University is a transformative time for many people. Whether it involves moving cities, making new friends or being responsible for your own finances (maybe for the first time), there’s more to it than just studying. For Caitlin Da Silva, studying marketing and economics at the University of Toronto brought her much more than a degree. Between classes, she started a popular YouTube channel called Caitlin’s Corner.

Fast forward a couple of years, and her channel now has over 238K subscribers and is her full-time career post-graduation. Here she talks about how she built her business, some of the money lessons she learnt as a student and how Interac was there for both big financial milestones and day-to-day budgeting.

Managing money as a student

The costs associated with attending university can sometimes be overwhelming. Juggling expenses like school supplies, tuition and general living costs is a skill that can take time to master. On top of these regular purchases, Caitlin also had to think about business payments including equipment and stationery supplies to buy for her growing YouTube channel.

“I remember struggling with knowing how much things were worth, even for simple things like grapes. Using Interac Debit was one of the things that helped me understand my own spending habits,” she says. It also helped her to really think about each purchase. “Using my own money means I’m more intentional with how I’m spending. I only spend with a purpose and I’m also intentional about when I set money aside for a rainy day.”

It turns out this is a common trend. A recent Interac study found that 57 per cent of Gen Z adults and 52 per cent of Millennials reported that using debit makes them less likely to buy things they don’t need.

Making a career out of a side hustle

Starting your own business is no easy task, especially when you’re young and still studying at university. For Caitlin it all started as an avenue to talk about the books she was reading, but it quickly evolved into something else. Her desire to connect with people over shared interests led her to expand into creating videos and blogs on many different topics like productivity, budgeting, self-care, planning, and bullet journaling.

However, one thing she learned very early in her journey as a content creator is that you can’t please everyone — especially online. “It reinforced to me the importance of being myself, doing what feels right and being okay with putting myself out into the world,” she says.

Budgeting like a boss

Through her videos Caitlin is a big advocate of self-care and staying on top of your well-being, which includes financial well-being. Some of her techniques for doing this include tracking spending every 2-3 days, creating a budget, and getting excited about saving.

Whether she’s exploring Toronto with friends or buying stationery supplies for her bullet journaling videos, she is always checking her digital transactions. Every few days she lists out each expense (either in Excel or as a bullet list), so she notices if she’s overspending in a certain area. She’s not alone in this behaviour, either.

The same Interac study showed that, like Caitlin, half of Gen Z and Millennials use digital payments to keep track of their spending in real time — stopping themselves from going over their personal budgets.

An empowering moment leads to more confidence

Getting in control of your finances is often a series of smaller wins over time. And one of Caitlin’s most memorable wins came with a big milestone. After she graduated and her roommate moved out the apartment they shared, she still remembers the first time she had to make a full rent payment by herself using Interac e-Transfer. For her, it felt like another big step towards independence.

“I remember being a little sick to my stomach and also feeling really empowered” she says. “New chapters like these always come with a lot of fear and excitement, but ultimately I just remember thinking, okay, first one down. I got this!”

“Using Interac e-Transfer was a natural choice because it’s so convenient, easy and secure. For something as significant as my rent, I wanted to know for sure it was going where it’s supposed to go,” she adds.

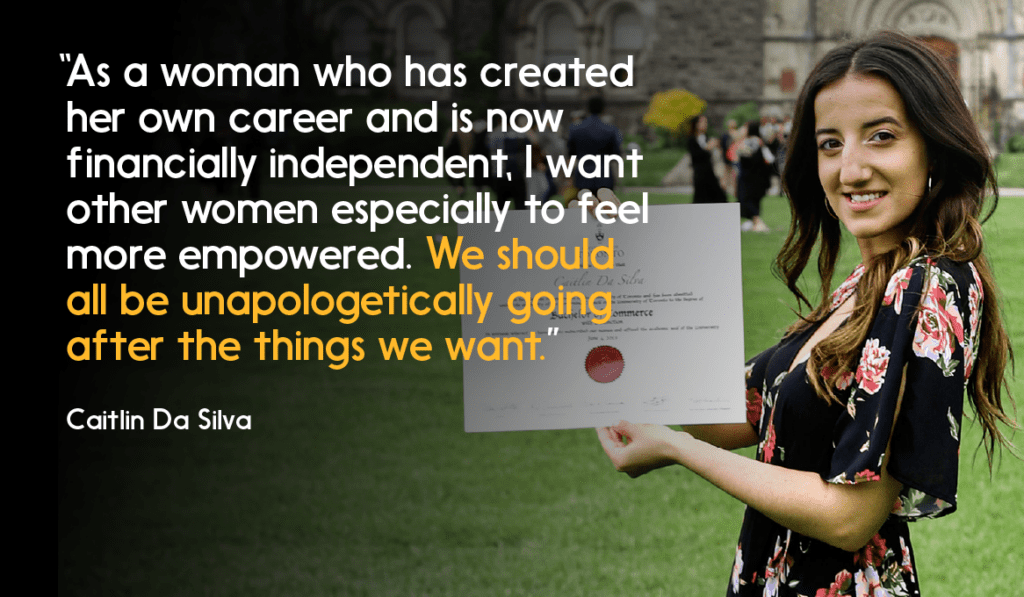

What’s next?

It’s no doubt that Caitlin’s POV resonates with her audience, so her future as a content creator is looking bright. Her big picture goal, though? As an avid reader, she’d love to write a book one day. Maybe one that can serve as an inspiration to others. “As a woman who has created her own career and is now financially independent, I want other women especially to feel more empowered. We should all be unapologetically going after the things we want,” she says. And a solid foundation for chasing your dreams can be to first make sure your budget is under control.

“When I started working for myself, it wasn’t as stable as a salaried job. So I started thinking about how I could make sure I’d be ok whether I have income or loans or whatever it is, and how can I mitigate all my risks. With COVID, it put me into that saving mindset more than ever before. It reinforced how important it is to think of my future self and look for opportunities to save. I’ve never loved my emergency fund, more than I did during the pandemic.”

Using products like Interac e-Transfer alongside Interac Debit can help you manage money, get faster payments, and make life easier overall.

Small businesses like Caitlin’s also benefit from products such as Interac e-Transfer for Business — as a new tool in their payments toolkit to help automate payment processing and much more. Discover how Interac e-Transfer can help you with your financial independence.