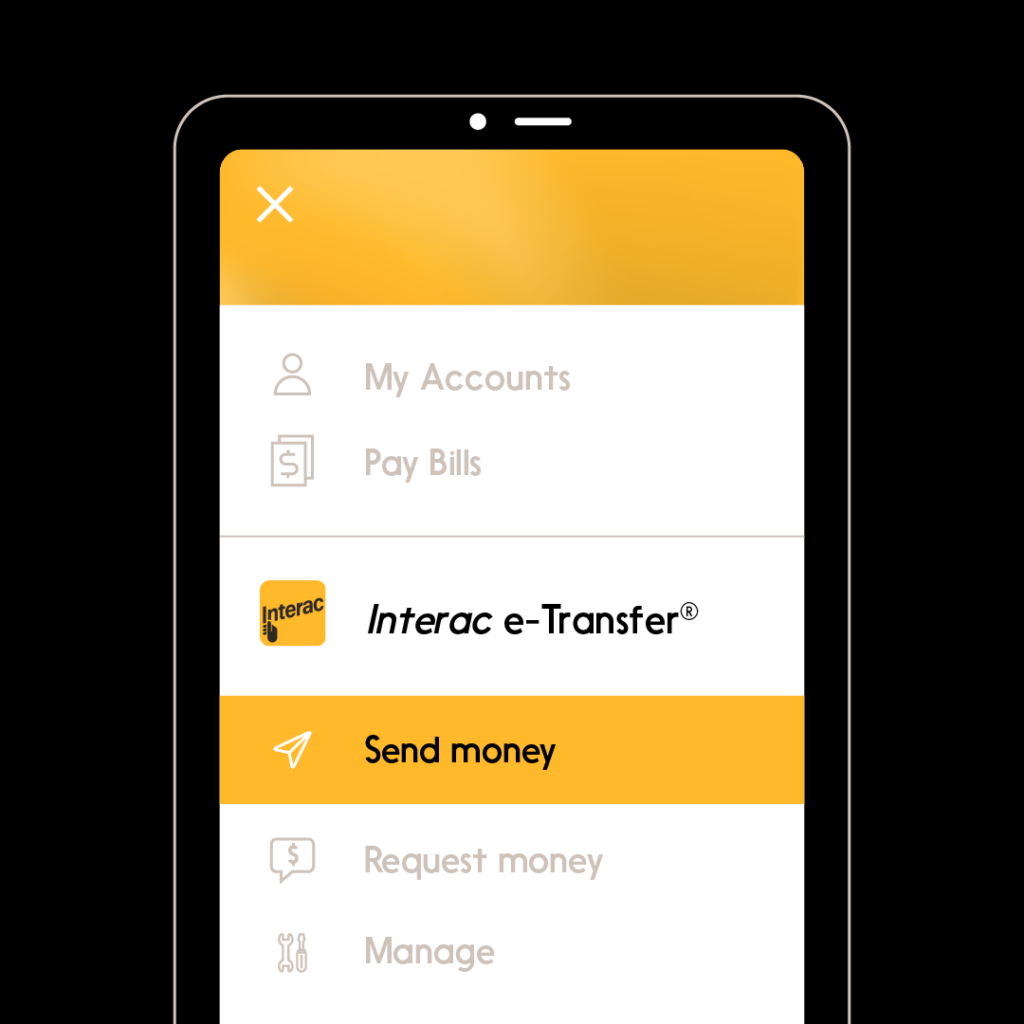

Navigate to the option to send money using Interac e-Transfer.

