Interac e-Transfer is best known for allowing Canadians to send each other money quickly and easily.

But it’s so much more than that.

Interac e-Transfer also helps give businesses the flexibility they need in a competitive environment, where technology and consumer demands are always changing.

Some large enterprises in Canada are using Interac e-Transfer (including Interac e-Transfer for Business features) for a lot of the same reasons consumers are: It’s a safe, fast, and easy-to-use money transfer tool that more and more businesses are using to streamline their payments.

Interac e-Transfer simply makes things easier.

More than that, in many ways Interac e-Transfer offers a level playing field to businesses of all sizes. Small- to medium-sized companies can take advantage of the features and capabilities of Interac e-Transfer to compete in a rapidly evolving, increasingly digital economy.

What Interac e-Transfer empowers you to do as a business owner

Questions this section will answer:

- Can you accept customer payments with Interac e-Transfer?

- Can you pay vendors with Interac e-Transfer?

- Can you pay employees and bills with Interac e-Transfer?

- What is Interac e-Transfer for Business?

You’re probably already familiar with Interac e-Transfer: It’s a safe, fast and convenient money transfer service that many Canadians use in their daily lives, accessing it through their online banking services to send money directly from their bank accounts.

But you can also use Interac e-Transfer as a powerful payment tool for small- to medium-sized businesses, and it can complement your existing accounting processes.

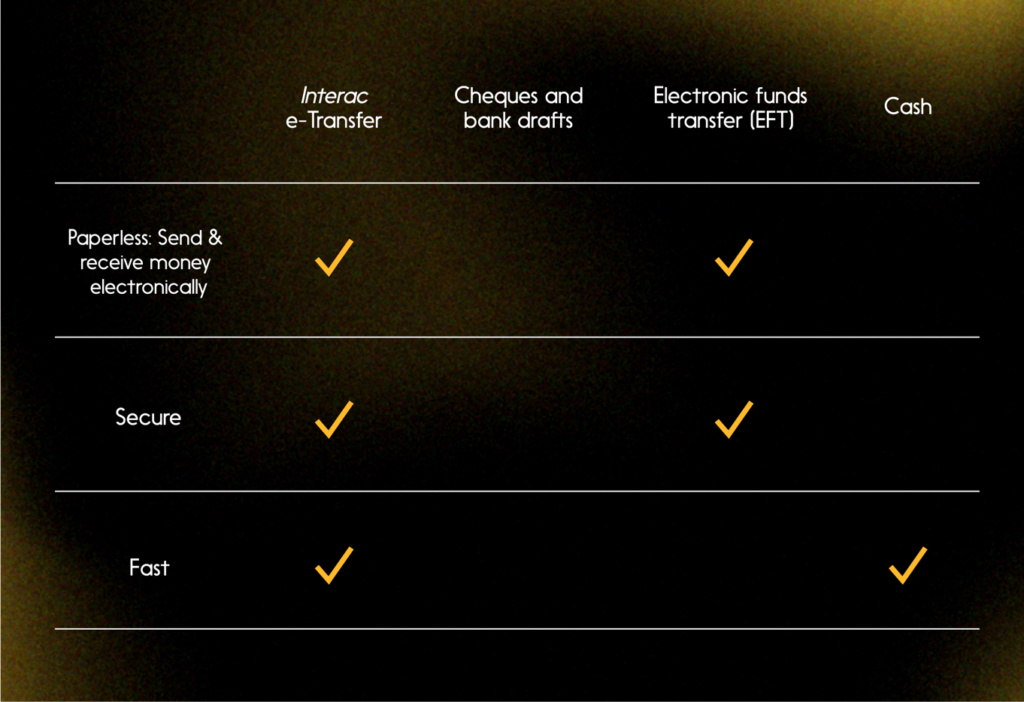

Why should your business adopt Interac e-Transfer over traditional payment methods like cash, cheques and electronic funds transfers (EFTs)? Because they’re often cumbersome, time-consuming and slow — they may not be optimal for the pace of your business.

