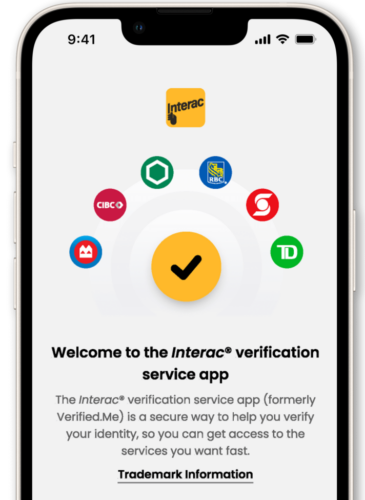

Verified.Me is now Interac® verification service. For you, nothing changes. You can continue to rely on the same secure verification service that you’ve used for many years. Learn more

Interac®

verification service

Interac verification service provides Canadians with the option to use existing login credentials with a participating financial institution1 for secure digital verification of their data to get faster and more convenient access to participating services that require personal data confirmation.

How it works

- Look for the Interac verification service option when verifying your identity online and follow the registration steps.

- Select your financial institution when prompted and log in using your banking credentials.

- You will be asked to review and accept the terms before choosing what information you’d like to share.

- Each request will always ask for your consent and will disclose what personal details are being asked for.

- The information is shared with the service provider privately and securely.

Privacy and Encryption

Keep your credentials protected

Interac verification service does not save or have access to the credentials you use to log in to your financial institution.

Easy & convenient user experience

You have the option to verify your data digitally using your existing login credentials with a participating Canadian financial institution. This option is simple, secure, quick, and reduces the need for you to visit physical locations to verify your data in-person.

Network participants

Use your existing banking credentials with one of the participating financial institutions below to log in to the Interac verification service.

Securely verify your identity with the following organizations

Concilia

Costco

Dynacare

Equifax

First Canadian Title Company

Government of Canada

Niagara Health System

RBC Direct Investing

Southlake Regional Health Centre

Sun Life Financial

TD Precious Metals

Support

What is the Interac verification service?

The Interac verification service helps you verify your identity quickly and securely from your computer or mobile device. The service allows you to access digital services by establishing a connection with your financial institution using your existing login information. You will be asked for your consent before any personal information is share.

Why use the Interac verification service?

Using Interac verification service allows you to quickly verify your identity in a convenient, secure and private way without the need to verify in-person. You use the personal information that you have already consented to and provided to your financial institution to verify your identity.

Which financial institutions can be used to log in or access Interac verification service?

The Interac verification service currently supports customers with an active and eligible online account with various Canadian banks and credit unions, including:

- BMO

- CIBC

- Desjardins

- RBC

- Scotiabank

- TD Canada Trust

Don’t see a preferred bank or credit union listed above? Stay tuned – we are continuously working on adding more participants to the Interac verification service network.

Does it cost me anything?

No, the Interac verification service is available for eligible users in Canada free of charge. You do not have to pay to use the Interac verification service.

What is required for setting up my Interac verification service account and what information do I need?

You must have an active and eligible online bank account with one of the participating financial institutions to enrol in and use the Interac verification service. Please reach out to the participating financial institution with which you want to create your account to learn what is required to create an Interac verification service account with them.

Looking for assistance with Interac e-Transfer? Click here.

Report a problem with Interac verification service

Contact Us

If you still need assistance, contact us 24/7 at: 1-844-778-5409

TTY Service: 1-855-224-1714

1. For a list of participating banks or credit unions that can be used to log in or access the Interac verification service, click here.