-

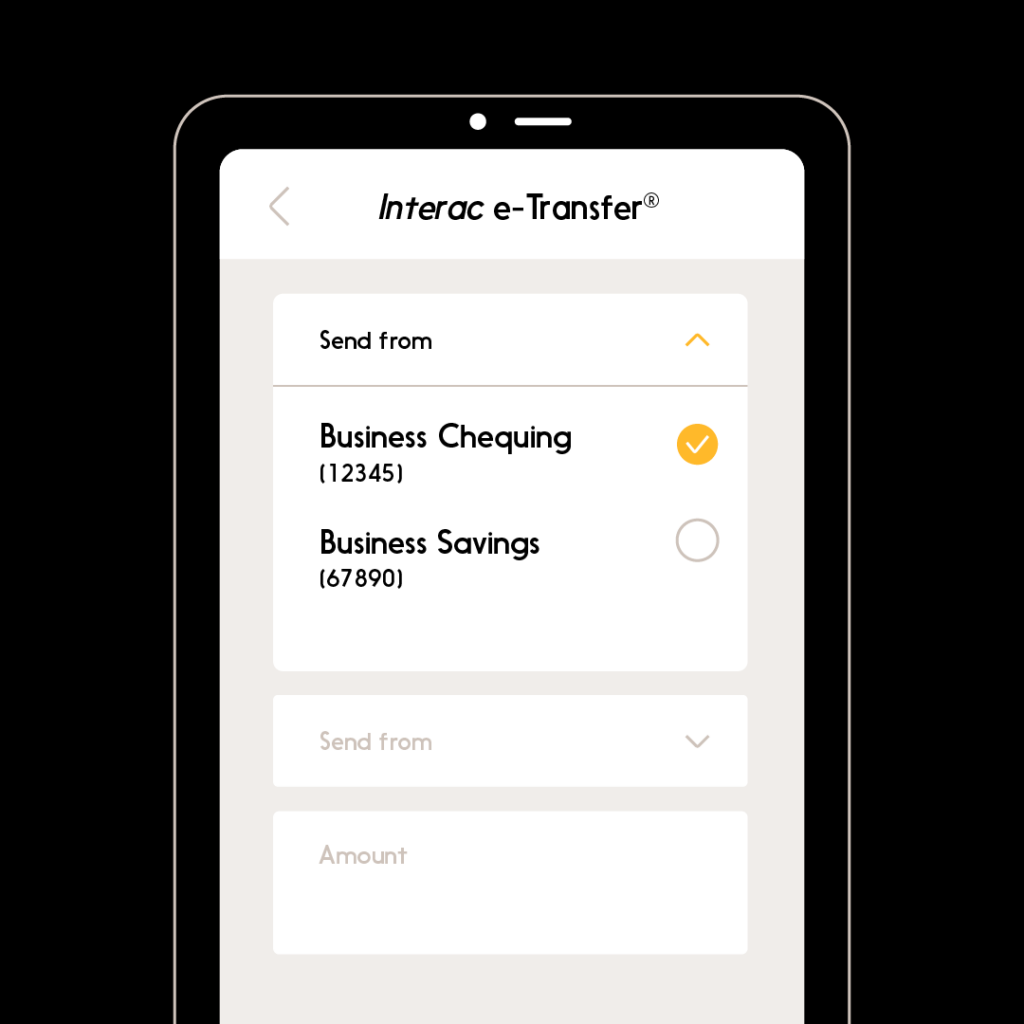

Select the account that you will be sending the funds from.