With Interac e-Transfer you get the speed and convenience of a future-ready payment solution. Use it for:

Customer payments

If you run a consumer-facing business, you can accept Interac e-Transfer as a form of payment from your customers. Millions of Canadians already use Interac e-Transfer, and almost half (47 per cent) of Interac e-Transfer users have used it to pay a small business.

Tip: Enable the Interac e-Transfer Autodeposit feature and you won’t have to co-ordinate individual security questions and answers for each customer that’s paying you.

Business-to-business payments

You can use Interac e-Transfer to pay vendors and suppliers within Canada. With Interac e-Transfer there’s no need for signatures, as with cheques, and no more fussing around with paper invoices and waiting for the payment to clear (which can take several days in the case of cheques and EFTs).

The Interac e-Transfer Request Money feature can take the place of a traditional paper invoice. As a bonus, it lets you take the clunkiness out of billing — which is often an issue for smaller and startup businesses.

Paying employees

Whether it’s for regular pay, tips, or expenses, your employees will appreciate the speed and simplicity of having their funds directly deposited into their bank accounts.

And for larger transactions and business-to-business payments, there’s Interac e-Transfer for Business. Keep reading to learn more about Interac e-Transfer for Business in the next section.

Three reasons to use Interac e-Transfer over cash

- Cash is costly to count and handle

- Cash is more susceptible to being lost or stolen

- Cash continues its growth momentum yet remains lower than pre-pandemic levels

How Interac e-Transfer and Interac e-Transfer for Business work

Questions this section will answer:

- How does Interac e-Transfer work as a business tool?

- What is Interac e-Transfer for Business?

- What are the key features/benefits of Interac e-Transfer for Business?

Using Interac e-Transfer is easy for a business to use (just as it is for consumers) and the service is available through many financial institutions in Canada. (Learn more here about how to use Interac e-Transfer.)

And if your small- to medium-sized business could use an additional, robust set of features — like higher transaction limits — that’s where Interac e-Transfer for Business can help.

Interac e-Transfer for Business: Launched in 2021, Interac e-Transfer for Business gives you features designed around the needs of 21st-century business, including higher transaction limits and payment in real time.

It gives you transaction limits of up to $25,000 (these are set by your financial institution — they can tell you more about what your banking package includes).

No banking information for the payee? No problem. With Interac e-Transfer for Business, you can send and receive payments using just an email address or SMS number to identify the payee. Or you can use the recipient’s account information if you have it.

And it all happens fast: recipients of a real-time Interac e-Transfer for Business transaction will receive a confirmation that funds are available in their account within seconds.

What are the key features of Interac e-Transfer for Business?

- Real-time money transfers

- Send & receive funds whenever, wherever in Canada

- Transaction limits up to $25,000*

- Designate a payee using email, SMS, or account/banking info

* Transaction limits are set by your financial institution

How to get started using Interac e-Transfer for your business transactions

Questions this section will answer:

- Is Interac e-Transfer for Business available through my bank?

- How do I start using Interac e-Transfer for Business?

If you’re just starting out (or running a small side business), Interac e-Transfer is an easy way to accept customer and client payments within Canada. Many organizations already accept Interac e-Transfer as a form of payment. You may be able to join them through your current financial institution— and if you’re already familiar with Interac e-Transfer, there’s really no learning curve.

As your business grows, so will your needs. When you’re ready for Interac e-Transfer for Business, it’s ready for you: It’s available through most major financial institutions in Canada. (See the list of participating financial institutions here.) Log in to your business banking online service and look for the tools for transferring funds.

To learn more about how to use Interac e-Transfer for your business needs, contact your financial institution.

Recap: The benefits of doing business with Interac e-Transfer

Questions this section will answer:

- Why should I use Interac e-Transfer for Business?

- How long does it take to complete an Interac e-Transfer transaction?

- What is a cheap/low-cost way to send money/make B2B payments?

