Improving convenience and reducing fraud for Canadian gaming customers

According to a recent global survey, more than one in four prospective customers have abandoned a registration process with an online gaming site.

Introduction

In Canada, lotteries and gaming have evolved over the past few decades from a relatively minor — if enjoyable — source of weekly televised entertainment, to a major industry employing thousands of people and providing more than $9 billion per year in revenues to provincial governments. In 2017, Canadians spent $17.1 billion1 on government sponsored games of chance and related services (e.g. food and accommodation), this volume being but a subset of the worldwide gambling market, which is predicted to reach annual revenues of USD$565 billion by the end of 20222.

Given the scale and scope of this industry, it is no surprise that fraudsters have been attracted to it, and that the question of how to secure the identity of customers has become an urgent one — indeed, online gaming in particular suffers from the risk of account takeovers and a range of frauds enabled by registrations created on behalf of “synthetic” identities. Yet efforts to prevent fraud have brought their own costs, as requirements to show or transmit physical pieces of identification add significant delays and inconvenience to the registration process. According to a recent global survey, more than one in four prospective customers have abandoned a registration process with an online gaming site3. Fortunately, digital ID has the potential to significantly alleviate both of these problems. In this white paper, we’ll explain how.

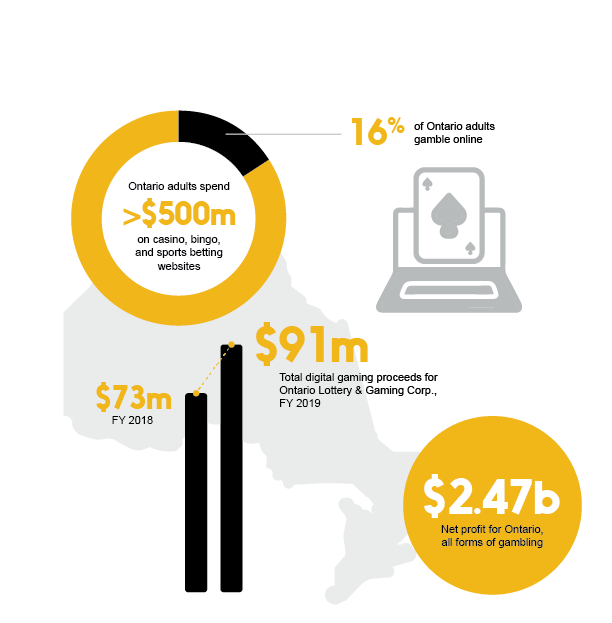

How much are we spending?

Canadians spend a great deal of money on the gaming industry in both its “brick and mortar” and online forms, and many of these transactions require a form of identification to be presented. As Ontario’s own statistics indicate, it is clear that digital ID’s impact in making all of these transactions more secure and convenient will be a significant one.

How digital ID helps

Lottery corporations & gaming companies

- Digital ID reduces identity fraud by eliminating error-prone manual authentication processes, reducing chargebacks and other expenses and losses stemming from such activity.

- Digital ID improves customer satisfaction. Gaming companies can provide a faster onboarding process while reassuring customers their identities (and accounts) are safe.

- Digital ID reduces risk, making sure that applicable user age and residency regulations are adhered to. It also gives governments that own or sponsor gaming activities an improved ability to encourage responsible gambling behaviours — for example by providing robust “self-exclusion” options.

Users

- Digital ID improves privacy and security, ensuring that a customer’s personal identification information cannot be copied in transit or seen by unauthorized parties.

- Digital ID offers greater convenience. Customers have to fill in significantly fewer registration fields during onboarding, and no longer have to scan or otherwise send copies of their identification documents.

- Digital ID enhances the experience of winning by allowing gaming companies to offer fast deposit of payouts through services like Interac e-Transfer.

Using digital ID: a walkthrough

Step 1: Account initiation

A customer arrives at a lottery website and decides to create an account. The registration form offers an option to fill it in manually or via his digital wallet. He chooses the latter.

Step 2: Authentication

The site presents him with a QR code, which he scans with his digital wallet. The wallet then prompts him to perform a facial verification check to confirm his identity.

Step 3: Share digital identity

This done, the wallet asks him to consent to the sharing of his personal information with the lottery corporation. He agrees, and his digital identity (e.g. driver’s license) is used to populate the site’s registration fields.

Step 4: Account creation

Since the customer’s information is now verified, he reviews and confirms his registration and his account is immediately created.

How does facial verification work?

Facial verification seeks to confirm a customer’s identity visually, whereby a person’s facial details are captured and compared against another image of the same person’s face to provide a high level of certainty. A “liveness check” (the user may be asked to turn their head back and forth) may also be required to ensure that it’s a real person.