-

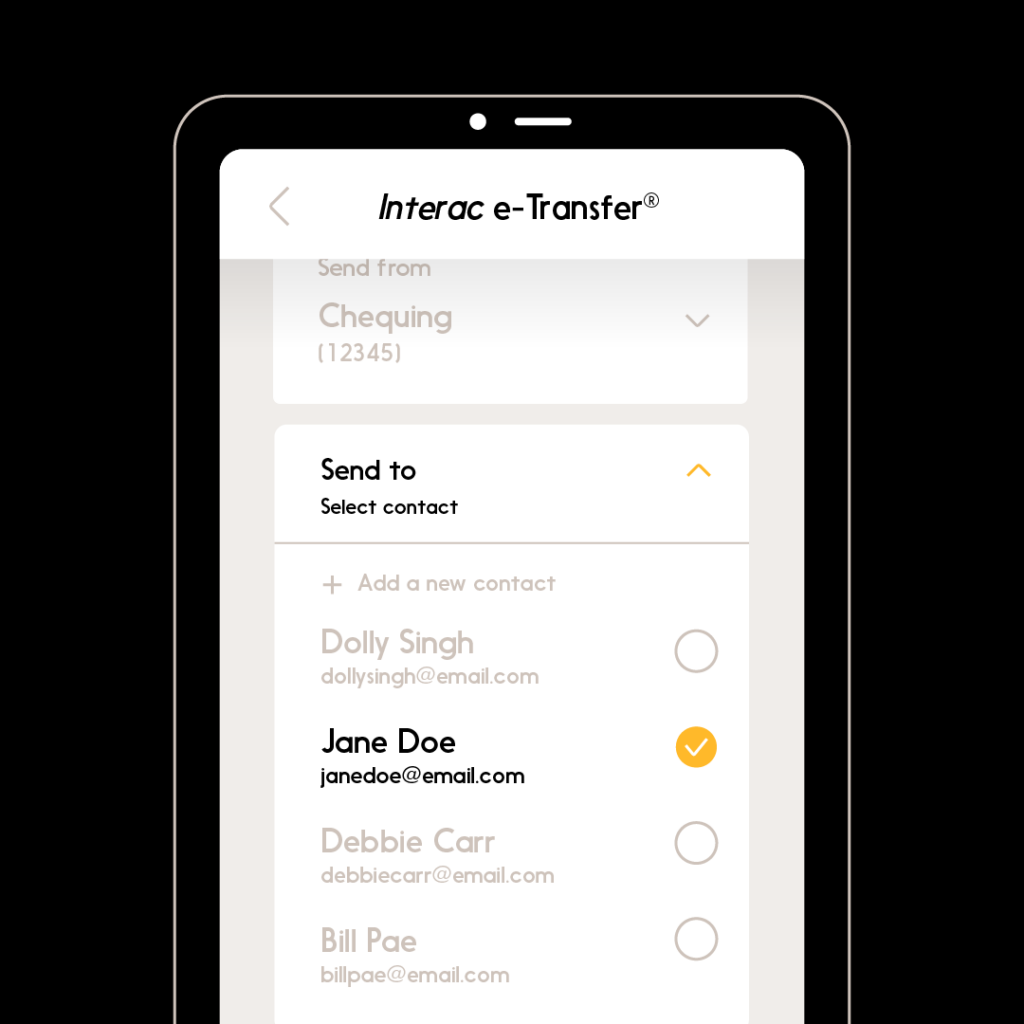

Choose the recipient. If the recipient has a Canadian bank account and is registered for Interac e-Transfer Autodeposit, you will see their full legal name.

If this is the first time you are sending them money, you’ll have to add them to your list of recipients using their name and either their email address, mobile phone number, or account number. Be sure to verify that these details are correct.

-

If the person receiving the money has a Canadian bank account but isn’t registered for the Autodeposit feature, you’ll have to set up a security question they will have to answer to complete the transaction.

Make sure the answer isn’t obvious and do not share it in the Interac e-Transfer memo field.

-

Enter the amount you wish to send.

Transaction limits are set by your financial institution but can go up to $25,000. Please contact your financial institution for more information.

-

Include an optional message or invoice number for both your records.