Interac e-Transfer levels the playing field by giving even small businesses and entrepreneurs access to technology that streamlines payment operations.

Fast

Interac e-Transfer is also one of the fastest ways to send money. Transactions typically take minutes — or even seconds. Compare that to an EFT, which can take several business days.

Convenient

Interac e-Transfer is one of the most convenient ways for a business to send money: Think of how much easier it is to handle a payment through a mobile app versus writing a cheque and sending it in the mail. And think of the time and resource savings of reducing your reliance on cash.

Secure

As well as being convenient, Interac e-Transfer is backed by bank-grade security. You can learn more about our security benefits for business further down on this page, and read about the security features of Interac e-Transfer for Business here.

Looking ahead: What else can Interac e-Transfer help you do?

Questions this section will answer:

- What are some other ways to use Interac e-Transfer/Interac e-Transfer for Business?

- How do I use ISO 20022/data-rich payments with Interac e-Transfer?

- How do I stop using cheques at my business?

Interac e-Transfer is scalable: You’ll discover more uses for Interac e-Transfer as your business grows. Here are some more features and capabilities that can help fuel your growing business:

Bulk payments: Imagine you’re using Interac e-Transfer to pay contingent employees, vendors and suppliers. Your number of accounts and payments keep expanding, and you’re seeking a larger-scale solution. Enter Interac e-Transfer Bulk Payables. These are Interac e-Transfer services that make it easy to send funds to a large number of payees.

And for receiving payments from multiple customers or clients, there’s Interac e-Transfer Bulk Receivables. Here, you can learn more about the bulk services of Interac e-Transfer and check to see which ones your financial institution offers.

Want to stop using cheques at your business? Use Interac e-Transfer to:

- Pay employees

- Pay vendors, suppliers and landlords

- Use the Request Money feature instead of sending invoices

Streamlining accounting and adopting a paperless office strategy: Interac e-Transfer is a tool that businesses of any size can use to streamline and modernize the way they handle payments. Yes, that means you can also use Interac e-Transfer for Business to move beyond cheques.

In the bigger picture, Interac e-Transfer for Business is a vehicle for modernizing the way you handle business transactions, thanks to its capability of delivering rich-data payments. This can help you bring in some efficiencies to your processes. By digitizing your payments receivable, for example, you can simplify reconciliation — freeing up labour hours that can be re-dedicated to other important tasks.

Not only that, you can capture information like shipping addresses and invoice numbers in tandem with the payment itself.

So, why wait? With Interac e-Transfer, you can level up your payments so there’s no more paper holding you up — and holding your business back.

Security that’s ready for business

Questions this section will answer:

- Is Interac e-Transfer for Business safe/secure

- Is Interac e-Transfer secure enough for business?

- What are the security measures of Interac e-Transfer for Business?

Interac e-Transfer is a secure money transfer service. And by reducing your business’s reliance on cheques and other physical forms of payment, it can help you reduce counterfeit risk and prevent fraud.

Here are some other important security features to know about Interac e-Transfer/Interac e-Transfer for Business:

Bank-grade security: You access Interac e-Transfer and Interac e-Transfer for Business through your financial institution, which means it’s secured by the robust set of security measures that protect your commercial business banking platform. These could include multi-factor authentications and secure passwords.

Flexible routing: The flexible routing-based feature of Interac e-Transfer for Business adds another layer of security by allowing you to send money directly using a recipient’s account details. This allows you to route funds straight to their bank account, as opposed to notifying them via an email address or SMS number. This removes the need for a security question-and-answer component of the transaction.

Click here to learn more about the security behind Interac e-Transfer for Business.

Where to go from here

Want to know more before you begin?

- Visit this page to read more about how Interac e-Transfer can help your small- to medium-sized business thrive and grow.

- See the FAQ page for businesses using Interac e-Transfer.

- See a quick how-to on using Interac e-Transfer for Business.

Interac e-Transfer is ready to power your business to the next level