At Interac we enjoy an excellent vantage point to observe shifts and changes in the payments landscape, thanks to our deep connections to consumers, merchants, financial institutions and payments processors — as well as data generated by the 19 million transactions we handle each day. Since the first half of 2020, we’ve been using our front-row seat to share data and insights about the transformative effect the pandemic is having on consumer behaviour and Canada’s increasingly digital economy.

Now, Payments Canada provides fresh confirmation of our overall observations in its recent Canadian Payment Methods and Trends Report. Some key highlights: Nearly four in five (79 per cent) of all payment transactions are now electronic. Contactless payments grew at a brisk pace in 2020: 13 per cent growth in volume, 10 per cent in the total value of transactions. And debit accounts for the majority of contactless transactions (62 per cent).

Overall, Payments Canada’s findings are in line with our observation that the payments landscape is in a state of rapid evolution: “Changes in consumer and business behaviour in response to the pandemic accelerated a shift to e-commerce, digital payments and the reduction of cash usage around the world,” the report says. “That, in turn, spurred disruption and adoption of alternative payment options.”

The annual Payment Methods and Trends Report gives leaders in Canadian business, fintech and payments an annual look at how businesses and individuals across the country are choosing to make payments. The 2020 report looks back on a year of accelerated change on account of the COVID-19 pandemic — as well as forward to a more fully digital payments landscape.

Its findings validate the acceleration of a number of the trends and shifts toward a digital economy that many of us have noted since early in the pandemic. Here, we share a few additional insights in more detail.

Consumer behaviour: More digital and contactless payments

Overall, Canadians are using contactless and digital payments more often, and concerns over viral transmission are helping to drive the shift. In a related development, consumers are also making more online purchases, as Interac has also been reporting since mid-2020.

What was once a novelty is rapidly becoming an expectation. Our research shows that fast, convenient digital payments have become a critical consideration when Canadians make shopping decisions.

Businesses embrace e-commerce in response

Payments Canada reports businesses are transforming themselves by embracing e-commerce sales platforms. Indeed, it’s now imperative for them to do so, given nine out of 10 Canadian consumers made an online purchase in the past year (according to the Payments Canada report), spending $56 billion altogether (up 20 per cent from 2019).

At Interac we’re helping Canadian enterprise — including small and medium-sized businesses — meet consumers’ growing omnichannel payments expectations. The Payments Canada report confirms that many have been taking advantage of our online offerings.

“Interac has partnered with more online retailers to include Interac Online Debit as a payment option” Payments Canada writes. “Interac Online transaction volume increased over 70 per cent from 2019, with 30 per cent of Canadians indicating that they’ve used Interac online services more frequently since the onset of COVID-19.”

Canadian payments are going (even more) paperless

As more payments move over into the digital realm, fewer transactions involve old-fashioned paper. When it comes to cheques, for example, Payments Canada reports a staggering 28 per cent decrease in volume and 12 per cent decrease in value in 2020.

The overall decline in cash and paper-based transactions predated the pandemic by a number of years, of course, but Payments Canada reports that COVID-19 has accelerated the trend.

Gen Z, over-55s and the digital economy

The Payments Canada report affirms the continuing importance of debit as a payment method for Canadians of all ages. Contactless debit payments continue to grow and replace cash at the point of sale.

With a penetration of 97 per cent (according to the report), nearly all Canadians have a debit card, and 57 per cent of them report using it at least once in the previous week.

As for why they choose debit, the top answers given were: Paying with debit is fast (46 per cent agreed), the buyer is able to use their own funds (as opposed to borrowing — again, 46 per cent agreed), and debit is widely accepted (42 per cent).

All of the above holds especially true for Generation Z consumers, according to Payments Canada. “Those aged 18-24 [have] the highest propensity to use debit. This indicates a preference for using their own funds, or a lack of access to credit for this age group,” the report says.

As we noted in our e-commerce position paper earlier this year, many of those young consumers are using e-wallets, rather than physical cards, to pay with debit — underscoring the point above about the imperative on businesses to adapt and follow consumers as they adapt to digital payments.

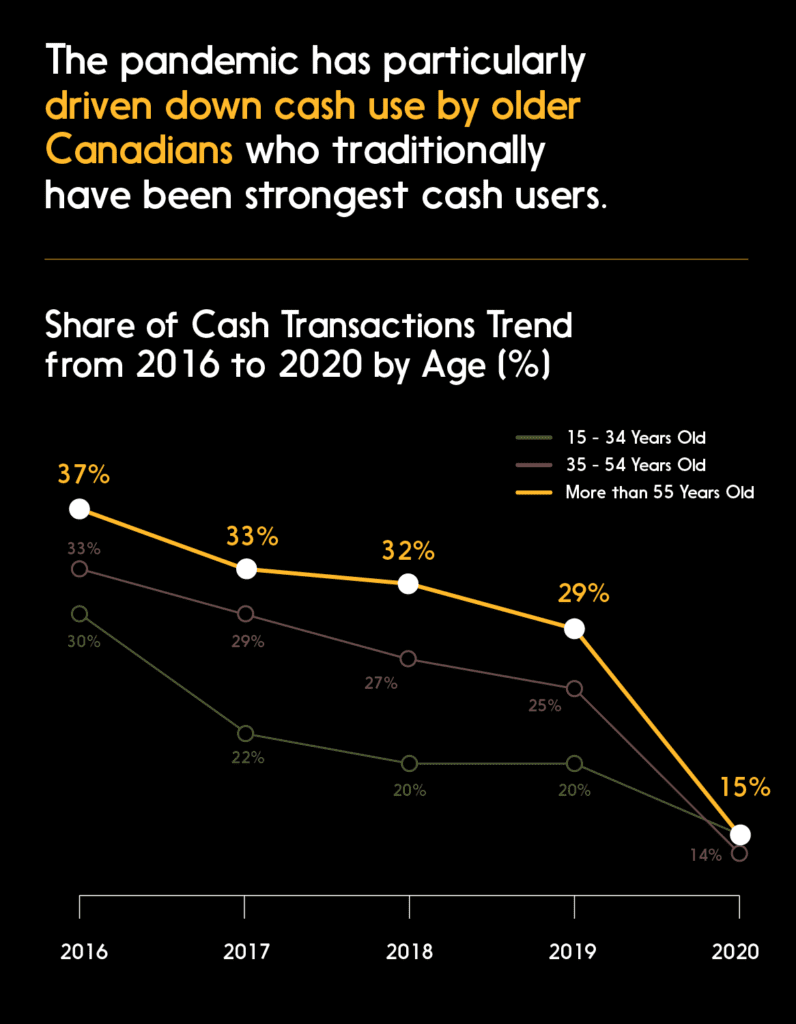

Yet people over a certain age aren’t set in their ways. Interac data shows older Canadians rapidly adopting aspects of “younger” consumer behaviour. When it comes to payment choices, they do eventually catch up.

One noteworthy example relates to the decline of cash. During the pandemic, the over-55 group have changed their habits more than younger cohorts. That’s an insight from a recent Interac Payments Diary report.

Looking ahead

Other broad trends to watch include the decline of cash (will trend continue as the pandemic subsides?), the potential for an official digital currency, and the growth of alternatives to cards (smart watches, for example). At Interac we’ll continue to use our vantage point to gather information and keep our fellow stakeholders in the know — for the greater good and further development of Canada’s digital economy.