-

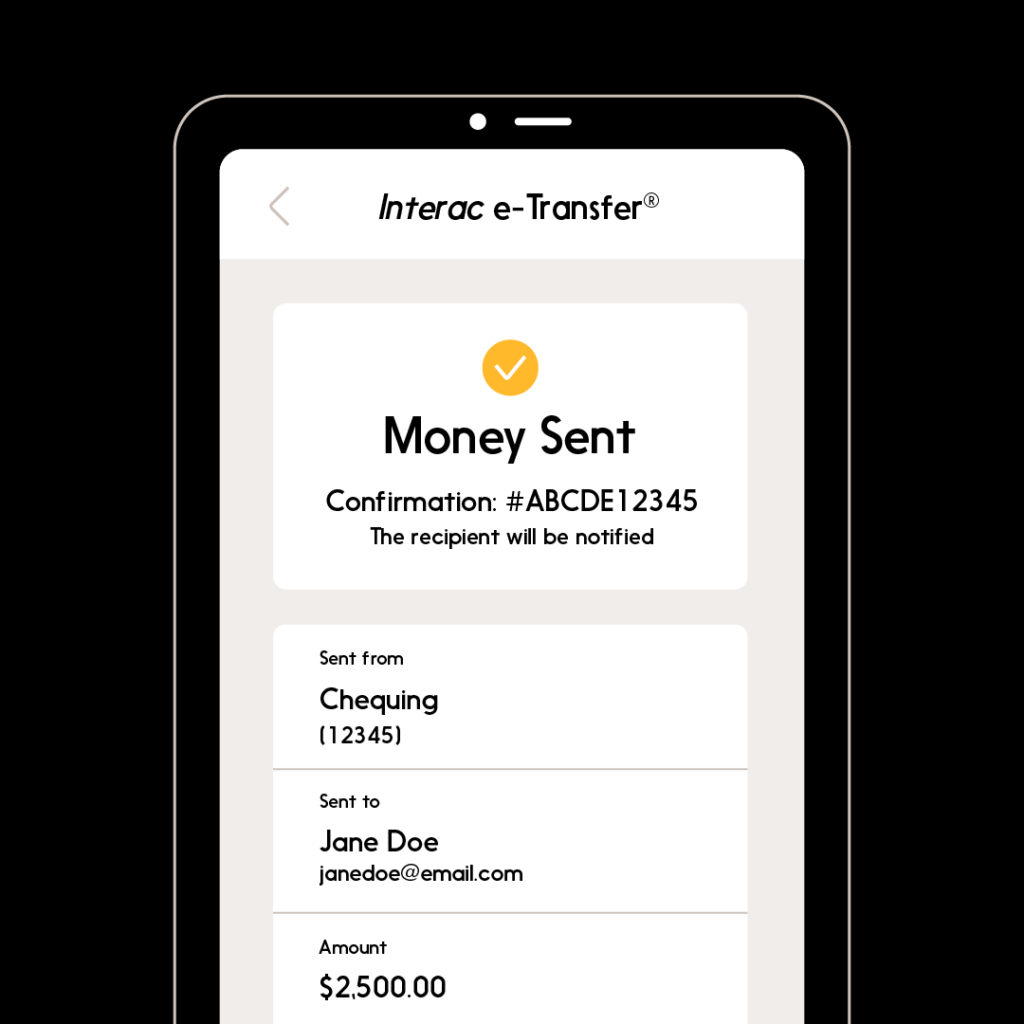

You’ll have a chance to confirm the details again before sending. Once confirmed, the money can be sent.

-

All parties involved (sender, recipient, financial institution) will receive real-time confirmation of payment completion, and transaction history will be available.