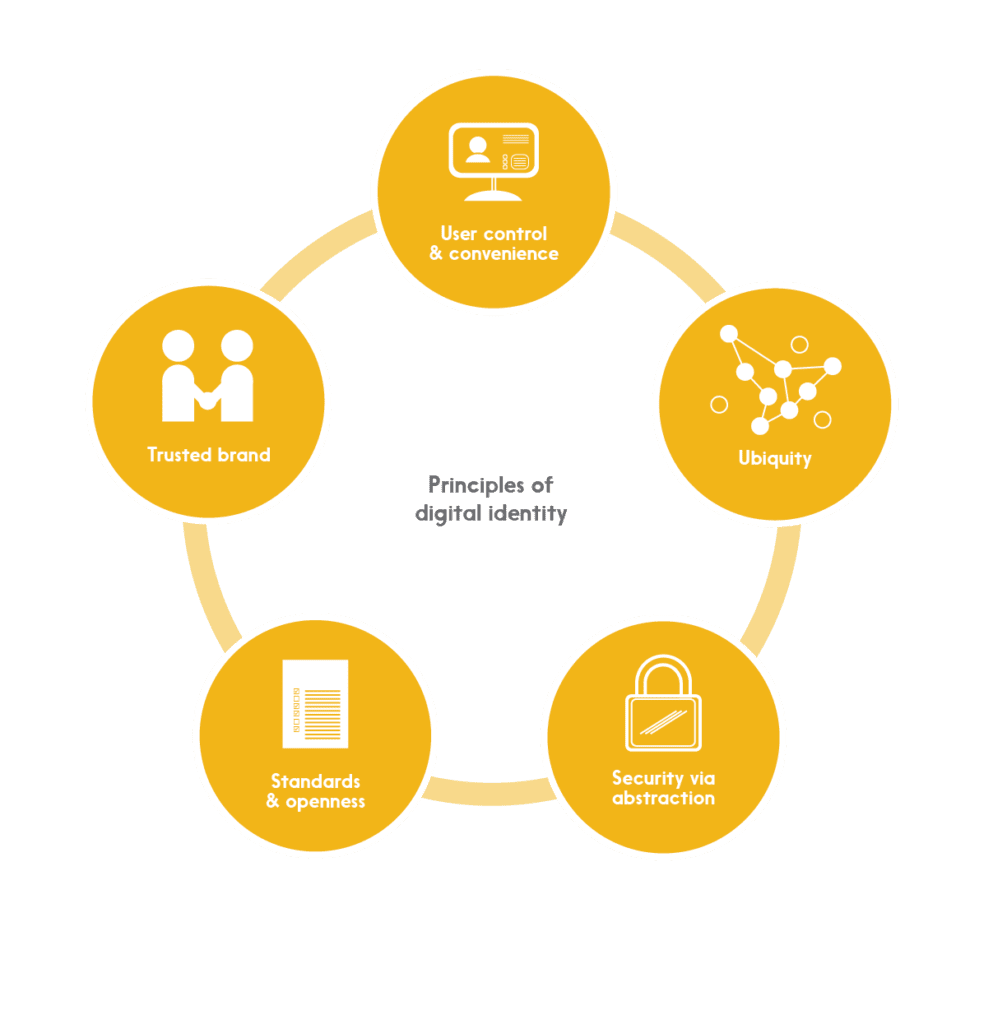

Our principles

Digital identity is easy to theorize about, but architecting and implementing a comprehensive, secure, and sustainable system is another matter entirely – and an important part of getting it right is having a clearly articulated set of principles to guide the effort. We believe that there are five:

User control & convenience

No one wants to entrust a system with their personal details if those details are going to be transferred to and stored by numerous parties – especially if this happens without the user’s knowledge and express consent. While ensuring user control, an identity system must also be convenient and easy; if it isn’t, it won’t be adopted by users, many of whom are already used to intuitive apps on mobile devices.

Standards & openness

In any dynamic system, it’s difficult to predict what the future will look like – so it’s important to build today’s solutions on universally-agreed standards. Not only does this reduce costs by eliminating the expense of building and then later having to adapt custom, one-off solutions, but it enables solutions built by others in the future to “plug into” the initial solution. Openness encourages adoption, innovation, and flexibility.

Ubiquity

Security risks abound when people create different identities and passwords for each public and private service they access. They’ll often default to a single, easy-to-remember (and easy to crack) password, for example. At the same time, a digital identity that only applies to a handful of services will probably not be well-adopted. A ubiquitous system is a more convenient and a more secure system.

Trusted brand

No user is likely to adopt an identity solution built or maintained by an organization they don’t trust. The question of identity is simply too important, and the impact of identity theft too great, to leave this to chance. Further, building a large-scale (and ubiquitous) solution will require the cooperation and coordination of many players, and these players need to trust each other and the organization leading the effort.

Security via abstraction

Even with the best user controls, a certain amount of identity data must be part of transactions in any given ecosystem. A highly effective way of securing that data is to “abstract” it, by replacing a private identifier with a publicly-available one (like a person’s email address) or by replacing it with a randomized number that serves as an authorized “token” for the purposes of the transaction – and is not useful for any other purpose.

Conclusion

Digital ID has the potential to make registrations and transactions in a wide range of industries more efficient and more secure, as well as to improve both customer experiences and customer retention. These benefits are readily available to a range of sectors, including lottery and gaming as well as alcohol and cannabis. Canadians are frequent users of lottery and gaming services, and deserve the highest levels of security and convenience that the industry can provide them. Their governments — who depend on this sector for the essential revenues it generates — will benefit too, as digital ID enables faster onboarding, reduced fraud, and happier (and more frequent) customers.

If you’re interested in collaborating with Interac on the future of Digital ID, drop us a line at digitalid@interac.ca

Canadians are frequent users of lottery and gaming services, and deserve the highest levels of security and convenience that the industry can provide.

1 National Economic Benefits of the Canadian Gaming Industry, Canadian Gaming Association (2017 figures)

2 The Growing Gambling Industry: Forecasts, Technologies, and Trends, The Business Research Company (Feb 2020)

3 Account Opening in the Online Gaming Industry, Jumio