Money has evolved from shells to coins to bank deposits. Today, deposits and bank notes issued by the Bank of Canada make up the vast majority of money in Canada’s economy. In 2008, the Bitcoin whitepaper set out the technical principles underlying the world’s first peer-to-peer electronic currency, kicking off the development of so-called “cryptocurrencies.” At the same time, increased use of digital payment methods (accelerated by the pandemic) spurred the declining use of cash and the acceleration of today’s finance transformation.

Central banks now find themselves pulled into the fray, compelled to maintain control of monetary systems spawning new alternatives, yet aware of potential harm to financial institutions and consumers if intervention goes wrong. Facebook’s 2019 announcement of plans for a new digital currency, Libra, increased central bank concerns about the impact all of this might have—if scaled up to critical mass through the reach of big tech—on the role and responsibilities of financial institutions, and of themselves. “Central bank digital currencies”, or CBDCs, are now on the table as a possible response, with research projects and pilots emerging in China and around the world.

In a recent paper, the Bank for International Settlements (BIS) defined a CBDC as “a digital payment instrument, denominated in the national unit of account, that is a direct liability of the central bank.” Both “wholesale” (customers access CBDCs via financial institutions) and “retail” (customers access CBDCs directly with the central bank) delivery mechanisms have been considered by policymakers, but the retail version is the one most often discussed publicly.

Payments modernization and the rise of new forms of money

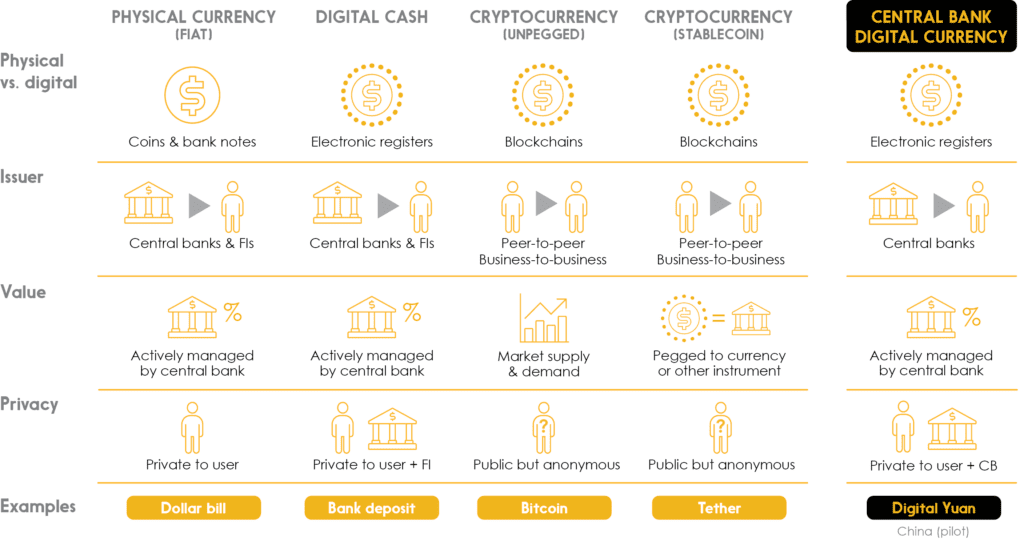

With payments modernization on the rise, new forms of money are taking shape. Like any new technology, these new forms of money aren’t immediately and comprehensively replacing older forms — but instead function alongside them in the economy as alternatives with attributes that differentiate them. A few examples include their physical or digital nature, who issued them, how their value is determined, and the level of transaction privacy they may offer. Here is a comparative look at the four primary categories of money currently in use, and how CBDCs may compare with them.

While some observers point to risks that may impact financial institutions and their customers, proponents of CBDC have identified opportunities which they think justify further exploration of the concept.

CBDC principles

Central banks have well-defined mandates, and in light of these, the BIS has proposed a set of “foundational principles” that should guide the development and implementation of CBDCs.

- Do no harm to wider policy objectives: CBDCs should continue supporting public policy objectives and should not impede a central bank’s ability to carry out its stability mandate.

- Ensure co-existence and complementarity of public and private forms of money: Different types of central bank money should coexist in a wider payment processing ecosystem, including commercial bank accounts.

- Promote innovation and efficiency: Innovation and competition must be allowed to enhance payment systems, to avoid user migration to less safe instruments.

CBDCs as pieces in the “new money” puzzle

For all the buzz around CBDCs, many financial services players find themselves asking whether CBDCs may be a problem in search of a solution, particularly in light of the various mechanisms and initiatives already aiming at the same opportunities that CBDCs have been proposed to address. Given the complexity of modern financial and monetary systems, the possibility of unintended consequences must also be considered.

Central banks, of course, cannot ignore ongoing declines in the use of physical cash, nor the potential ramifications of a Big Tech-led boom in cryptocurrency usage if no competing alternative has been offered. Yet in developing such an alternative, a crucial balance needs to be struck between the need for societal protection and the principle of privacy. Another important issue that central banks ought not to ignore is that of equality of access to payment processing mechanisms.

With potential implications for a wide variety of stakeholders—financial institutions, consumers, governments, businesses, payment processors, and central banks themselves—CBDCs are only one of several pieces in the “new money” puzzle, which includes unpegged cryptocurrencies, stablecoins, and decentralized finance (DeFi) itself.

Ready to look into the future of digital currencies?