To Request Money with Interac e-Transfer for Business:

-

Sign in to your financial institution’s online banking service.

-

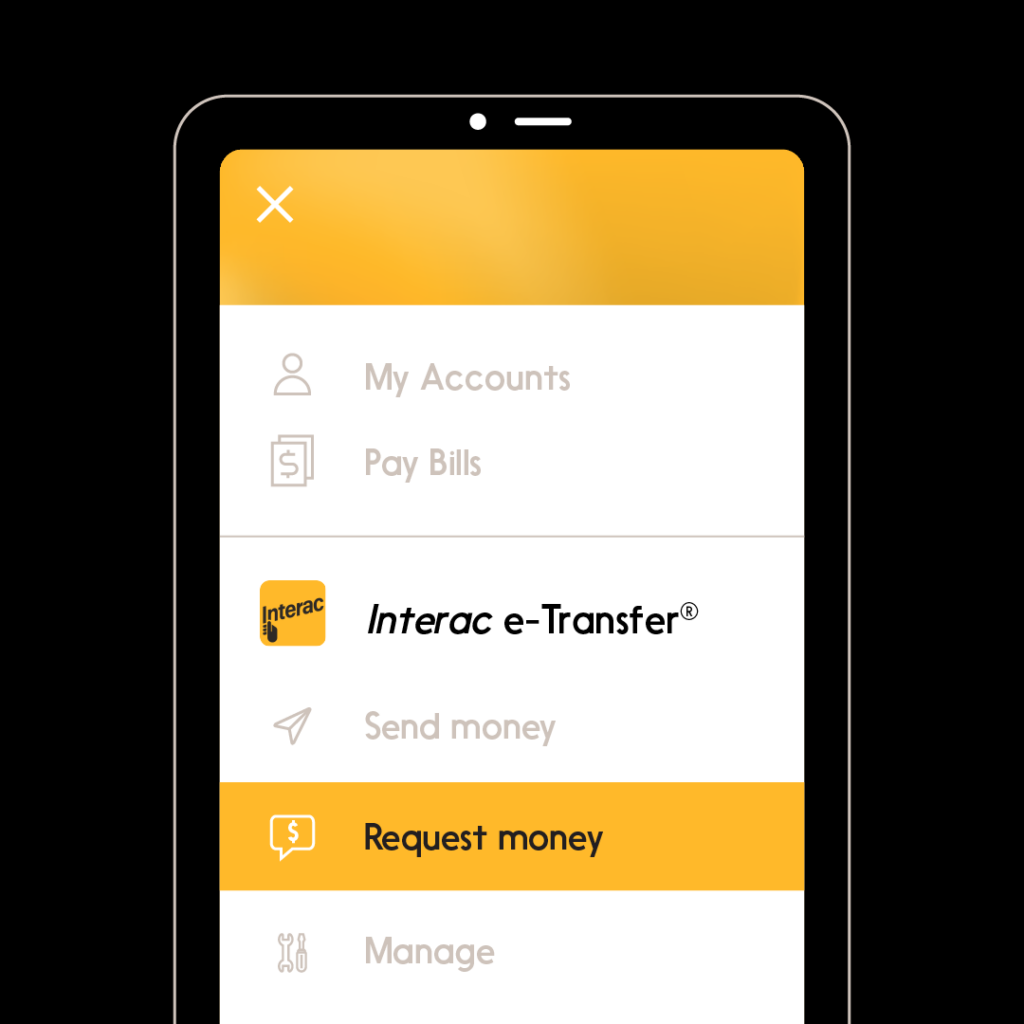

Navigate to the option to request money using Interac e-Transfer for Business.

-

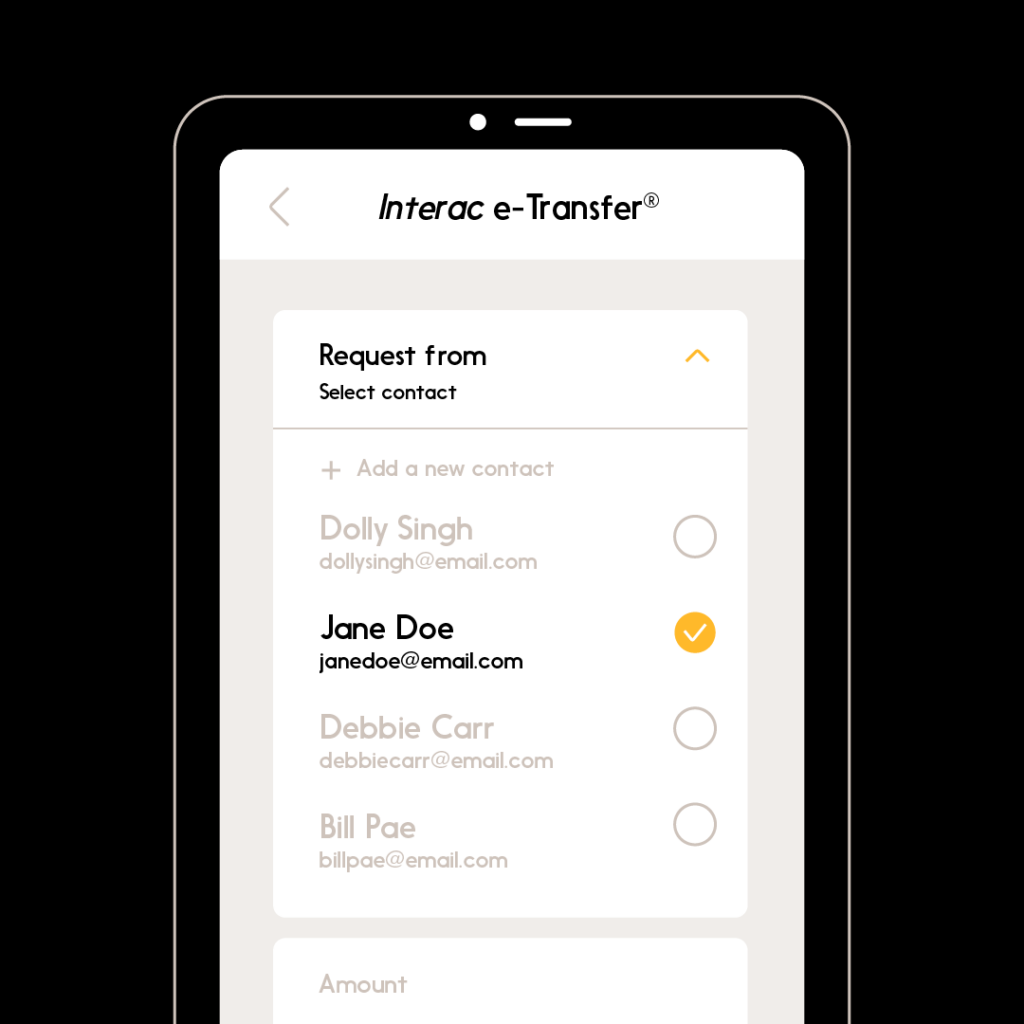

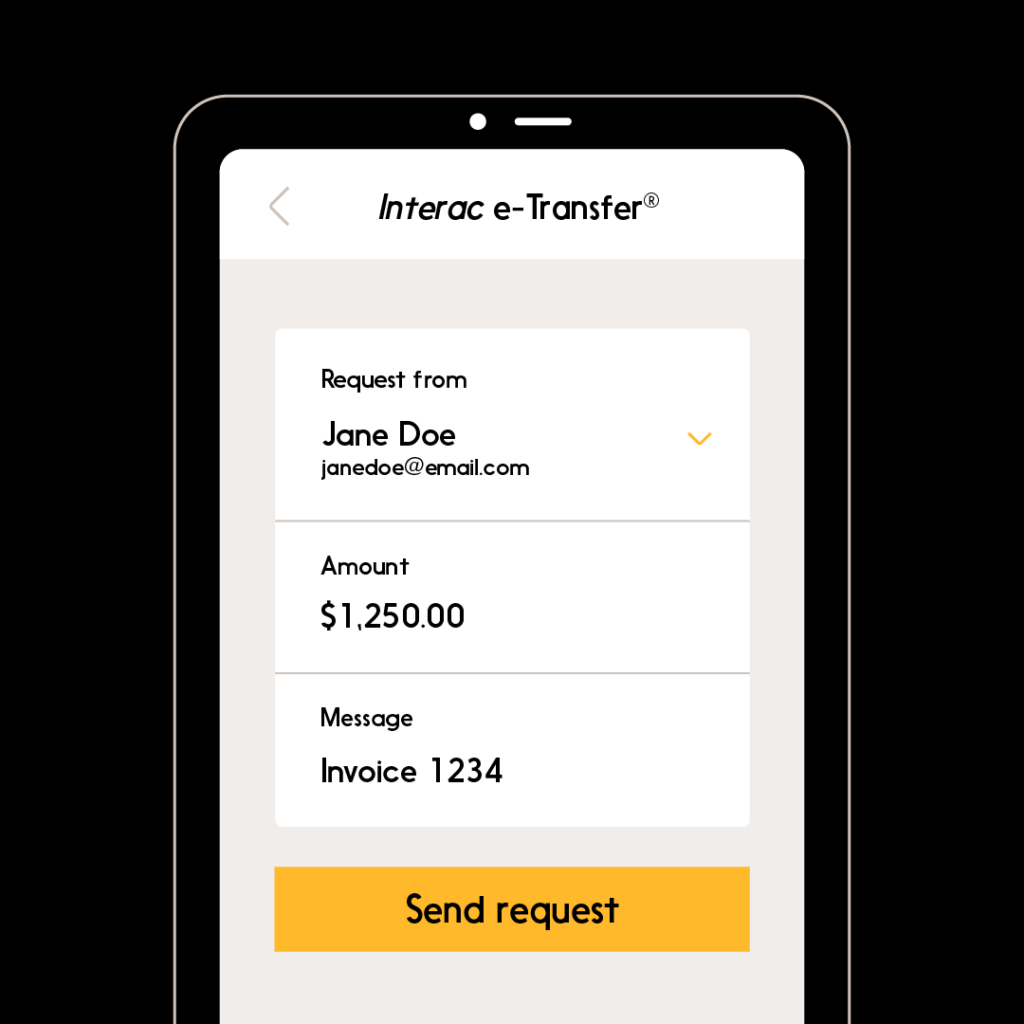

Choose the party you would like to request money from.

If this is the first time you are requesting money from them, you’ll have to add them to your list of contacts using their name, email address and/or mobile phone number. Be sure to verify that these details are correct.

-

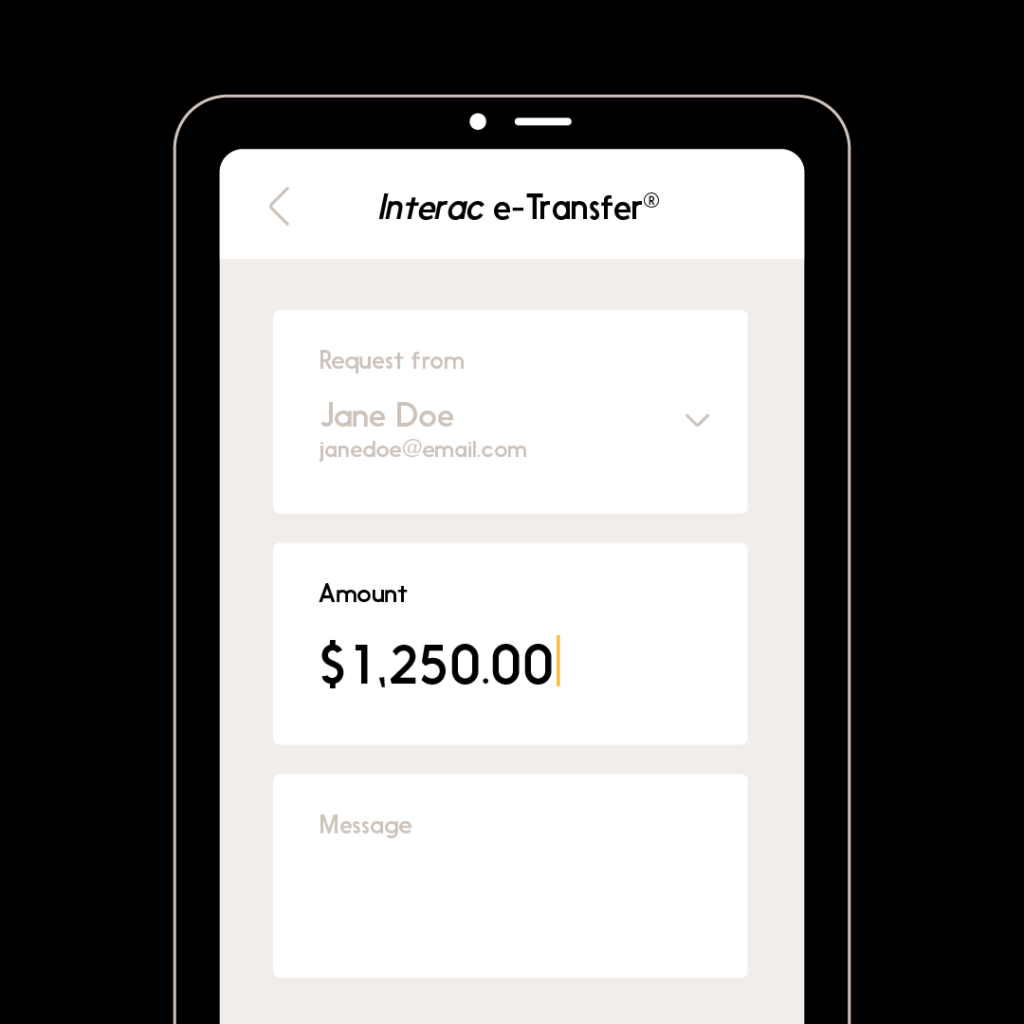

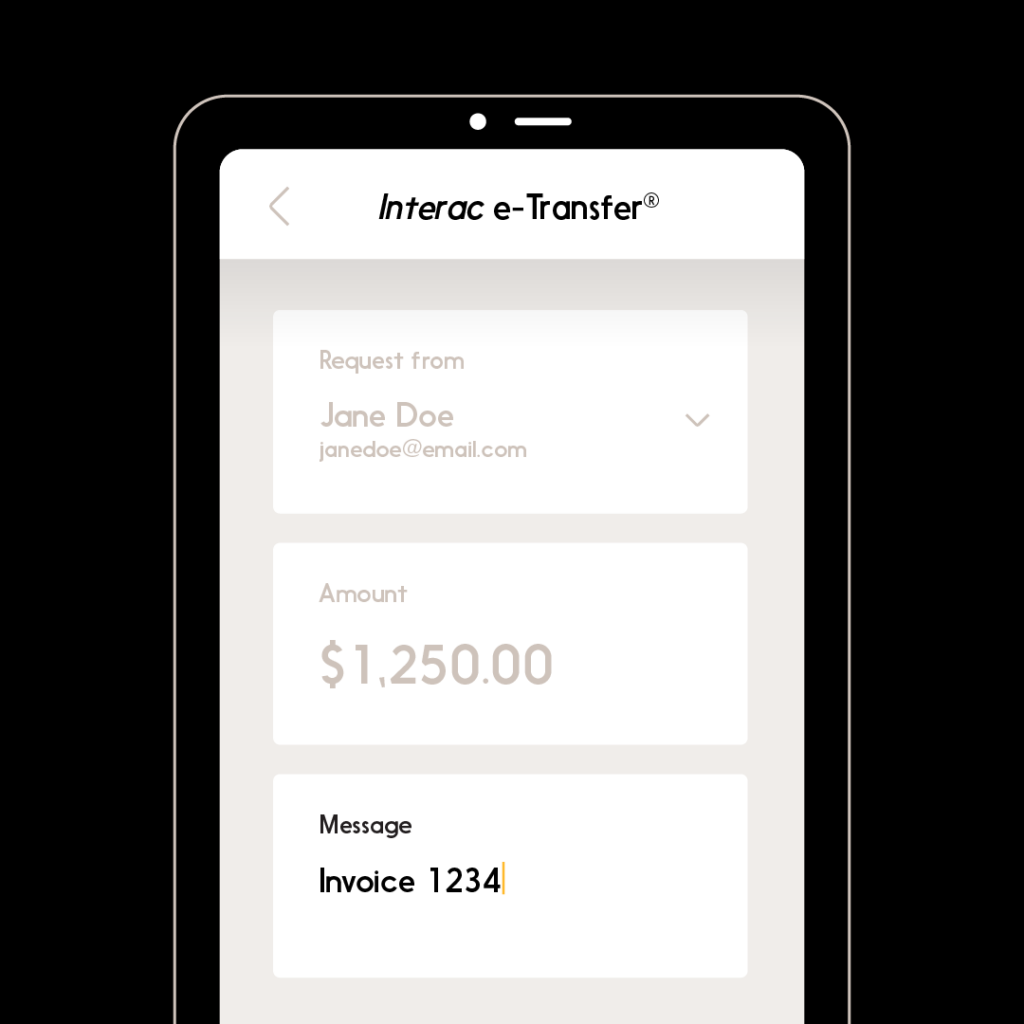

Enter the amount that you would like to request.

Sending limits will vary by financial institution and account type.

-

Enter an optional personal message or invoice number to include in the request.

-

You will have a chance to confirm the details. Then click on the “send request” button and the money request will be sent.

-

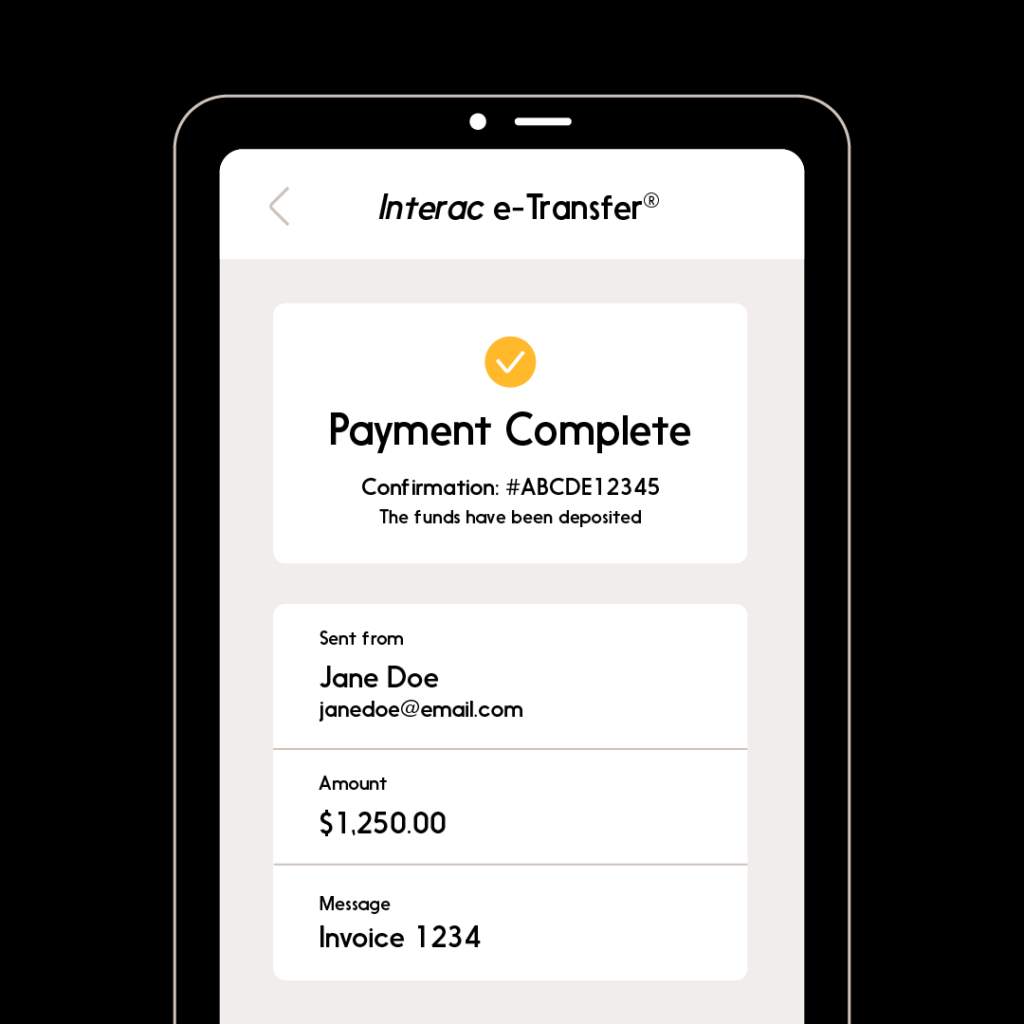

Once the recipient of the request approves payment, all parties involved (requester, sender, and financial institution) will receive real-time confirmation of payment completion. Funds will be available in the requester’s account, and transaction history will be available.

To learn more about how Interac e-Transfer for Business can help your business thrive, click here.